- 金币:

-

- 奖励:

-

- 热心:

-

- 注册时间:

- 2006-7-3

|

|

楼主 |

发表于 2009-3-20 17:21

|

显示全部楼层

Wednesday, October 24, 2007Dummy Gapper (Short) Trade of the Day - Amazon.com, Inc. (Public, NASDAQ:AMZN)

AMZN gapped down on a disappointing earnings report. I entered short on a break 6th - 5 min. bar low and covered when price approached the 38% Fibonacci extension of the previous day high to the ORL. AMZN gapped down on a disappointing earnings report. I entered short on a break 6th - 5 min. bar low and covered when price approached the 38% Fibonacci extension of the previous day high to the ORL.

BRCM also gapped down on disappointing earnings. It spent most of the morning consolidating the gap in a sideways trade, printing a number of doji sticks. Since dojis represent indecision, I decided to place a sell stop order below the base. After triggering, if fell but attempted to reverse, carving a bullish morning star and I was just about to close the trade but the morning star didn't confirm and price started moving lower, so I stayed in. BRCM also gapped down on disappointing earnings. It spent most of the morning consolidating the gap in a sideways trade, printing a number of doji sticks. Since dojis represent indecision, I decided to place a sell stop order below the base. After triggering, if fell but attempted to reverse, carving a bullish morning star and I was just about to close the trade but the morning star didn't confirm and price started moving lower, so I stayed in.

AKAM was a bearish flag breakout - weakness ahead of earnings. I took a partial after a 1 pt. gain and folded shortly after. I don't like to overstay these pre-earnings trades as they can be extremely unpredictable. AKAM was a bearish flag breakout - weakness ahead of earnings. I took a partial after a 1 pt. gain and folded shortly after. I don't like to overstay these pre-earnings trades as they can be extremely unpredictable.

[url=] [/url] [/url]

Posted by Jamie at 10/24/2007 10:11:00 PM 6 comments

Labels: Base and Break, Bearish_Flag, Dummy, Fibonacci, Gapper, Morning_Star

Tuesday, October 23, 2007Dummy Gapper Trade of the Day - Amazon.com, Inc. (Public, NASDAQ:AMZN)

AMZN gapped up on the open and carved out a flat base following the 15 minute OR. These flat base breakouts can be very powerful even though they are extremely boring to watch, stick after stick. I waited for price to break and then consolidate the break as can be seen on the 5 minute time frame below. I managed the trade on the 15 minute time frame and closed the position after three WRBs. I place my Fibonacci extension from the previous day low to the base as opposed to the ORH. Price reached the 62% Fib. extension on the third WRB. AMZN gapped up on the open and carved out a flat base following the 15 minute OR. These flat base breakouts can be very powerful even though they are extremely boring to watch, stick after stick. I waited for price to break and then consolidate the break as can be seen on the 5 minute time frame below. I managed the trade on the 15 minute time frame and closed the position after three WRBs. I place my Fibonacci extension from the previous day low to the base as opposed to the ORH. Price reached the 62% Fib. extension on the third WRB.

After extending 62%, AMZN retraced 38% on the move from the ORL. This is a normal retracement and usually means that the stock is preparing for the next leg up.

[url=] [/url] [/url]

Posted by Jamie at 10/23/2007 05:30:00 PM 25 comments

Labels: Dummy, Fibonacci, Fibonacci_retracement, Gapper

Gappers Tuesday October 23rd

Following yesterday's rebound, futures indicate a higher open for the mkt. The PC sector is leading the way following Apple's (AAPL) blowout quarter. The co not only beat handily on both the top and bottom lines, but issued Q1 (Dec) guidance that was above consensus ests. Typically, the co guides conservatively and below expectations. Lexmark (LXK) is also providing a boost to the group after destroying its Q3 EPS consensus est, beating by $0.47. Not all earnings were good, though. Texas Instruments (TXN), which beat Q3 expectations by $0.02, is indicated lower by 6% after the co issued a rev warning for Q4 that was tied to increased competition. In turn, Target (TGT) cut its Oct same-store sales view to a rise of 2-4% from the earlier est of 3-5%. Outside of earnings, there's very little news out this morning. Dow futures are currently +60; Nasdaq futures are currently +24.3; S&P futures are currently +8.3. Notable pre-market Calls include Upgrades: TXN at Caris & Co, APOL at Robert W. Baird, ZRAN at CIBC and Needham, SPWR at Lehman; Downgrades: TXN at UBS, Jefferies, JP Morgan, Lehman and Credit Suisse... On the Earnings calendar, 66 cos are confirmed to report after the close including AMZN and BRCM... Today's Economic calendar is empty.

