- 金币:

-

- 奖励:

-

- 热心:

-

- 注册时间:

- 2006-7-3

|

|

楼主 |

发表于 2009-3-25 14:03

|

显示全部楼层

Labels: employment

Treasury Tuesdays

Click on all images for a larger image.

Notice on this 1 year chart that while bond prices were at incredibly high levels at the beginning of the year they have since come down. Prices are still over the 200 day SMA indicating a bull market, however.

Prices have been consolidating in a triangle consolidation pattern since the beginning of February. However, the SMAs are now giving a different picture. The 50 and 10 day SMA are moving lower while the 20 day is moving higher. Prices are tied together with the 10 and 20 day SMA indicating a lack of direction.

From a fundamental perspective there are two macro-situations competing right now. Pulling prices lower is the massive supply of treasury bonds coming to market over the next 9-12 months. However, keeping prices higher is the safety play which will continue to long as the stock market continues to move lower.

Posted by bonddad at 3/10/2009 06:38:00 AM

0 comments Links to this post

Labels: Treasury Market

Monday, March 9, 2009Media Appearance

Today I was on the BBC Program World Have Your Say.

Here is a link to the show. I was on in the last 7-10 minutes.

http://downloads.bbc.co.uk/podcasts/worldservice/whys/whys_20090309-1900a.mp3

Posted by bonddad at 3/09/2009 05:11:00 PM

1 comments Links to this post

Today's Markets

On the daily chart notice we're in a very bearish position. Prices are moving lower, prices are below all the SMAs, the shorter SMAs are below the longer SMAs and all the SMAs are moving lower. While the chart today printed a hammer, we printed a similar bar a littel over a week ago and it didn't do much. However, today we saw lower volume which could be encouraging.

For the second day in a row prices opened higher but were unable to maintain their upward momentum. However, prices today closed above the lows of Friday. In addition there were two bars moving higher at the end of trading with strong volume surges. However, I wouldn't get too excited about that just yet.

Posted by bonddad at 3/09/2009 04:52:00 PM

1 comments Links to this post

Buffet In Words and Pictures

From CNBC:

Yeah. The economy, ever since we talked in September, we talked about it being an economic Pearl Harbor and how--what was happening in the financial world would move over to the real world very quickly. It's fallen off a cliff, and not only has the economy slowed down a lot, people have really changed their behavior like nothing I've ever seen. Luxury goods and that sort of thing have just sort of stopped, and that's why Walmart is doing well and you know, and I won't name the ones that are doing poorly. But there's been a reset in people's minds, and we see that in something like Geico where year after year after year we say you can save some money insuring with Geico, and year after year there's been a certain number of people who have said, `You know, I've got this pal, Rotary Joe, and I've been insuring with him and for 100 bucks, why should I shift?' Every week we're just seeing it build and build. More and more people are calling. Our price differentials haven't widened, our advertising isn't that much different, but the American public really has changed their buying habits. On the reverse side, our jewelry stores just get killed in a period like this. And high end gets hurt the most, next down gets hurt the second most, and the lowest people get hurt the least.

Take a look at this chart from the WSJ. 7 stores posted gains in February. 4 (BJs, Sam's Wal-Mart and Costco) were discounters.

In addition, consider these two charts from the St. Louis Fed:

Posted by bonddad at 3/09/2009 11:03:00 AM

1 comments Links to this post

Dividend's Are Dropping

From IBD:

U.S. companies have already slashed $40.7 billion in dividends in 2009, topping last year's $40.6 billion in just over two months.

No bank now ranks among the top 30 dividend-paying companies in terms of total dollars. Financial companies pay out only 11% of dividend income vs. more than 30% before the credit crisis hit, says S&P analyst Howard Silverblatt.

Dividends among S&P 500 companies are on track to fall 22.6% in 2009, the most since 1938, with many more cuts likely. The pain has spread from shareholders in banks to investors in auto, consumer discretionary and other stocks.

This shouldn't be a surprise. But it is another reason for more investors getting out of the market.

Posted by bonddad at 3/09/2009 09:14:00 AM

0 comments Links to this post

Market Monday's

Click on all images for a larger image

While I usually don't line line charts, this one helps to show the major trend of the last year. Prices are in a clear downtrend. Rallies have been bear market flags or pennant patterns that have offered an opportunity to short the market.

Above is the same chart of the SPYs but with candles.

The following charts show the market is oversold.

However, the MACD tells us we have a ways to go.

Posted by bonddad at 3/09/2009 05:00:00 AM

0 comments Links to this post

Labels: market analysis

Friday, March 6, 2009Media Appearance

I'll be on Air America at 6:05 CST to talk about the latest employment disaster report.

