- 金币:

-

- 奖励:

-

- 热心:

-

- 注册时间:

- 2006-7-3

|

|

楼主 |

发表于 2009-3-21 11:39

|

显示全部楼层

Tuesday, April 18, 2006Nasdaq Technical Picture

The market gapped up and held its gains for the first hour and half. We had a second leg up from 11:00 until shortly before the Fed minutes. After the announcement, we started the third leg up for a total of 45 points on the session. The markets needed to hear that an end to the interest tightening was near in order to move higher. Now if earnings are favourable, we should be able to accelerate the bullish bias. All tech sectors were in the green with the SOX the clear leader, adding 3.4% on the session. After hours trade was good as well with several big names beating and/or guiding higher. The following names are trading higher in AH - YHOO, CYMI, TXN, GILD, IBM. MOT, on the other hand, is trading down. Most NDX stocks closed the session favourably. The big winners were JDSU, SNDK, ATVI. The market gapped up and held its gains for the first hour and half. We had a second leg up from 11:00 until shortly before the Fed minutes. After the announcement, we started the third leg up for a total of 45 points on the session. The markets needed to hear that an end to the interest tightening was near in order to move higher. Now if earnings are favourable, we should be able to accelerate the bullish bias. All tech sectors were in the green with the SOX the clear leader, adding 3.4% on the session. After hours trade was good as well with several big names beating and/or guiding higher. The following names are trading higher in AH - YHOO, CYMI, TXN, GILD, IBM. MOT, on the other hand, is trading down. Most NDX stocks closed the session favourably. The big winners were JDSU, SNDK, ATVI.

[url=] [/url] [/url]

Posted by Jamie at 4/18/2006 07:12:00 PM 0 comments

Trade of the Day - AKAM

Entered AKAM on a break of resistance. Sold 50% as the market started to weaken before noon. I was stopped out on the balance of the position just prior to the FOMC minutes. I re-entered the full position after the FOMC minutes were released and closed the position for an additional $0.40. Entered AKAM on a break of resistance. Sold 50% as the market started to weaken before noon. I was stopped out on the balance of the position just prior to the FOMC minutes. I re-entered the full position after the FOMC minutes were released and closed the position for an additional $0.40.

[url=] [/url] [/url]

Posted by Jamie at 4/18/2006 04:16:00 PM 0 comments

In Play

Slow start this morning as last night's watch list did not come into play.

Long AKAM, and MRVL.

Update 12:08 EST: Sold 50% AKAM and MRVL. Long AAPL and BRCM.

Update 1:49: The market has peaked for the time being (awaiting FOMC minutes) and I have been stopped out profitably on all four positions.

Interesting item on CNBC - Susquehanna analyst on CNBC says NVDA options trading, noting they have seen investors buying April options, positioning for some sort of mkt moving information in NVDA over the next four days.

[url=] [/url] [/url]

Posted by Jamie at 4/18/2006 11:41:00 AM 0 comments

Pre-Market

TZOO gapping up on earnings beat: TZOO prelim $0.24 vs $0.14 Reuters consensus; revs $16.9 mln vs $14.71 mln Reuters consensus

NDX futures up just slightly.

Piper Jaffray believes expectations are low for AAPL's March quarter results, noting that the co is scheduled to report March quarter results on 4/19. They expect Apple will report in line or slightly below Street consensus of $0.43 on $4.54 bln and, similar to last year, will guide June quarter revenue and EPS flat or up slightly from March quarter levels, which could be below consensus. Their analysis of the first 2 months of March quarter iPod shipment data from NPD leads them to believe Apple is on track to meet or be slightly below their 9.0 mln iPod assumptions. They expect Mac sales in the quarter will be closer to the Street's average estimate of 1.16mln. While they do not expect Apple's March quarter results and June quarter guidance will exceed expectations, they continue to believe that Apple will launch new products and gain market share with the Mac in 2H CY06 and CY07, which would likely lead to outperformance for AAPL shares. Firm's Mac market share sensitivity indicates that a 1% increase in share in CY06 would add $0.33 (or 14.5%) to their $2.28 CY06 EPS estimate.

[url=] [/url] [/url]

Posted by Jamie at 4/18/2006 07:46:00 AM 0 comments

Monday, April 17, 2006Watch List - BBBY, AMZN, ITRI, ENER, AAPL, CYMI

BBBY may be finished pulling back. Look for a reversal off of today's hammer like bar. BBBY may be finished pulling back. Look for a reversal off of today's hammer like bar.

