- 金币:

-

- 奖励:

-

- 热心:

-

- 注册时间:

- 2006-7-3

|

|

楼主 |

发表于 2009-3-24 17:45

|

显示全部楼层

Monday, October 06, 2008VWAP

Markets have rallied sharply from their lows and are now battling with the daily VWAP

Posted by Brian at 10/06/2008 11:18:00 AM

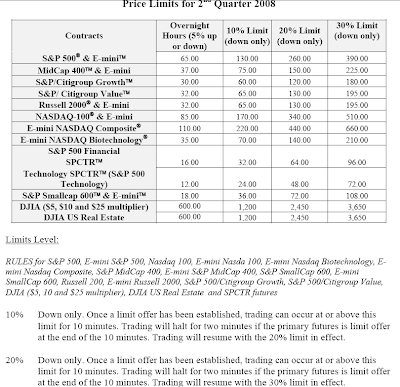

Limits

Will this be the bear market by which all future bears are compared to?

Here are the limits again.

Posted by Brian at 10/06/2008 10:44:00 AM

Reasons Not To Buy

- It's down too much

- The PE is just...

- It is at the __ day moving average

- It is at the __ retracement level

- But the earnings were great!

- Historically, the market has....

- It's an election year

- But the analyst said....

- It is at "support"

- The VIX is at __

_ etc...

The only reason to buy?

PRICE ACTION and then MANAGE RISK!!

The market is melting down and unless you are short it is just a horror show to watch from the sidelines.

Posted by Brian at 10/06/2008 10:33:00 AM

Dow 10,000?

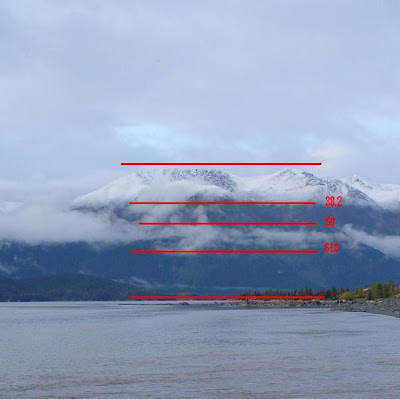

Art Cashin was just mentioning a possible capitulation scenario on CNBC. He thought some hard selling today and tomorrow morning would bring the Dow back below 10,000 and then setup a "massive reversal". I think his scenario makes sense for a TRADABLE bounce. The chart below shows the .618 retracement of the 2002 lows to the 2007 highs, which is found near 9,800. If you are looking to trade a bounce do not buy until there is evidence of a turn developing on the short term timeframes.

Here's a picture from my Alaska trip, I didn't think of the market at all while on vacation.

Posted by Brian at 10/06/2008 09:22:00 AM

Bamboozled

One of the saddest lessons of history is this: If we've been bamboozled long enough, we tend to reject any evidence of the bamboozle. The bamboozle has captured us. Once you give a charlatan power over you, you almost never get it back.

~Carl Sagan

Posted by Brian at 10/06/2008 07:06:00 AM

Labels: quotes

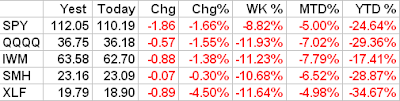

Sunday, October 05, 2008More Weakness

Futures are lower by more than 1%.

Posted by Brian at 10/05/2008 08:56:00 PM

Friday, October 03, 2008Stock Market Video Trend Analysis 10/3/08

Ed Dobson is a trader and owner of TRADER'S PRESS, a financial bookstore which operates online and at tradeshows through out the country. He just reviewed my book and I am honored to have my book included in his "top ten trading books ever written." Below is his review.

Purchase YOUR COPY TODAY

Book Review of: Technical Analysis Using Multiple Time Frames

Author(s): Shannon, Brian

One of my favorite actors (Al Pacino) said in one of my favorite movies (The Scent of a Woman) “I’ve been around, y’know!” I might modestly say that I too have “been around” books and literature on trading for a long time, almost fifty years….and have literally read hundreds of books on the subject. The majority of them fall into the category of SSDD (same stuff, different day)….and I’ll confess that it takes something truly new and unusual to impress me. Brian Shannon’s new book, Technical Analysis Using Multiple Time Frames not only impresses me, it earns a place in my “top 10 trading books ever written” list.

