- 金币:

-

- 奖励:

-

- 热心:

-

- 注册时间:

- 2006-7-3

|

|

楼主 |

发表于 2009-4-28 10:58

|

显示全部楼层

Wednesday, June 20, 2007Do We HAVE to Have a Bounce?

I started the day off, before the opening bell, feeling very discouraged. The market seemed inclined to stay at - to borrow from Irving Fisher - a "permanently high plateau". Today provided a welcome respite, with interest rates gutting the Dow for 146 points.

But surely you've seen a change in my temperment. Whereas typically I would be tooting the celebratory horns at such a thing, all I can think now is, "Great, we'll just go into another bounce now." And, perhaps, in my own twisted way, that's actually a really bearish sign. Because when I was feeling balls-out, it's the end of the world, the market invariably pushed higher. I regard these recent jolts downward not with glee, but with dire suspicion, bordering on a sense of dread.

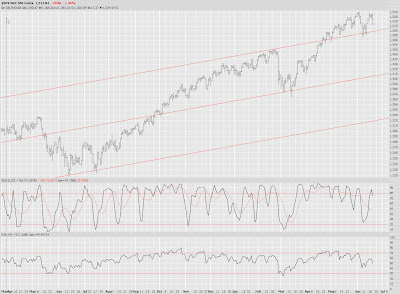

Not to say that, from a chartist's viewpoint, the indexes (and carefully chosen stocks) don't look terrific for the bears. The S&P 500 looks gorgeous.

And yet, as I look at the minute bars of the same index over the past 60 days, unless the lows of last Thursday, June 7th, are taken out we're going to continue to stay stuck in this f*cking grind upward. If there is, in fact, a loving God, and we blow out the lows of June 7th, then it's time to rock. But I'm a doubter until it happens.

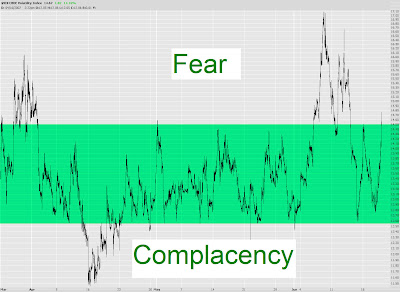

Another reason for my skepticism is that whenever the VIX goes rip-roaring higher, it is prone to ease back down (lately, at least). You can see the general range I've highlighted below. We're a bit above it.

Apple (AAPL), on which I own a small put position, edged down both yesterday and today. Next Friday is when the JesusPhone gets introduced. Obviously it will be fascinating on the 29th to see what happens to the stock. To say this product is widely anticipated is a gross understatement. |

|

|

[复制链接]

[复制链接]