AMZN is a potential short if the market is weak again tomorrow. AMZN is a potential short if the market is weak again tomorrow.

I'm posting the ITRI chart as a follow-up to April 12th watch list. I'm posting the ITRI chart as a follow-up to April 12th watch list.

ENER had a high volume breakout of a two and half month consolidation base. Look for continuation if high oil prices continue to dominate trading. ENER had a high volume breakout of a two and half month consolidation base. Look for continuation if high oil prices continue to dominate trading.

AAPL's selloff may be due for bounce as it has retraced 50 % of the move from the March low to the April high. Click on the 60 minute view for a better indication. AAPL's selloff may be due for bounce as it has retraced 50 % of the move from the March low to the April high. Click on the 60 minute view for a better indication.

CYMI shed over a dollar as it follwed the market down midday, however, in the last 90 minutes of high volume trade it took everything back and more. CYMI appears to be in the handle portion of a cup & handle continuation pattern and will likely retest $50.00 soon. It reports earnings tomorrow after the bell and could be a good long in anticipation of a glowing report. CYMI shed over a dollar as it follwed the market down midday, however, in the last 90 minutes of high volume trade it took everything back and more. CYMI appears to be in the handle portion of a cup & handle continuation pattern and will likely retest $50.00 soon. It reports earnings tomorrow after the bell and could be a good long in anticipation of a glowing report.

N.B. TEK and CTXS are still on the watch list even though I am not reposting the charts tonight.

[url=] [/url] [/url]

Posted by Jamie at 4/17/2006 08:32:00 PM 2 comments

Nasdaq Technical Picture

Although we were still on holiday lightened volume, today's selloff was energy related and touched all major tech sectors. Pacing the way was the SOX followed by software and hardware. DDX (disk drive) managed to close in the green. Although we took out last week's low, the late day bounce brought us all the way back to 2311 after trading as low as 2299. Today's NDX losers were topped by JDSU, RHAT, and CHRW. The winners included CTSH, FLEX, and PTEN. Hopefully, with the onslaught of earnings scheduled over the next three days, we can start trading off of more than just rising energy and commodity prices. Although we were still on holiday lightened volume, today's selloff was energy related and touched all major tech sectors. Pacing the way was the SOX followed by software and hardware. DDX (disk drive) managed to close in the green. Although we took out last week's low, the late day bounce brought us all the way back to 2311 after trading as low as 2299. Today's NDX losers were topped by JDSU, RHAT, and CHRW. The winners included CTSH, FLEX, and PTEN. Hopefully, with the onslaught of earnings scheduled over the next three days, we can start trading off of more than just rising energy and commodity prices.

[url=] [/url] [/url]

Posted by Jamie at 4/17/2006 07:54:00 PM 0 comments

Trade(s) of the Day - AMD and BRCM

I missed the open due to some maintenance work that had to be dealt with first thing this morning, but the day was not lost because I was able to get some very good low risk short setups in the late morning.

I'll start with AMD because it was on our watch list this weekend as a short candidate below $31.60. In late morning, AMD took out he low set on the opening 15 bar and I went short at $31.55. I covered in the last half hour at $30.17 for a nice gain.

The second shorting opportunity was BRCM. This is a new setup which I've been developing lately. I set an upper and lower parameter based on the late day trade of the previous trading session as marked by the two blue lines. The object is to trade in the direction on the first bar that closes outside of the parameters on the 15 minute timeframe. Although both the upper and lower parameter were tested in early trade, our first close below the lower parameter didn't occur until shortly after 11:00 as marked by the pink arrow. This is wide range bar on higher volume and presents a strong indication that BRCM is going lower, however, a higher risk because the stop would set above it. So I waited for a lower risk opportunity. The next bar was a hammer (potential reversal). The next two bars are NR and both closed below the blue line. As price took out the second NR bar, I took the low risk short. I covered 50% after a gain of $1.00 and covered the balance near the close. The second shorting opportunity was BRCM. This is a new setup which I've been developing lately. I set an upper and lower parameter based on the late day trade of the previous trading session as marked by the two blue lines. The object is to trade in the direction on the first bar that closes outside of the parameters on the 15 minute timeframe. Although both the upper and lower parameter were tested in early trade, our first close below the lower parameter didn't occur until shortly after 11:00 as marked by the pink arrow. This is wide range bar on higher volume and presents a strong indication that BRCM is going lower, however, a higher risk because the stop would set above it. So I waited for a lower risk opportunity. The next bar was a hammer (potential reversal). The next two bars are NR and both closed below the blue line. As price took out the second NR bar, I took the low risk short. I covered 50% after a gain of $1.00 and covered the balance near the close.

