- 金币:

-

- 奖励:

-

- 热心:

-

- 注册时间:

- 2006-7-3

|

|

楼主 |

发表于 2009-4-26 17:21

|

显示全部楼层

Sunday, July 22, 2007The Slope of Hope

Everyone....

I am moving over (if all goes well) to a new blog publishing platform. From now on, please go to:

http://www.SlopeOfHope.com

I would REALLY appreciate your comments (not here, but at the new site) about what you do and don't like about the new platform. I have done almost no customization of it, so it's kind of sparse. But I'd like to fine-tune it with your help. Thanks.

at 7/22/2007 11 insightful comments

Links to this post Links to this post

Friday, July 20, 2007Home In the Range

What a week! And a great week it was.

For those of you insane enough to have owned July puts on Google until today, congratulations. The slight earnings disappointment from GOOG nicked $40 off their stock price at one point, and naturally the options were going insane.

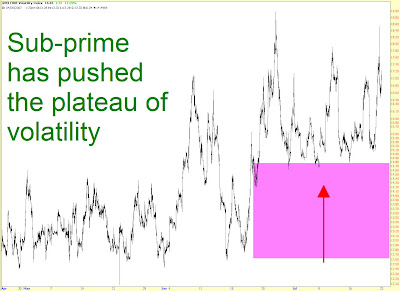

The sea-change that has taken place is that all the sub-prime woes have elevated the volatility in this market. It's very plain to see from the $VIX graph below.

But this market right now is all about one thing - range, range, range. As David Byrne once sang: "I go up and down/I like this/curious feeling." If you are able to pay close enough attention to it, and you've got your groove on, you can make a lot of money.

But a glance at the Dow graph below shows that the price is currently about in the middle of a very sweeping range. And now we're in no man's land. Do we bounce off the horizontal line and fly well above 14,000? Do we push our way through the muck beneath that line and start and honest-to-goodness bear market? Or do we continue to fart around ad nauseum. I dunno. And you don't either.

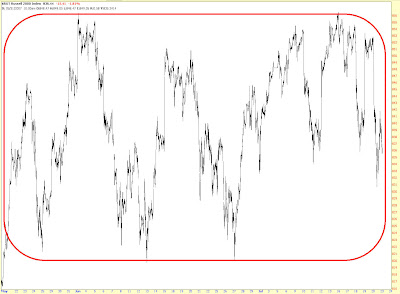

The Russell is even more "range-y". Hell, I was in and out of calls AND puts all day long on this, and nary lost a cent in the process. It was quite a ride. But I'm about as flat as Kate Moss right, since I'd rather enter Monday morning with a relatively clean slate. (e.g. mountains of cash).

One last intraday index to show you - the S&P 500. I'd say we are at an important "bounce or break" point here. It will take a lot of strength for either the bulls or the bears to reach escape velocity from the range shown here, but once either side wins, it's going to be dramatic.

The rest of the charts are just short/put ideas. I sold a lot of "I told ya so" graphcs today (e.g. items I had suggested which went very much as planned), but I don't want to waste your time with those. You know I've got good ideas from time to time, don't you? Once in a while?

Here's BP.

CAH looks ready to break its neckline.

Colgate (CL) might have finished a nice triple top here.

CVX also looks good.

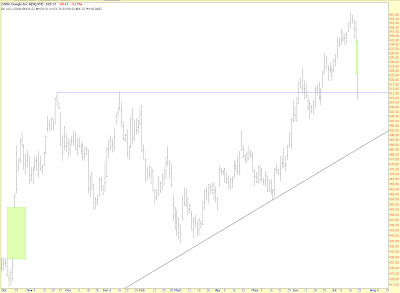

I'm putting GOOG here not as a suggestion, but mainly to show how nicely it retraced its entire hard-fought gain in just a single day. Who knows - those who bought in the low 500s might be very happy in the long run. After all, it's still a nice bullish pattern. But today it was a better buy!

HES, like many oil-related stocks, looks great to short.

I suggested MLM a while back (howdy, Leisa!) It's doing well.

I made so much cash today I decided to risk a bit on a couple of RIMM puts. This sucker has to fall some day.

Here's a final thought for you. See ya Monday.

at 7/20/2007 24 insightful comments

Links to this post Links to this post

Labels: $indu, $rut, $spx, $vix, bp, cah, clf, cvx, goog, hes, mlm, rimm

Thursday, July 19, 2007Google-y Eyes

I'm going to make you feel how deeply you want and love me by having a really short post today. I am moving heaven and earth to get this blog moved to a different platform, so I need to focus on that.

I will say, however, that I'm pleased to see the after-hours market slamming the bejesus out of Google (GOOG). As I am typing this, it is down nearly 40 points. Congratulations to you brave put owners out there.

Maybe the bloom's coming off the rose, eh? I mean, it's Google for the love of Jesus.

Did you know I have a Google connection? Yes, it's true. I'm even more interesting than you imagined. The angel investor for my company, Prophet, was none other than Andy Bechtolsheim (Sun's co-founder and Google's first investor). His $100,000 check to them is now worth billions. And, hey, he did all right on Prophet too! Thanks, Andy.

at 7/19/2007 45 insightful comments

Links to this post Links to this post

Older Posts |

|

|

[复制链接]

[复制链接]