Posted by bonddad at 3/06/2009 03:21:00 PM

3 comments Links to this post

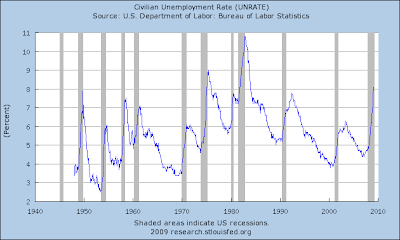

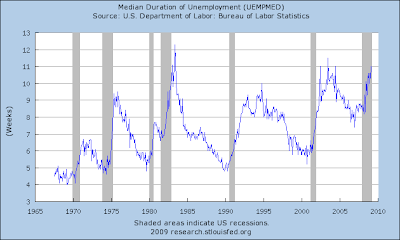

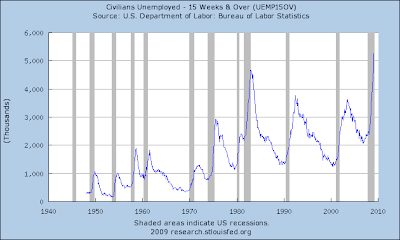

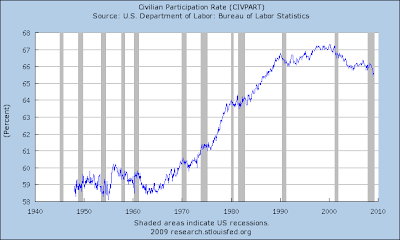

The Employment Situation in Pictures.

Click on all for a larger image. There are presented in no order of importance. All have been updated with today's information.

Posted by bonddad at 3/06/2009 11:11:00 AM

1 comments Links to this post

Employment Down -651,000

From the BLS:

Nonfarm payroll employment continued to fall sharply in February (-651,000), and the unemployment rate rose from 7.6 to 8.1 percent, the Bureau of Labor Statistics of the U.S. Department of Labor reported today. Payroll employment has declined by 2.6 million in the past 4 months. In February, job losses were large and widespread across nearly all major industry sectors.

.....

The number of long-term unemployed (those jobless for 27 weeks or more) increased by 270,000 to 2.9 million in February. Over the past 12 months, the number of long-term unemployed was up by 1.6 million. (See table A-9.)

.....

In February, the number of persons who worked part time for economic reasons (sometimes referred to as involuntary part-time workers) rose by 787,000, reaching 8.6 million. The number of such workers rose by 3.7 million over the past 12 months. This category includes persons who would like to work full time but were working part time because their hours had been cut back or because they were unable to find full-time jobs. (See table A-5.)

.....

About 2.1 million persons (not seasonally adjusted) were marginally attached to the labor force in February, 466,000 more than a year earlier. These individuals wanted and were available for work and had looked for a job sometime in the prior 12 months. They were not counted as unemployed because they had not searched for work in the 4 weeks preceding the survey. Among the marginally attached, there were 731,000 discouraged workers in February, up by 335,000 from a year earlier. Discouraged workers are persons not currently looking for work because they believe no jobs are available for them. The other 1.3 million persons marginally attached to the labor force in February had not searched for work in the 4 weeks preceding

the survey for reasons such as school attendance or family responsibilities. (See table A-13.)

.....

Total nonfarm payroll employment dropped by 651,000 in February. Since the recession began in December 2007, about 4.4 million jobs have been lost, with more than half (2.6 million) of the decrease occurring in the last 4 months. In February, employment declined in most major industry sectors, with the largest losses occurring in professional and business services, manufacturing, and construction. Health care continued to add jobs over the month. (See table B-1.)

Let's break this information down.

1.) The best read of job growth for the last expansion is a total of 8.2 million jobs created. 2.6 million jobs were lost in the last 4 months, or 31%. Since the recession began, we've lost 4.4 million jobs or 53%. There is no way to spin those numbers as anything except terrible.

2.) The number of people who worked part-time for economic reasons increased by 787,000. That's also a ton of people. That number has increased by 3.7 million over the last 12 months -- also a ton of people. That facts tells us two relevant data points. First, businesses are still cutting back sharply. Secondly, there is probably at least one more month of horrible job losses in the works; that number is simply too high for there not to be another serious round of job losses coming down the pike.

3.) Year over year, the unemployment rate of service occupations has increased from 6.7% to 9.1% the unemployment rate of natural resources, construction and maintenance has increased from 9.1% to 17.7% and the unemployment rate of production, transportation and material employment has increased from 6.6% to 13.1%.

4.) Hours worked is decreasing across a wide swath of industries.

Simply put, this is an incredibly ugly report.