[url=] [/url] [/url]

Posted by Jamie at 4/17/2006 04:14:00 PM 2 comments

Saturday, April 15, 2006Tech Heavy Reporting Week Ahead

Tuesday - IBM, LLTC, YHOO, MOT, TXN, CYMI

Wednesday - INTC, AAPL, CTXS, EBAY, RMBS, JNPR, NVLS, QCOM

Thursday - CREE, FFIV, BRCM, FDRY, SNDK, GOOG, CERN (NOK pre-market)

AH except where noted

[url=] [/url] [/url]

Posted by Jamie at 4/15/2006 10:59:00 PM 2 comments

Watch List - NTAP, THLD, SYNA, TEK, AMD

Despite Cramer's strong recommendation of NTAP and CTXS as potential stars of the next tech rally, I am posting this chart of NTAP because it looks well positioned to break as early as Monday. Next level of resistance is in the area of $41.00. CTXS has been on my watchlist for a while now and could also be a buy on an upside break of its current consolidation pattern. Despite Cramer's strong recommendation of NTAP and CTXS as potential stars of the next tech rally, I am posting this chart of NTAP because it looks well positioned to break as early as Monday. Next level of resistance is in the area of $41.00. CTXS has been on my watchlist for a while now and could also be a buy on an upside break of its current consolidation pattern.

Thursday THLD broke out of a four month base on three times average daily volume. I like how the ADX is curving up from a very low reading. This often foreshadows explosive moves. Let's see if THLD has legs.

SYNA broke its downtrend line on a closing basis on Monday. On Tuesday it gapped up on high volume. Since then, it has been consolidating its gains. I would like to see it pullback to $24.00 before resuming its uptrend. I'll be watching SYNA daily to see how it unfolds. Next earnings report is Thursday April 20th, AH. SYNA broke its downtrend line on a closing basis on Monday. On Tuesday it gapped up on high volume. Since then, it has been consolidating its gains. I would like to see it pullback to $24.00 before resuming its uptrend. I'll be watching SYNA daily to see how it unfolds. Next earnings report is Thursday April 20th, AH.

TEK swung into action on Thursday, carving out a morning doji star reversal pattern. Look for further upside next week. TEK swung into action on Thursday, carving out a morning doji star reversal pattern. Look for further upside next week.

The street did not appreciate AMD's quarterly earnings report and there are many reasons to expect more selling next week including the gap down on extremely high volume and the fact that the stock closed on its lows and in so doing violated support. Short below Thursday's low of $31.60. The street did not appreciate AMD's quarterly earnings report and there are many reasons to expect more selling next week including the gap down on extremely high volume and the fact that the stock closed on its lows and in so doing violated support. Short below Thursday's low of $31.60.

N.B. I will be updating this post over the course of the long weekend.

[url=] [/url] [/url]

Posted by Jamie at 4/15/2006 09:34:00 AM 7 comments

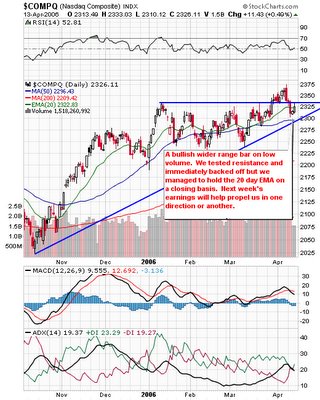

Thursday, April 13, 2006Nasdaq Technical Picture

We didn't do too badly for a volume reduced pre-holiday session. The Nasdaq added 11 points and carved out a wider range bar which met with resistance mid-day. Networking and biotechs led the rally, while the internets and software lagged. The SOX was mixed due to AMD's weak earnings report offset by LRCX's strong beat.Today's NDX winners were AMLN, LRCX, and SNDK while the losers were NVDA, PDCO, and EXPE. We didn't do too badly for a volume reduced pre-holiday session. The Nasdaq added 11 points and carved out a wider range bar which met with resistance mid-day. Networking and biotechs led the rally, while the internets and software lagged. The SOX was mixed due to AMD's weak earnings report offset by LRCX's strong beat.Today's NDX winners were AMLN, LRCX, and SNDK while the losers were NVDA, PDCO, and EXPE.

[url=] [/url] [/url]

Posted by Jamie at 4/13/2006 07:22:00 PM 0 comments

Newer Posts Older Posts Home |

|

|

[复制链接]

[复制链接]