- 金币:

-

- 奖励:

-

- 热心:

-

- 注册时间:

- 2006-7-3

|

|

楼主 |

发表于 2009-3-25 07:11

|

显示全部楼层

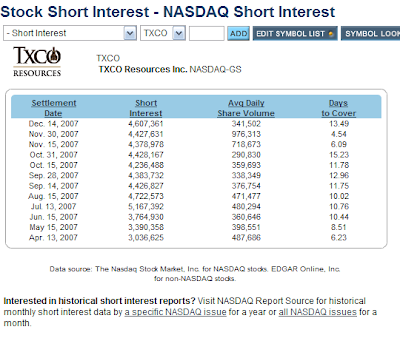

TXCO Resources Inc. (Public, NASDAQ:TXCO)

Looks like it could get going here, particularly if it moves above 12.80 I bought a little anticipating such a move and will take a small loss if it drops below 12.55.

TXCO Resources Inc., formerly The Exploration Company of Delaware, Inc., is engaged in the exploration, exploitation, development, production and acquisition of onshore domestic oil and gas reserves. The Company's oil and gas enterprise interests are located in the Maverick Basin in Southwest Texas, and the Marfa Basin of West Texas. The Company's principal products are crude oil and natural gas. Generally, the Company sells all of its oil and gas under short-term contracts that can be terminated with 30 days notice, or less. The Company operates and directs the drilling of oil and gas wells and also participates in non-operated wells. As operator, the Company contracts service companies, such as drilling contractors, cementing contractors, for specific tasks. In some non-operated wells, the Company participates as an overriding royalty interest owner. In April 2007, the Company completed the acquisition of Output Exploration LLC, a privately held exploration and production firm

Posted by Brian at 1/03/2008 01:48:00 PM

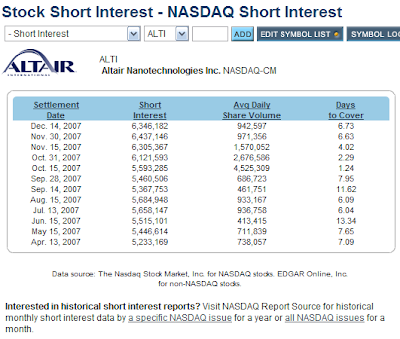

Altair Nanotech (ALTI)

Six million shares short in a stock with a chart like this? I'm long **UPDATE*** Stop at 4.58

Posted by Brian at 1/03/2008 12:18:00 PM

Wednesday, January 02, 2008Solar Stocks

are getting pre market action again today as AKNS is the lastset one to soar. I still like HOKU here.

Clever "mashup" on WALLSTRIP today.

Posted by Brian at 1/02/2008 08:43:00 AM

Tuesday, January 01, 2008

Posted by Brian at 1/01/2008 06:56:00 AM

Monday, December 31, 2007Happy New Year!!

these numbers will likely be adjusted to reperesent the actual settlement figures.

Posted by Brian at 12/31/2007 04:03:00 PM

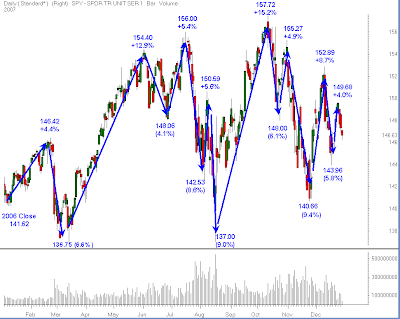

No Predictions

Making trading profits is not about forcing your opinion on the market, but to listen objectively to the message of the market in order to uncover and exploit low risk, high potential opportunities as they are presented. I do not have a grand theme for 2008, to me a guess as to where the market will finish one year from today is irrelevent. My goal each day is to seek out the low risk opportunities and cut losses quickly if the market does not agree with my analysis, or ride the winner for the bulk of the short term move. Is anyone who predicted the SPY would be up 4% in 2007 actually claiming they were smart? There were at least fifteen occasions where the market showed a rally or decline of at least 4% in 2007. The volatility rewarded disciplined traders the most this year and next year is anyones guess again. I choose to focus on finding the trades where I can make money and that will be my game plan for 2008. It is the same approach which has served me well for the last fifteen years of trading. I hope that 2008 is a great year for you in everything that is important to you, not just your trading success.

Posted by Brian at 12/31/2007 12:23:00 PM

Since Coming Public

four days ago, NetSuite Inc.(NYSE:N) had an excellent run. Now the stock is experiencing a little profit taking and the best level of support for the stock appears to be near 32.75-33.25 which is the location of the 61.8% retracement level of the rally. That level is also where the Volume Weighted Average Price (VWAP) is found, meaning that it is the average price paid for the stock in the after market. With little else to base an analysis on, the combination of these price and volume based indicators suggest we look for the stock to find support in that area.

Posted by Brian at 12/27/2007 09:20:00 AM

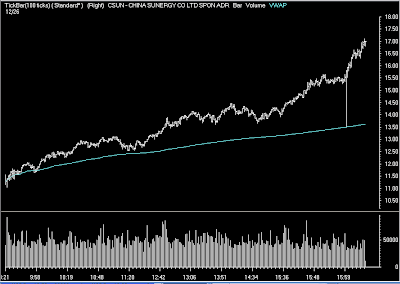

Wednesday, December 26, 2007CSUN

is getting a little more after hours action. Can't feel too good to be short there.

Posted by Brian at 12/26/2007 06:24:00 PM

Newer Posts Older Posts Home |

|

|

[复制链接]

[复制链接]