- 金币:

-

- 奖励:

-

- 热心:

-

- 注册时间:

- 2006-7-3

|

|

楼主 |

发表于 2009-4-30 07:40

|

显示全部楼层

KRC is another homebuilder with a similar pattern forming like ESS.

On a final note - one frequent commenter, Gary, has mentioned the Commitment of Traders many times in the comments section. I was intrigued and did some basic research, but I find this data difficult to interpret. I guess I'm a sucker for easy-to-read graphs. I would appreciate his illuminating this issue in the comments section to give us a bit of a tutorial on the subject, since it sounds interesting; thanks in advance.

at 5/21/2007 14 insightful comments

Links to this post Links to this post

Labels: $indu, $spx, cme, csx, ess, jcp, krc

Friday, May 18, 2007Sheer Energy

Another record. This is getting really monotonous.

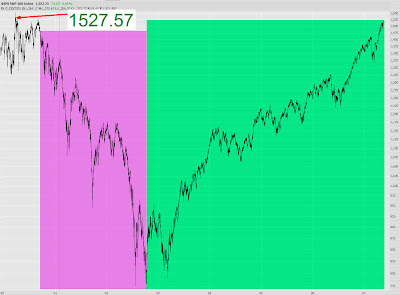

One index that hasn't actually reached a new record, but is within a hair's breadth of it, is the S&P 500. It peaked back in January of 2000, and if Monday is up at all, it will almost certainly reach a new record closing high (and I don't need to tell you the financial media will make a huge stink about it).

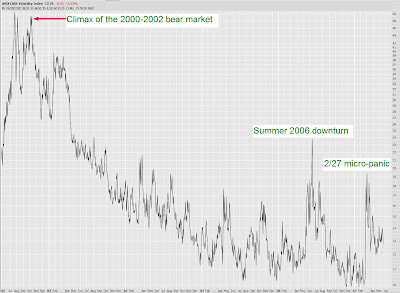

The $VIX remains very, very low, indicating widespread complacency. You can see how the VIX deteriorated from 2003 through 2005 and has remained low ever since. There was a time when the normal VIX range was between 20 and 50 or so. These days, it's lucky to even stay in the teens.

Real estate has been getting hit, in spite of the market's overall strength. I've got a number of real estate shorts, one of them being AIV. |

|

|

[复制链接]

[复制链接]