- 金币:

-

- 奖励:

-

- 热心:

-

- 注册时间:

- 2006-7-3

|

|

楼主 |

发表于 2009-3-25 06:43

|

显示全部楼层

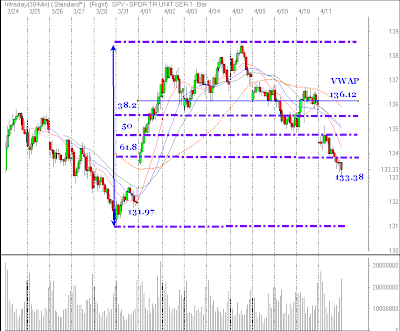

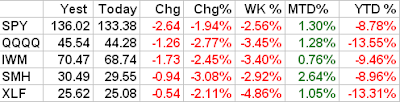

Tuesday, April 15, 200830 Minute Charts

The path of least resistance continues to be lower. 43.50 is an important level for the Qs.

Posted by Brian at 4/15/2008 11:33:00 AM

Monday, April 14, 2008Trend Trading Video Stock Market Review 4/14/08

Posted by Brian at 4/14/2008 04:18:00 PM

General Electric 10 Years

The chart below shows the last 10 years (120 months) of trading in General Electric (GE). On Friday the stock closed at 32.05. The average price the stock traded at over the entire 10 year period is approximately 35.90. The average participant over the last 10 years is down $3.85/share (not including dividends). The green shaded areas are the times where the stock traded below Friday's close, these people are making money. The light red shaded area shows times where GE traded above Friday's close, these participants are losing money.

Posted by Brian at 4/14/2008 10:50:00 AM

Earnings Reports

can be a catalyst for large price movements. This week we will see a heavy release of earnings from some large and influential stocks. I will be watching those large ones for market direction and possibly some trade opportunities, but being options expiration week, there can be some "special situations" to take advantage of with at the money to slightly out of the money options. For a very small portion of my risk capital, I sometimes purchase options on stocks where there appears to be a large potential move. Because the path of least resistance for the market is lower, I am choosing to concentrate on put positions this week. Some of the stocks I am considering purchasing puts on are:

INFY

STX

AVCT

CHKP

IART

The only fundamental information I am aware of in any of these stocks is that they are reporting earnings this week. These are bets. High risk, high potential reward. I trade them small. I do not have any favorites from the list and I may trade all or none of them. I do not make any recommendations so I will not answer any email questions regarding trade specific information. Good luck if you choose to trade any of them.

Posted by Brian at 4/14/2008 08:21:00 AM

Burlington Northern (BNI)

is the stock on WALLSTRIP today.

The stock backed off from all time highs last week, but there is no evidence of any damage to the powerful uptrend. 85 looks like the best level of potential support if the stock continues lower.

Posted by Brian at 4/14/2008 08:15:00 AM

Saturday, April 12, 2008Up for the Month?

On March 31, the SPY closed at 131.97.

On Friday, the SPY closed at 133.38.

For the month, the SPY is up 1.41.

Those are the facts.

But is the average participant up for the month? If they bought at any time during April and are still holding the answer is no (except for a handful of people who bought late Friday). The average price the SPY has traded at this month is at 136.12, this number represents the Volume Weighted Average Price (VWAP) since the beginning of the month. The April 1 move got a lot of attention but now those gains are rapidly deteriorating.

The rally from low near 131 to the high near 138.60 has now retraced more than 61.8% which is technically considered to be a failed move.

Price has memory and the more recent the price activity (in particular if there was a strong emotional event like we saw) the fresher the memory and the stronger the emotional responses. Time heals all wounds right? Well the recent financial wounds are still in need of much more time to heal and the risks in this market remain large as it struggles to find a bottom. Earnings reports this week from some large and important company's (GOOG, MER, ISRG, SPWR, EBAY, WM, C, IBM, JPM, etc) will make it extra treacherous.

Posted by Brian at 4/12/2008 08:36:00 AM

Friday, April 11, 2008Trading & Investing Video Technical Analysis 4/11/08

Video on the way

Posted by Brian at 4/11/2008 04:18:00 PM

Stocks Are Going

to open lower in today's trading. The SPY is trading back below the important 135.00 level, but the Qs are holding above the lows of the week. The market will continue to experience wild volatility as the pace of earnings releases continues to increase. Risk Management!

Posted by Brian at 4/11/2008 08:34:00 AM

Stepan Company (SCL)

is the stock on WALLSTRIP today.

Did you see THIS EPISODE? It was nominated for a Webby. Follow the link to vote for it, I did.

Posted by Brian at 4/11/2008 07:53:00 AM

Newer Posts Older Posts Home |

|

|

[复制链接]

[复制链接]