- 金币:

-

- 奖励:

-

- 热心:

-

- 注册时间:

- 2006-7-3

|

|

楼主 |

发表于 2009-3-24 16:11

|

显示全部楼层

Friday, March 06, 2009For All The Hype

the reaction to the number is fairly quiet so far.

Posted by Brian at 3/06/2009 08:47:00 AM

Panic

Fear cannot be banished, but it can be calm and without panic; it can be mitigated by reason and evaluation.

~Vannevar Bush

Posted by Brian at 3/06/2009 05:50:00 AM

Labels: quotes

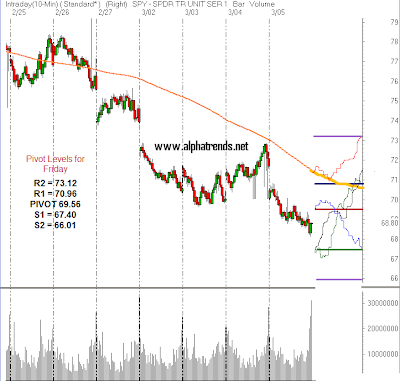

Thursday, March 05, 2009Roadmap for Tomorrow?

The chart below is complete fiction beyond the close at 68.80 on Thursday. I have sketched in 4 possible scenarios for trading tomorrow. See explainations below the chart.

Scenario 1- Red Line

The market gaps significantly higher (near the 5DMA) digests the move a bit and then rockets higher after a brief dip below the VWAP. The market continues higher into the close as shorts scramble to cover and new cash comes in from the sidelines.

Scenario 2- Blue Line

The market gaps higher, excited longs chase the strength but the market slowly churns and breaks below the daily VWAP which causes longs to liquidate and shorts (including me at this point) pile in to exploit the further weakness. In this scenario prices close near the low and the market continues to be vulnerable to this tortuous selloff. See song below.

Scenario 3- Black Line

The Market gaps down towards S1 and buyers immediately show up and pressure shorts to cover on "bad news" The market pauses briefly below daily pivot (which is also prior support from 3/3 which was resistance on 3/5) After the brief consolidation which takes prices below VWAP, buyers re-emerge and pressure shorts into the close.

Scenario 4- Green Line

This is the one I like best in spite of small long position. The market gaps down near S1 rallies for about 10 minutes then falls below VWAP and takes out the morning low. This lower low occurs on lighter volume and the market recovers back above VWAP (this is where I load up with stops below morning low). Shorts realize they had their chance to buy at low prices, they chase and that brings sidelined cash to the party. The market goes positive, stalls a bit, sucks in more shorts then rockets higher into the close.

I am hoping for one of the bullish outcomes, but gotta keep an open mind to all outcomes because bear markets continue on broken hope. Any of these scenarios is possible or the market could do something completely outside of what I have outlined. The point is to be prepared for anything, forget what YOU think of the jobs number, listen to the market. We are down at important levels here and if the market is going to experience a BEAR MARKET RALLY, this is a likely area where it will emerge from. When I trade tomorrow I will have an open mind. VWAP will be a big factor in how I decide to trade as it will tell me in real time who (buyers or sellers) has control of the session. More important than VWAP, economic numbers, pivot levels, moving averages, etc. will be the same things that keep traders alive to pay increasing taxes (editorial comment) each day; EMOTIONAL CONTROL, POSITION SIZING, RISK MANAGEMENT AND DISCIPLINE.

Nothing here is meant as a prediction it is just meant to show the thought process at an important level.

Boulevard of Broken Dreams seems appropriate until tomorrow...

Posted by Brian at 3/05/2009 07:06:00 PM

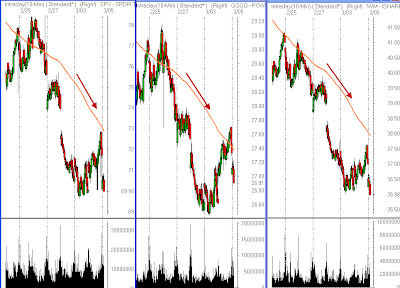

Stock Market Video Analysis 3/5/09

My buddy Joe from UPSIDETRADER has been more right about the financials than ANYONE, even Meredith Whitney. It is one thing to call it (as Meredith has) and completely different to TRADE it. Much respect for Joe.

When it feels as bad is it does in the market I could not help but break my guidelines (there are no rules) and get a little long near the close. I am actually hoping the market gaps lower, I have plenty of ammo for any potential reversal but bought some "just in case" upside exposure. There is ZERO technical evidence of a turn, but I smell fear. I do not want to encourage anyone to do anything reckless with their money, we are still in a vicious bear market. Small share size and risk management will keep you in the game when you make mistakes (and we all do).

Posted by Brian at 3/05/2009 05:39:00 PM

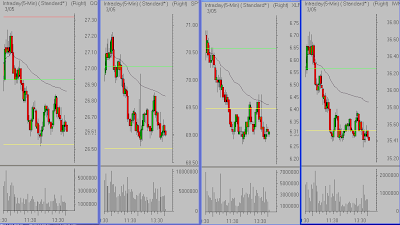

Still No Bullish Clues

even on the charts for just today, looks like we are going lower still. Only a big volume push above those VWAPs would change my opinion for today.

Posted by Brian at 3/05/2009 02:06:00 PM

No Signs

of the bottom that so many people are looking for. Would be great to see a high volume flush still.

Posted by Brian at 3/05/2009 10:23:00 AM

What Stocks Are Worth

I rarely think the market is right. I believe non dividend stocks aren’t much more than baseball cards. They are worth what you can convince someone to pay for it.

~Mark Cuban

Posted by Brian at 3/05/2009 06:45:00 AM

Labels: quotes

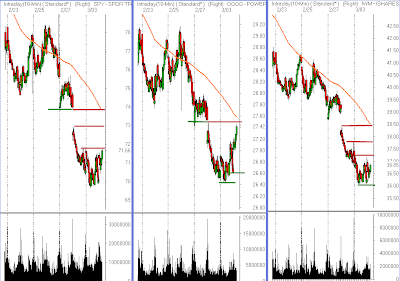

Wednesday, March 04, 2009Stock Market Video Analysis 3/4/09

Here is the article I wrote with VWAP info, it is in the current issue of SFO MAGAZINE I get asked a lot if I am aware of any free source of VWAP info and I am not **I just received and email saying Quotetracker does, I have not and do not plan on confirming myself, I use www.realtick.com

I will be doing a free online educational seminar similar to recent NYC presentation APRIL 21 from 6:30- 8:00 PM Eastern. It is a long way off but already filling up. If you sign up today, you will receive auto email reminders.

Posted by Brian at 3/04/2009 03:50:00 PM

Short Term Improvements

but the market is broken and all rallies should be viewed as trading opportunities only.

Posted by Brian at 3/04/2009 11:08:00 AM

Newer Posts Older Posts Home |

|

|

[复制链接]

[复制链接]