Gapping down on weak earnings/guidance: LVLT -16.2%, TXN -7.4% (also downgraded at multiple firms), PCP -3.7%, COH -3.1%, TLAB -2.8%, BIIB -1.2%, AKS -1.1%, ... Other news: CSUN -5.8% (started with a Sell and $6 tgt at Lazard), ORA -4.2% (offering 3 mln shares of our common stock), BEAS -3.7% (ORCL announces "that BEA's board again rejected our proposed price of $17 per share in cash").

Gapping up on strong earnings/guidance: EDAC +13.2%, NFLX +12.8%, MICC +11.%, JDAS +10.9%, ZRAN +10.3% (also upgraded to Buy at Needham), PTEC +9.8%, AAPL +7.5%, JBLU +6.2%, LXK +2.9%... Other news: CNIC +33.2% (releases mobile update to include Apple iPhone optimization), GRRF +17.9% (obtains 100 mln Yuan R.F. order), MVIS +13.1% (enters development agreement with Asian consumer electronics manufacturer to create accessory pico projector for mobile phones and other devices), STV +5.7% (recent China IPO -- not seeing any news to account for today's move)

Courtesy of Briefing.com

Better late than not at all. Power failure.

[url=] [/url] [/url]

Posted by Jamie at 10/23/2007 10:21:00 AM 2 comments

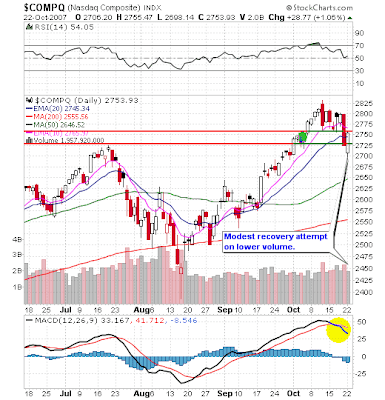

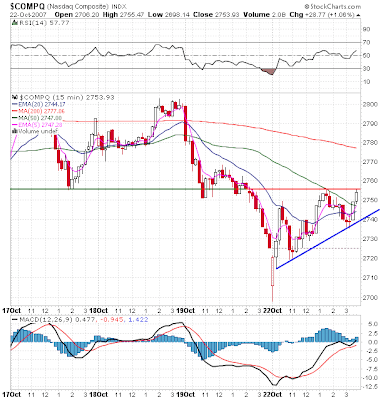

Monday, October 22, 2007NASDAQ Technical Picture - NAZ leads in Modest Recovery Attempt

The NASDAQ provided leadership on today's modest recovery attempt. Still after the first thrust from the opening gap down, it felt uninspiring. Will AAPL's blowout earnings and increased guidance provide impetus to more bullish developments tomorrow? The NASDAQ provided leadership on today's modest recovery attempt. Still after the first thrust from the opening gap down, it felt uninspiring. Will AAPL's blowout earnings and increased guidance provide impetus to more bullish developments tomorrow?

[url=] [/url] [/url]

Posted by Jamie at 10/22/2007 10:44:00 PM 0 comments

Labels: NASDAQ

Dummy Trade of the Day - Hansen Natural Corporation (Public, NASDAQ:HANS)

HANS gapped down on the open and was quickly met by bargain hunters who managed to push price back up to Friday's morning swing low. HANS could not close above resistance and it carved out a NRB as price fell back under the 5 period EMA. This set up a dummy short. At first I was planning to take a partial when price retested the ORL, but when I saw the volume spike on the second WRB, I decided I would fold as this spike implied capitulation. HANS gapped down on the open and was quickly met by bargain hunters who managed to push price back up to Friday's morning swing low. HANS could not close above resistance and it carved out a NRB as price fell back under the 5 period EMA. This set up a dummy short. At first I was planning to take a partial when price retested the ORL, but when I saw the volume spike on the second WRB, I decided I would fold as this spike implied capitulation.

