- 金币:

-

- 奖励:

-

- 热心:

-

- 注册时间:

- 2006-7-3

|

|

楼主 |

发表于 2009-4-26 17:53

|

显示全部楼层

Friday, July 13, 2007Is 14K Up Next?

On the whole, it was a great week for the bulls. The Dow, the S&P, the Major Market Index, and a host of others climbed to all-time, never-seen-before high prices. So where does it stop?

The Dow's high on June 1 was about 13,690. Its low on June 8th was about 13,250. That's a 440 point difference, and that's the approximate range of the rectangle out of which it just emerged. By traditional measurement, you take the high of 13,690 and add 440 points and get the target of 14,130. That's 223 points or 1.6% away. It won't take much to get us there.

The Russell pushed into new high territory, but by the slimmest of margins. I'm not sure I would call this a breakout on this particular index yet.

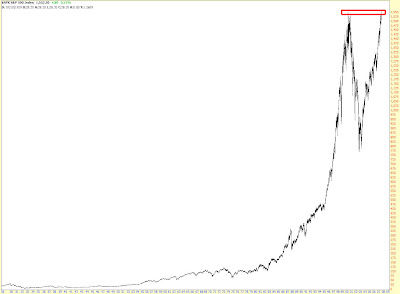

I rarely use arithmetic scale, but I am going to do so here on the S&P 500 to make a point. What I want you to see is the amazing drama that has taken place over the past quarter century, with the S&P exploding to a high in January 2000, collapsing terribly in a bear market, and then flying yet again to the prior high. Is this the mother of all double tops? Only time will tell. Although the bulls that visit this blog certainly would say no.

My puts on Baker Hughes (BHI) did well today. The oil service sector seems like it may be ready to drop a while.

[ 本帖最后由 hefeiddd 于 2009-4-28 06:11 编辑 ] |

|

|

[复制链接]

[复制链接]