- 金币:

-

- 奖励:

-

- 热心:

-

- 注册时间:

- 2006-7-3

|

|

楼主 |

发表于 2009-3-24 18:20

|

显示全部楼层

Tuesday, July 15, 2008Impressive but Not Convincing

Posted by Brian at 7/15/2008 01:45:00 PM

OIL (USO) Daily Chart

USO found support along the rising trendline and, like any other technical tool, the more times it is tested, the weaker it becomes. This is also the fourth test of the trendline which is often the one which proves fatal to the trend. I would not suggest selling USO short, but I would be more careful with oil longs. If the trendline were to break it would not necessarily indicate a reversal, instead it only suggests a slowing of momentum until we see a pattern of lower highs and higher lows.

Posted by Brian at 7/15/2008 11:43:00 AM

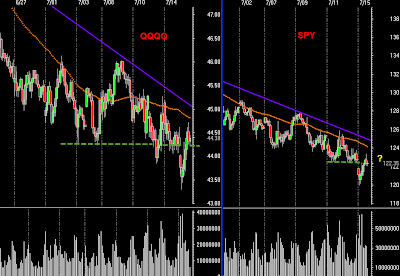

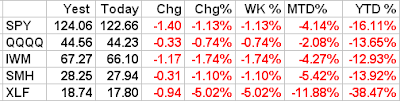

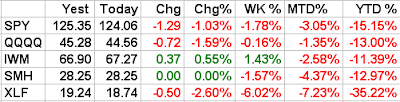

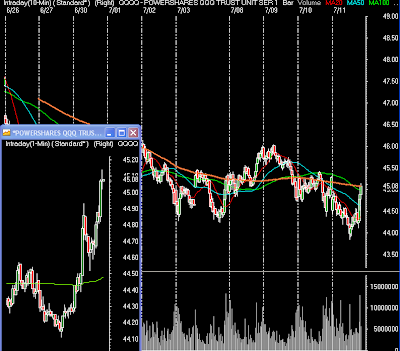

Attempting a Turn?

The strong sell off in oil seems to be providing some temporary relief for equities and buyers are back with heavy volume which could support a short term turn. The trends are still clearly lower and it will take more strength above former levels of support to confirm a turn. Risks remain high, be careful.

Posted by Brian at 7/15/2008 11:16:00 AM

Scalp Trade Video

I recorded an opening trade to the long side in ABT. The video of the trade with my reasons for buying and selling can be found under the bonus tab at the book website.

Posted by Brian at 7/15/2008 10:02:00 AM

When dealing with people, let us remember we are not dealing with creatures of logic. We are dealing with creatures of emotion, creatures bustling with prejudices and motivated by pride and vanity.

~Dale Carnegie

Posted by Brian at 7/15/2008 08:50:00 AM

Labels: quotes

Monday, July 14, 2008Stock Market Technical Analysis Trend Review 7/14/08

Be sure to check out Andrew Horowitz's INTERVIEW with Brett Steenbarger. Thanks for the book plug too, Andrew!

Just got it. Thank you very much

for "not" putting it into "computer dweb"

"squint size" fonts. It never ceases to

amaze me that with all the use of computers

people will put out books, pamphlets, articles, etc.

in small fonts dictated by some computer person

as detailed above. Obviously, you did not and

additionally you put it in a nice size, one up

from what is usually the standard of 5 x8 or

thereabouts. You made it real convenient to learn. Thanks

Brian, sorry to have not gotten to Ontario this

weekend but had other stuff to do and anyway

I wanted to have read your book before meeting

you. Again, thanks, dan z

Hi Brian-Your book is over the top great. It brings to mind the saying "...give a man a fish and he eats for a day, but teach him how to fish, and he eats for a lifetime."

If someone has a bit of capital and the good sense to follow the disciplines that you lay out in such an incredibly concise manner, they will quite literally

thrive in the market.

Please allow me to express deep gratitude for what is essentially a remarkable gift....not only the book but, just as importantly, your generosity of spirit.

Best wishes,

Robert J

Posted by Brian at 7/14/2008 03:51:00 PM

Labels: book review, customer feedback

Sunday, July 13, 2008Earnings Season

begins this week and with options expiration on Friday it is almost certain to continue to be a very volatile trading environment. The charts below are of some of the more interesting (influential) companies due to report this week. Remember that news and surprises tend to follow the direction of the trend, but speculating on earnings reports is a very risky bet. It is not your interpretation of the headline which matters, but the market reaction to it. It is interesting that ABT and JNJ look setup for a break to highs not seen in at least the last 10 years. The only way I would consider playing any of these stocks before earnings is with options. The release day and time comes from www.briefing.com.

Posted by Brian at 7/13/2008 08:25:00 PM

Friday, July 11, 2008Stock Market Video Trend Analysis 7/11/08

I counted my books on options and technical analysis this PM – I have 37 of them (ranging from classics to a whole bunch of new ones). I can honestly say, after finishing your book this PM, it is by far the best book I own. Just a fantastic job…..way to go.

I loved everything about it. I especially liked the last chapter that showed how you tackle this business. I only wish there was more specific examples. As we talked in Vegas, I hope you start a paid service soon that shows your subscribers more detailed trades (some intraday).

It is going to take years for people to get to your level of understanding….. There is a lot to learn via school of hard knox, but we can only go through this journey one step at a time…….

Thanks again…..the best $80 I ever spent

Frank F

Brian,

I want to thank you for writing such an easy to read, no fluff, eye opening book on technical analysis. In reviewing my trade journal and charts, I was an “amateur” technician but I’ve already implemented changes to make me a better trader thanks to you. I’ve been full time trading for two years and my only trading education was taught through Investools which gave me a good overall basis but as a swing trader I was taught on the daily charts only. In so many trades I was whipsawed and gave back all kinds of profit where too many trades turned into losses by basing my exits on the daily chart only. Your trend alignment and executing on the shorter term timeframe was one of those “Aahha” moments. I’ve always felt close to being a really good trader, I followed my rules, had a plan, stuck to my stops etc. Your book was the final and biggest piece to the puzzle for me on why I wasn’t doing better.

By the way, the font size, color charts and book binding were great as well. The book would lay flat as I took notes, seems minor but it made it easier.

Of course, thanks for your work on the blog as well. Many “successful” traders (I think) I had previously followed always made a point by bragging about this or that trade which made me feel like a bad trader if I missed a move. I have always appreciated your professionalism.

Sincerely,

Andy T

Posted by Brian at 7/11/2008 04:12:00 PM

Labels: book review, customer feedback

Buyers Back (for now)

Posted by Brian at 7/11/2008 03:03:00 PM

Newer Posts Older Posts Home |

|

|

[复制链接]

[复制链接]