- 金币:

-

- 奖励:

-

- 热心:

-

- 注册时间:

- 2006-7-3

|

|

楼主 |

发表于 2009-4-29 16:29

|

显示全部楼层

Friday, June 01, 2007Some Weekend Ideas

Another day, another record in the markets. So it goes, right?

Looking at the long-term Dow 30 chart, I frankly don't see any clear place where the push higher is going to stop, at least from a technical standpoint. We are sort of in unchartered territory. Only a sea-change in something.......a monstrous terrorist attack......a fundamental downturn in the economy......is going to make a difference.

Ken Fisher has a pretty good point where he talks about the spread between the E/P value (that's not a typo - earnings divided by price) and prevailing corporate interest rates. I'm paraphrasing, but his rationale goes something like this - the average P/E on the S&P 500 is about 17 right now, which means the E/P is akin to an interest rate of 5.8%.

However, the cost of borrowing money (for which a corporation can deduct the interest) is, once you factor the tax savings, less than 4%. So it's more economically efficient to borrow tons of cash and buy back stock. In his view, until that gap is closed, the market should continue to go higher. Assuming neither interest rates nor earnings (the "E") change, a rational value of the Dow would be at something like 18,000.

I've been battered enough over the past year to not question that kind of assumption. I'm not putting my money on it, but there's no reason to say it couldn't happen.

The American Stock Exchange's $XMI index had looked like it was going to start heading south again, but nope - it pushed to another lifetime high.

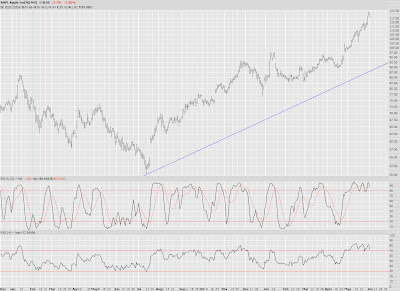

I've got a few specific stocks you might want to check out. If you think just about all the good news that can be had about Apple (the AppleTV/YouTube functionality, the forthcoming iPhone, the raging success of the iPod......) is out there and that AAPL is price for perfection, consider some puts on this high-flying stock.

Coach (COH), the purse/leather giant, also might be prone to a fall. |

|

|

[复制链接]

[复制链接]