- 金币:

-

- 奖励:

-

- 热心:

-

- 注册时间:

- 2006-7-3

|

|

楼主 |

发表于 2009-4-29 06:28

|

显示全部楼层

Friday, June 15, 2007Son of a (Triple) Witch......

Well, what a difference three days makes.

As of Tuesday's close, things looked just hunky-dory for the bears. Although such a rapid, 400+ point drop from the Dow certainly suggested it was time for a bounce up. But the very unresolved question is whether the bounce was the contratrend in the scope of a real downtrend, or whether the 400+ drop was no more important than the one from late February.

One trend is clear - - comments are up. Even with anonymous posters shut out of the comments section, activity has been ramping up in line with the market's volatility. Big down days bring out the snarling bears, and big up days bring out the told-ya-so bulls. Of course, beanie11111 alone was responsible for 15 of the prior post's comments, so a few people are largely responsible for the activity. (And Beanie - we get it - solar, solar, solar - enough!)

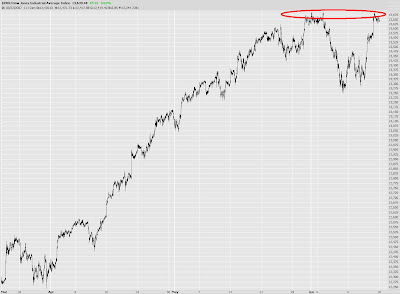

Looking at the $INDU, the best the bears can hope for at this point is a double top. A neat cascade of lower lows and lower highs simply didn't happen.......today's push higher broke that theory to pieces.

If the market does continue its descent next week, the Russell 2000 is, in my opinion, the best place to play it. Not only because of the relatively decent bid/ask spread, but also because it is relatively weak in its performance.

I don't think I've ever mentioned ACL before, but this looks like one which has turned the corner from uptrend to downtrend.

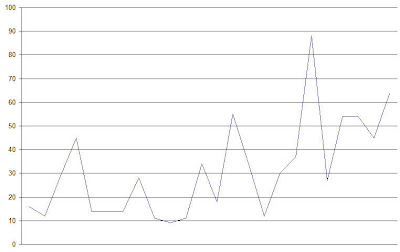

I got into a short position with BEAS today, and it's a bit in the green already, in spite of the market's strength. The right shoulder of this pattern is half completed. |

|

|

[复制链接]

[复制链接]