- 金币:

-

- 奖励:

-

- 热心:

-

- 注册时间:

- 2006-7-3

|

|

楼主 |

发表于 2009-5-1 06:52

|

显示全部楼层

Wednesday, April 25, 2007Yeeeeeech....

You can thank the good people of United Airlines for my ability to get this post done relatively promptly. My brief flight from Seattle to San Francisco has been delayed three hours. So here I sit on the plane, waxing poetic about this insane market.

By the way, does anyone find this image from the login page of TMobile to be strangely suggestive? (Long, uncomfortable pause). No? I guess it's just me.

Here's the NZD/USD - - what I have to say about it is basically the same as what I've got to say in the next paragraph.....

As long as the dollar remains weak, there's going to be yet another reason for stocks to go higher. Looking at the EUR/USD chart, it's clear that we're at an extreme point, but (obviously) it could push to yet another extreme. This chart, in case it's not clear to you, shows the strength of the Euro (and, conversely, the weakness of the dollar), so mentally invert it.

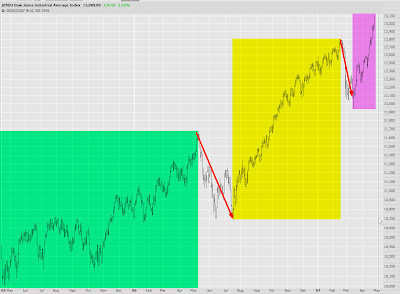

What's interesting about the market is just how swiftly it has pushed higher. Look at the chart below. I've highlighted each of the most recent three "surges", and as you can see, each surge is happening with greater speed. The two lonely down periods here were last summer (oh, how I miss those days....) and - ever so briefly - about eight weeks ago.

The NASDAQ Composite is still within its rising channel, at the tippy-tippy top. Clearly Apple's (AAPL) sensational earnings will push both Apple and the NASDAQ higher first thing in the morning |

|

|

[复制链接]

[复制链接]