ABX gapped down on the strength in the US dollar. It set up a dummy short after it failed to close above down sloping 5 period ema at the base of R2 (red line). Here again, I wanted to partial out at the retest of the ORL, but the lacklustre volume accompanying the move down, forced me to fold. ABX gapped down on the strength in the US dollar. It set up a dummy short after it failed to close above down sloping 5 period ema at the base of R2 (red line). Here again, I wanted to partial out at the retest of the ORL, but the lacklustre volume accompanying the move down, forced me to fold.

MTW was a forced trade based on a low risk entry. If you look at the daily chart, you will see that it was due for a bounce. I quickly scratched the trade when after breaching R2 (red line), it popped right back above it. MTW was a forced trade based on a low risk entry. If you look at the daily chart, you will see that it was due for a bounce. I quickly scratched the trade when after breaching R2 (red line), it popped right back above it.

[url=] [/url] [/url]

Posted by Jamie at 10/22/2007 09:33:00 PM 10 comments

Labels: Dummy, Gapper, Support_Resistance

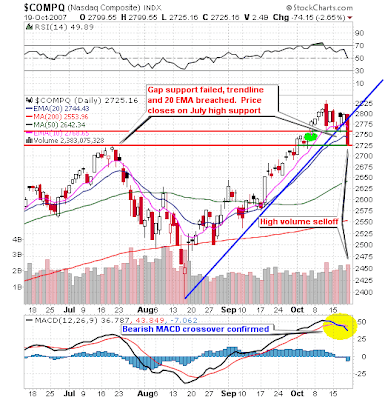

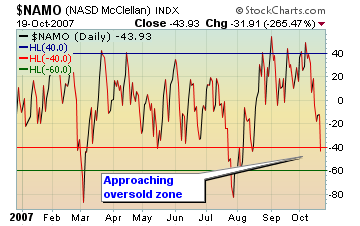

Sunday, October 21, 2007NASDAQ Technical Picture - Tipping Point or Anniversary Anxiety

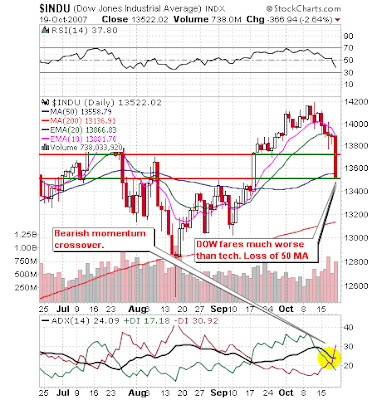

Was Friday's sell-off the tipping point leading to a larger correction, or was it just Black Monday anniversary anxiety? As has been well documented for weeks now, the 20th anniversary of the October'87 crash was a reminder that things can turn very ugly, very quickly. Was it coincidence or psychological, or is it real. According to those who remember, the Friday preceding the October' 87 Black Monday had many similarities to this past Friday.

What were the catalysts to Friday's drubbing - poor earnings from WB and poor guidance from industrials like SLB, and CAT. It was a given that the Financial sector would underperform and that Tech would outperform, but investors seem to be surprised that industrials are not optimisitc going into Q4.

Asian markets are tanking as I write this post. The USD continues to fall against overseas currencies. What's in store for tomorrow? We'll soon find out.

Friday's sharp sell-off has sent the "fear gauges" to their highest levels seen since the 9/18 rate cut. The steady weakness in equities has come as a mixed start to earnings season has cast doubt on the mkt's ability to push to new highs after the impressive bounce off the 8/16 lows. The Dow and S&P 500 are down ~4% on the week (~2.5% today), while the Nasdaq has lost around 2.8% this week (2.6% today). The NDX 100, however, bucks the trend by holding tight within its recent trading range. The VIX is currently +4.23 (+24%) on the week, while the more tech-focused VXN is up 4.51 (+21%) to 25.71 on the week... The CBOE put/call ratio is currently at 1.09, indicating slightly more active put trading than call trading.