Posted by bonddad at 3/06/2009 09:30:00 AM

1 comments Links to this post

Labels: employment

Forex Friday's

Click on all images for a larger image

The weekly chart is very positive. Notice the following:

-- The MACD is giving a buy signa

-- The RSI is rising indicatin increasing price strength

-- Prices have been rising for the last three months

-- Prices have broken through upside resistance

-- All the SMAs are moving higher

-- The 10 week SMA is about to cross over the 20 week SMA, which will lead to a very bullish alignment of all the shorter SMAs being above the longer SMAs

Notice the following on the weekly chart:

-- Prices have been rising since mid-December

-- All the SMAs are moving higher

-- The shorter SMAs are above the longer SMAs

-- Prices are above the SMAs

-- The MACD is increasing

Bottom line: this is a good example of a bullish chart.

Posted by bonddad at 3/06/2009 06:57:00 AM

0 comments Links to this post

Thursday, March 5, 2009Today's Markets

Click for larger image

The 5-minute chart shows a clear downward trajectory interrupted by bear market flag patterns. In other words, people have been selling into the rallies.

On the daily chart notice that prices are hugging the lower trend line of the downward sloping channel.

Posted by bonddad at 3/05/2009 05:00:00 PM

1 comments Links to this post

Fed Sees A Damaged Economy

From the most recent Beige Book:

Consumer spending remained sluggish on net, although many Districts noted some improvement in January and February compared with a dismal holiday spending season. Travel and tourist activity fell noticeably in key destinations, as did activity for a wide range of nonfinancial services, with substantial job cuts noted in many instances. Reports on manufacturing activity suggested steep declines in activity in some sectors and pronounced declines overall. Conditions weakened somewhat for agricultural producers and substantially for extractors of natural resources, with reduced global demand cited as an underlying determinant in both cases. Markets for residential real estate remained largely stagnant, with only minimal and scattered signs of stabilization emerging in some areas, while demand for commercial real estate weakened significantly. Reports from banks and other financial institutions indicated further drops in business loan demand, a slight deterioration in credit quality for businesses and households, and continued tight credit availability.

Upward price pressures continued to ease across a broad spectrum of final goods and services. This was largely associated with lower prices for energy and assorted raw materials compared with earlier periods, but also with weak final demand more generally, which spurred price discounting for items other than energy and food. With rising layoffs and hiring freezes, unemployment has risen in all areas, reducing or eliminating upward wage pressures. A number of reports pointed to outright reductions in hourly compensation costs, through wage reductions and reduction or elimination of some employment benefits.

None of this should be news to anybody. I wrote an article on 4th quarter GDP which has some relevant charts and graphs.

Posted by bonddad at 3/05/2009 11:30:00 AM

0 comments Links to this post

Anecdotal Job Market Information

Mr$. Bonddad is the HR director and an architectural firm in Houston.

1.) Last Friday she went to a recruiter event at an architectural school. Last year there were 26 firms; this year there were 6. And none of them were hiring.

2.) Her firm recently placed an advertisement from an administrative assistance. Last year she would have received between 50 and 100 resumes. This year she received 700.

This is one person's experience in a large city. But......

Posted by bonddad at 3/05/2009 09:30:00 AM

10 comments Links to this post

Thursday Oil Market Round-Up

Click on all charts for a larger image

On the weekly chart notice that prices have been in a triangle consolidation pattern for the last three months. Also note the MACD is rising and has given a clear buy signal. Also note the RSI is rising. Prices are above the 10 week SMA. There are two more areas of upside resistance that could keep prices from moving higher -- the upper line of the triangle and the 20 week SMA.

There's been a huge divergence between prices and the MACD over the last three months. Also note the RSI was hovering between 30 and 50 for most of that time but has posted some gains over the last fewweeks. From a price perspective, notice that prices were rebuffed at the 45 level recently but have since rebounded and are trying to move through the level again.

Bottom line: this chart is looking pretty good from a bullish perspective.

Posted by bonddad at 3/05/2009 06:27:00 AM

0 comments Links to this post

Labels: oil

Wednesday, March 4, 2009Today's Markets

Click on all for larger images

Today the market opened higher but then moved down to the 50 day SMA. The market repeated this several times throughout the trading day. Note the market sold-off at the end on a volume spike, indicating traders did not want to hold a position overnight.

On the daily chart, notice we're still in a downward sloping channel. In other words -- we're not out of the woods by a long shot.

Posted by bonddad at 3/04/2009 04:57:00 PM

0 comments Links to this post

Are We Going to 600 on the S&P?

Tim Knight makes a strong case that it's possible. Watch the first half of this video.

