- 金币:

-

- 奖励:

-

- 热心:

-

- 注册时间:

- 2006-7-3

|

|

楼主 |

发表于 2009-3-24 17:04

|

显示全部楼层

Friday, December 12, 2008Stock Market Trend Analysis 12/12/08

I should have the videos back up on Monday.

Posted by Brian at 12/12/2008 04:31:00 PM

Daytrading Environment

After my morning post of trades from this week I received some feedback that it helped my "credibility". With all the dubious marketers out there I can understand that sentiment, but I would rather that people view my daily posts as educational to them in making their trading decisions. I do not know why there is such a fascination with how I do financially, that is my business. If I were running money I would absolutely show my results, but running other peoples money is not my interest. Here are my trades today, I hope you can learn from them but they were all short term intraday trades based almost exclusively on the action on a one minute timeframe. I will not be posting my results with any regularity.

Posted by Brian at 12/12/2008 03:44:00 PM

Labels: daytrade results

Careful

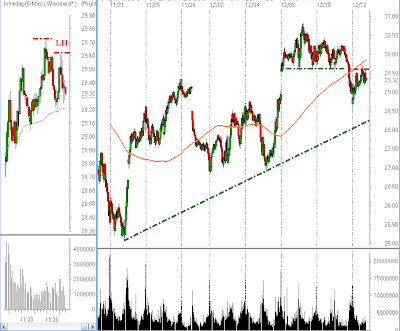

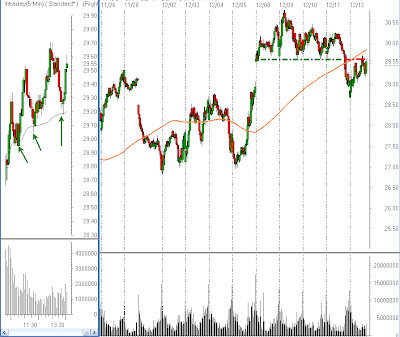

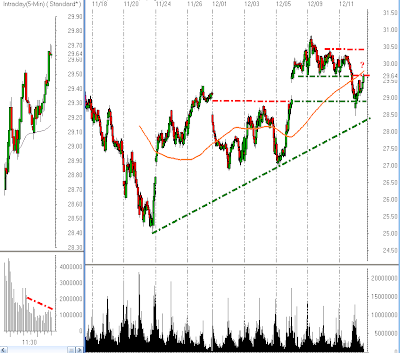

We have a lower high on the 5 minute timeframe and prior support has not been overcome. A move back below 29.20 could bring aggressive selling. The A/D is now 14:16

Posted by Brian at 12/12/2008 02:28:00 PM

It Woud Be Bullish

for next week if the Qs can close above 29.70. A market that can shake off bad news like this is capable of bigger upside. There are 1552 advancing stocks ant 1482 declining right now, that number has been improving for most of the day. Never let your guard down. Given the number of successful tests of VWAP today, a break below it could lead to more significant selling.

Posted by Brian at 12/12/2008 02:08:00 PM

Volume Is

drying up as the market approaches prior support. Be careful with longs here.

Posted by Brian at 12/12/2008 01:04:00 PM

Stabilizing

The market is trying to stabilize after the weakness from yesterday afternoon and this morning. So far, the VWAP has held as support which means buyers are taking advantage of the lower prices. It is also good to see the 29.00 level hold as support (for now). There will need to be more healing before buyers can have real confidence.

Posted by Brian at 12/12/2008 10:45:00 AM

Where To Start

I received an email from a reader this morning asking "where do you start on a day like today?" My answer was, "in cash, with an open mind" My opinion is unchanged, we remain in a high risk daytrading environment. You have to be patient enough to wait for the right opportunities, but aggressive enough to make sure you don't miss a good trade. It is a fine line to walk. Err to the side of caution.

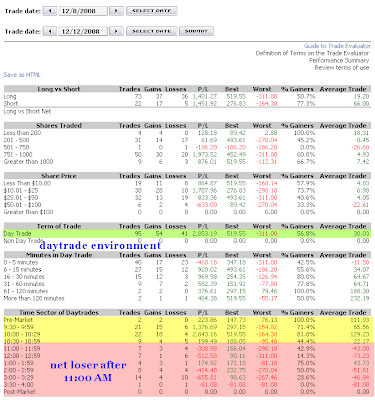

This is a report of my trades this week from Terra Nova, it allows me to analyze all my trades, it is a great learning tool to see what you are doing right/wrong. It looks like I should only trade the first 90 minutes of the day...

Posted by Brian at 12/12/2008 09:07:00 AM

Labels: daytrade results

Uncertainty

When the mind is in a state of uncertainty the smallest impulse directs it to either side.

~ Terence

Posted by Brian at 12/12/2008 06:31:00 AM

Labels: quotes

Thursday, December 11, 2008Stock Market Trend Analysis 12/11/08

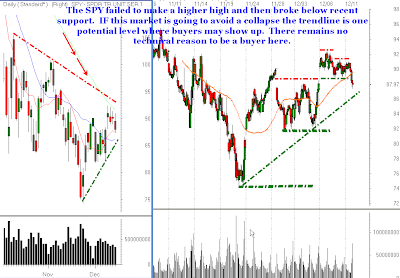

There will be no video today. The setup I use to record with is on my main computer which I do not have access to because it is being cleaned from a virus which I received from an email attachment. Once again, I ask that if you email me PLEASE DO NOT SEND ANY ATTACHMENTS, I refuse to open them. I should have the recording issues worked out by tomorrow, meanwhile here are some charts.

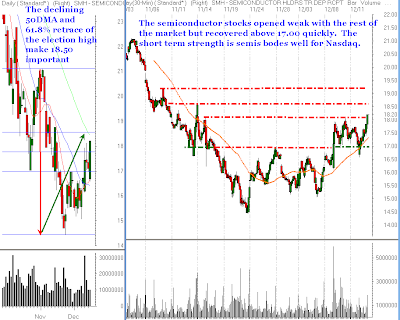

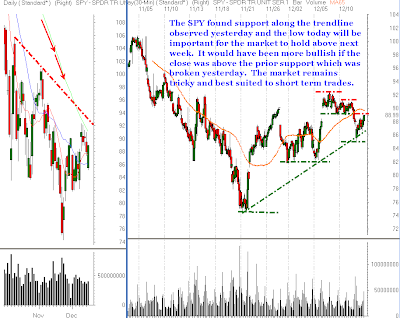

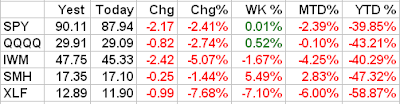

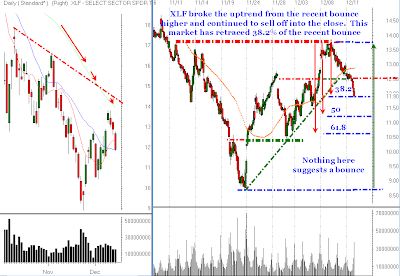

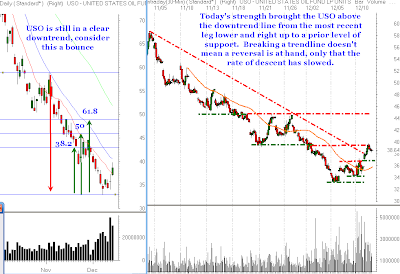

A one sentence summary of today's activity would go like this.... Short term support gave way and sellers returned in force below the declining 50 day moving averages.

Posted by Brian at 12/11/2008 04:43:00 PM

Labels: email

Newer Posts Older Posts Home |

|

|

[复制链接]

[复制链接]