I’ve had the pleasure of meeting Brian at a number of trading seminars and discussing his approach to trading. Long before his book came out, he impressed me as a particularly savvy trader with a wealth of knowledge well worth listening to…again, a rare situation. His book corroborates this early opinion of him, and represents a valuable contribution to trading literature. It expands greatly on some of the ideas on another old favorite of mine (Stan Weinstein’s Secrets for Profiting in Bull and Bear Markets), adds valuable and detailed insights into the psychology of market participants, gives greatly detailed guidance on the specifics of how he trades, and emphasizes the most important elements necessary to achieve success in trading (discipline, detailed plan, removing emotion for decision making, and many others). A book from a “real trader” is worth far more, in my estimation, than one that is written from the “safety of the sidelines”. And this is one of the best that I have seen.

Perhaps the reason I like this book so much is that it mirrors closely my own beliefs on trading, which were gleaned and formulated over many years. Dominant themes throughout the book include the fact that price is the most important factor to consider, nothing else (even volume, which often expands after price moves, not before); that one must trade only what one sees, not what one thinks; the supreme importance of avoiding large losses and protecting capital; how one should listen only to the market and to price action, never to opinions; and perhaps most importantly, that in order to have the odds in one’s favor, one must trade with the prevailing trend (and not just the major trend, but the intermediate and minor trend as well).

Perhaps the most significant and important contribution of this book is the detailed manner in which the reader is shown how to enter and exit trades just at the moment when they should begin “working”, and not a moment sooner, thus permitting very close protective stops, which minimizes risk to trading capital. Shannon describes himself as a momentum trader, and takes positions only when all timeframes are in alignment with each other, from long term charts down to a 10 minute intraday chart. This is the first, and I believe the only book which offers concrete guidance in precisely how to correlate multiple time frames in order to fine tune trades with a high probability of success and a low risk.

Many “good” books on trading are “dry”, boring, and difficult reading. This one is easy and entertaining to read, clearly written, and replete with sound trading advice and “nifty” sayings that are easy to remember (“from failed moves come big moves”; “Human nature is the only constant in an environment constantly in a state of flux”; “risk is your constant companion”; “discipline and patience are your friends, emotions are the enemy”). The detailed descriptions of “stage analysis” and the psychology of market participants as price patterns unfold are well done.

If you are a long term, value oriented investor who reads 10-K’s and balance sheets, and selects stocks based on PE’s, book value, and other fundamentals, I doubt this book will hold much value for you. But if you are a focused, serious short term trader, it may just prove to be one of the most valuable books you ever read.

Review by Edward Dobson

President, Traders Press Inc.

Purchase YOUR COPY TODAY

Posted by Brian at 10/03/2008 03:50:00 PM

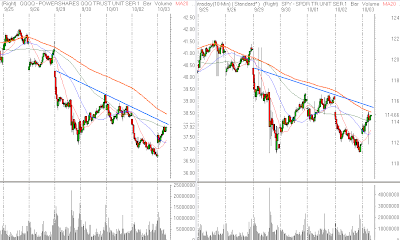

Intraday Trendlines

The SPY and QQQQ are up at the declining trendlines and also below the declining 5 DMA. Expect large volatility with the vote. Which way the vote or the market goes in reaction to the outcome is impossible to know which keeps risks high.

Posted by Brian at 10/03/2008 11:41:00 AM

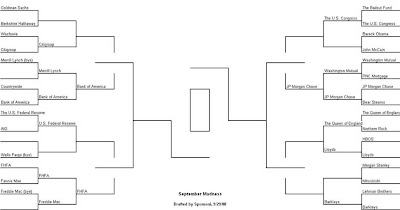

Who Will Make the Final Four?

Posted by Brian at 10/03/2008 08:56:00 AM

Newer Posts Older Posts Home |

|

|

[复制链接]

[复制链接]