Posted by bonddad at 3/04/2009 01:30:00 PM

0 comments Links to this post

More Signs of Credit Thawing

From Bernanke's testimony yesterday:

The measures taken since September by the Federal Reserve, other U.S. government entities, and foreign governments have helped improve conditions in some financial markets. In particular, strains in short-term funding markets have eased notably since last fall, and London interbank offered rates, or Libor--which influence the interest rates faced by many U.S. households and businesses--have decreased sharply. Conditions in the commercial paper market also have improved, even for lower-rated borrowers, and the sharp outflows from money market mutual funds in September have been replaced by modest inflows. In the market for conforming mortgages, interest rates have fallen nearly 1 percentage point since the announcement of our intention to purchase agency debt and agency mortgage-backed securities. Corporate risk spreads have also declined somewhat from extraordinarily high levels, although bond spreads remain elevated by historical standards. Likely spurred by the improvements in pricing and liquidity, issuance of investment-grade corporate bonds has been strong, and speculative-grade issuance, which was near zero in the fourth quarter, has picked up somewhat more recently. Nevertheless, significant stresses persist in many markets. For example, most securitization markets remain closed, and some financial institutions remain under pressure.

Let's look at some charts to see how this is playing out

Rate on 30 day commercial paper spiked at the end of last year but have since come down Rate on 30 day commercial paper spiked at the end of last year but have since come down

Issuance from the non-financial sector is good, but asset-backed and financial issuance is still weak.

And spreads have definitely come down. And spreads have definitely come down.

All the Libor rates have dropped considerably. In addition, the same link shows a drop in mortgage rates.

In addition,

Companies with risky credit ratings are lining up to tap the speculative-grade, or "junk," bond market for funds as they fear the window of opportunity could soon close.

The recent turmoil in the stock market and continuing problems at large financial institutions including Citigroup and American International Group have heightened fears that those suffering big losses will be forced to sell debt securities to raise precious capital.

Such selling could crowd out new debt sales, as had been the case last autumn.

.....

Still, it isn't cheap to issue debt in the high-yield market with interest rates for risky companies raising new debt coming in near 10% -- and that is after selling the bonds at a discount. But the incentive is there to get in while the water's still warm. It could always get worse.

"There really doesn't seem to be any floor for how low things can go," said Scott Grzankowski, a former hedge-fund trader and now an analyst at KDP Advisor. "So if you have funding needs you might as well tap the capital markets now in case they seize up like they did three months ago."

Posted by bonddad at 3/04/2009 11:30:00 AM

3 comments Links to this post

20% of Homes Are Underwater

From the WSJ:

Twenty percent of all U.S. residential properties that had a mortgage on them were underwater at the end of December, with mortgage debt greater than what the homes were worth, according to a report released Wednesday by First American CoreLogic. That's more than 8.3 million mortgages that were upside down at the end of the year, compared with 7.6 million three months earlier. It's a problem that is expected to get worse as home prices continue to fall.

"The accelerating share of negative equity, combined with deteriorating economic conditions, means that mortgage risk will continue to increase until home prices and the economy begin to stabilize," said Mark Fleming, chief economist of First American CoreLogic, in a news release. First American CoreLogic is a Santa Ana, Calif.-based provider of real estate data and mortgage analytics.

"The worrisome issue is not just the severity of negative equity in the 'sand' states, but the geographic broadening of negative equity that is expected to occur throughout the year," he added. "Sand" states include California, Nevada, Arizona and Florida.

Repeat after me: we're nowhere near a bottom in housing

Posted by bonddad at 3/04/2009 09:30:00 AM

0 comments Links to this post

Labels: housing

Wednesday Commodity Round-Up

The main issue with copper is prices are near their lowest levels in three years. However, also note the 20 and 50 day SMAs are moving lower. However, the 10 day SMA has turned neutral. In addition, prices and the SMAs are tied-up, indicating a lack of overall direction. The main issue with copper is prices are near their lowest levels in three years. However, also note the 20 and 50 day SMAs are moving lower. However, the 10 day SMA has turned neutral. In addition, prices and the SMAs are tied-up, indicating a lack of overall direction.

Aluminum is in a classic bear market pattern. Prices are below all the SMAs, the shorter SMAs are below the longer SMAs and all the SMAs are moving lower. In addition, prices have been in a downtrend since last summer.

Silver benefitted from the recent rally in gold. Prices fell starting last summer but bottomed in the first part of the fourth quarter and have since been moving higher. However, notice that prices have run into resistance at the 50 day SMA recently.

Posted by bonddad at 3/04/2009 05:00:00 AM

0 comments Links to this post

Labels: commodities

Newer Posts Older Posts Home |

|

|

[复制链接]

[复制链接]