- 金币:

-

- 奖励:

-

- 热心:

-

- 注册时间:

- 2006-7-3

|

|

楼主 |

发表于 2009-4-29 06:37

|

显示全部楼层

Thursday, June 14, 2007Nattering Nabobs

It's a pretty predictable trend. It the market goes down hard, the comments section is filled with kudos, praise, and huzzahs. And if the market goes up big, the comments section is filled with barbs, told-ya-so's, and permabulls. Either way, it's pretty tedious.

As I've said many times, this blog's purpose is for one person - me - to share his thoughts about the market via some charts. Nothing more. You can get ideas from it. You can take those ideas and turn them upside down (short everything I buy and buy everything I short). It's really up to you. All I hope for in the comments section is a place for other people to offer other ideas. Because there's plenty of interesting opinions out there.

Today, like yesterday, was another "up" day (although not nearly as dramatically). That's fine by me. Now, if tomorrow is up too, I'm going to start to worry. A healthy snap-back rally is terrific in the scheme of establishing lower highs and lower lows. But a continuous push higher can result in what we saw back in early March, where the allure of a drop was squashed and the market simply sashayed its way on to new lifetime highs. My view of the S&P 500 right now is along these lines:

I've got some puts on the DIA with a contingent stop at 136.16.

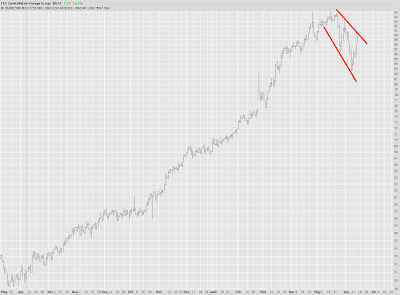

Symbol CEG has a nice series of lower lows/lower highs. I'm short.

Malaysia (EWM), mentioned here before, continues to look toppy in spite of recent strength in Asia. |

|

|

[复制链接]

[复制链接]