- 金币:

-

- 奖励:

-

- 热心:

-

- 注册时间:

- 2006-7-3

|

|

楼主 |

发表于 2009-4-27 09:11

|

显示全部楼层

Thursday, July 05, 2007The Voice of Optimism

Everyone knows the old saying: "If you Can't Beat 'em, Join 'em". So I submit myself to the New Normal. I embrace that Things Are Different This Time. I surrender my soul to the wisdom of the bulls. Let us gather hands around the truth together.

Corporate debt is a positive. First, because interest rates are so low, it represents virtually free money for private equity firms to maximize value to shareholders through buyout transactions. Those making access to this debt are trained professionals and are managing the debt load - and its risks - responsibly.

The booming Chinese economy is putting some strain on the environment, yes, but the Chinese have learned from the lessons learned in the British and American industrial revolutions and have taken the steps necessary to protect their environment for the sake of those that consume their products, for the sake of the economy in the long term, and for the sake of future generations.

The manic building in Dubai, Shanghai, and other emerging economies is exhilarating, and the race to see who can wind up with the world's tallest building just adds to the fun. The building boom is not overdone. On the contrary, Dubai - - until recently, a sweltering, barren desert - will become the top tourist attraction on the planet. The strength of the oil economy will allow this entire region to blossom for decades to come as the new epicenter of global capitalism and prosperity.

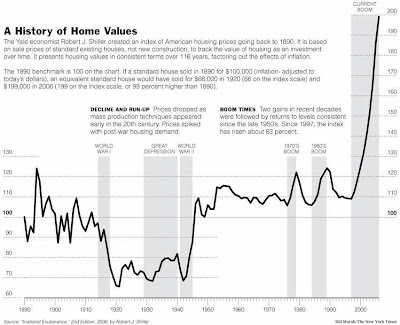

The housing "bust" is completely overblown. Yes, there are some isolated instances of damage from the sub-prime lending debacle, but it is completely contained. Although the red-hot pace of housing gains from years past will rest steady for a while, there is in fact no housing "bust", and thus no aftereffects to the economy at large.

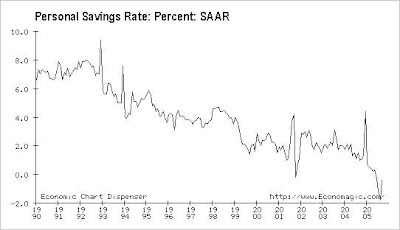

The fact that the savings rate has dropped into negative territory is simply illustrative of strong consumer spending. We live in an age of rapid change, and adapting and embracing that change takes money. Here in the United States, we are simply helping lead the way by taking part in an exciting new time of electronic and communications wizardry.

The U.S. equity markets are not overpriced. Indeed, as the private equity buyouts of late illustrate, stocks in the U.S. are undervalued.

By the same token, the Chinese stock market offers a store of value that will only continue to rise. A value of 8,000 on the Shanghai index seems almost a foregone conclusion, particularly since the number "8" is widely considered to be lucky in China.

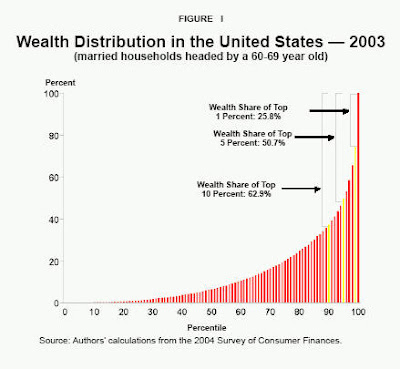

Some many say that the tremendous push of wealth to the highest echelons of society will create social unrest and turmoil. "Some" are wrong. There are about 1,000 billionaires in the world today (up from zero in 1915), controlling nearly $3 trillion in wealth. The couple of billion people in the world that live in poverty will view these billionaires as inspirational.

There's plenty more good news in the world. The Blackstone IPO was not an opportunistic event meant to exploit the naivete of investors buying at the top of a market. It was simply a means by which the principals in the organization could tap into some of the value they had built while at the same time providing a means for the common man to participate in this exciting new investment vehicle.

[ 本帖最后由 hefeiddd 于 2009-4-28 07:19 编辑 ] |

|

|

[复制链接]

[复制链接]