Of the hundreds of companies reporting earnings the week of Oct 22nd -26th some of the bigger names include: Monday: AUO, CRNT, CHKP, HAL, MRK, AAPL, EXP, NFLX, TXN, and WCN... Tuesday: AKS, EAT, BIIB, COH, JBLU, LVLT, LMT, SII, AMTD, AMAZN, BRCM, FLEX, HOKU, PNRA, RJET, RFMD, TRMB, and XL... Wednesday: APD, ABI, BA, CME, COP, LM, MER, NDAQ, NSC, NOC, RAI, BUD, AKAM, CDNS, FFIV, MNST, PHM, and TSCO... Thursday: EYE, BMY, CELG, CNCSA, DOW, ELNK, SSP, FLIR, IMCL, ICE, LLL, MATR, LCC, XMSR, AMGN, BIDU, CNET, DRIV, ESLR, IM, KLAC, MFE, WFR, MSFT, NTGR, OSIP, RACK, TRID, and WEN... Friday: BHI, BC, CFC, CVH, IR, LZ, TDW, THI, and WMI.

Stocks over $5 posting the largest percentage gain over the last five sessions include: ASTIZ 40.4%, TEK 33.4%, GSB 32.3%, LCRY 27.2%, LULU 27.1%, SHOO 25.7%, PTT 24.5%, SQNM 24.5%, RIMG 23.7%, FTEK 23.2%, SKP 20.9%, TBSI 20.2%, PLCM 19.6%, FONR 18.7%, KAZ 18.7%, ASTI 17.7%, RBN 17.3%, CNTY 17.2%, LOGI 17.1%, NTCT 16.6%, BIIB 16.0%, JAG 15.9%, SKF 15.7%, DSX 15.5%, HYTM 15.3%, PKTR 14.9%, CYBS 14.3%, VGZ 13.8%, SRS 13.8%, QMAR 13.7%, ASPV 13.6%, ALTU 13.4%, HMIN 12.2%, PALM 11.7%, STP 11.3%, FCS 11.3%, ANET 11.3%, PRGN 11.2%, WINN 11.2%, ANH 11.1%, ANW 11.1%, SHLM 11.1%, ANV 10.8%, ASX 10.7%, SONS 10.6%, ASMLD 10.6%, HNSN 10.3%.

Stocks over $5 posting the largest percentage loss over the last five sessions include: TGIC -58%, RDN -42.1%, NFI -39.2%, HSWI -36.4%, PMI -31.9%, MTG -30.6%, KUN -29.4%, FFHL -29.2%, ERIC -28.9%, RCH -28.8%, PRM -28.5%, WBMD -24.4%, IMB -23.6%, CBAK -23.5%. NKTR -22.7%, STV -22.5%, MGI -22%, CBON -21.5%, WPL -21.2%, CTEL -20.9%, RX -20.6%, ETFC -20.5%, PBKS -20.2%, PIR -20.2%, RSF -20%, CCRT -20.1%, ELOS -20%, RAMR -19.8%, BKUNA -19.6%, CFC -19.5%, RMH -19.4%, CSUN -19.3%, MHJ -19.3%, AOS -19.1%, RHY -18.8%, CSIQ -18.8%, FCFS -18.7%, QXM -18.5%, BHS -18.3%, TRGL -18.1%, PJC -18.1%, DSL -18.1%, NANX -18%, RMA -17.9%, PFBC -17.8%, RRR -18%, TMA -17.8%, WM -17.7%, SAFM -17.7%, CDS -17.7%, QRCP -17.4%.

[url=] [/url] [/url]

Posted by Jamie at 10/21/2007 08:38:00 PM 4 comments

Labels: NASDAQ

Newer Posts Older Posts Home |

|

|

[复制链接]

[复制链接]