- 金币:

-

- 奖励:

-

- 热心:

-

- 注册时间:

- 2006-7-3

|

|

楼主 |

发表于 2009-3-21 07:18

|

显示全部楼层

Sunday, May 13, 2007Dummy Trade of the Day - Alcan Inc. (USA) (Public, NYSE:AL)

Alcoa's hostile bid for Alcan should make AL an interesting play in the near term, so I added it to my usual suspects list last week. Friday we had problems with NASDAQ quotes in the early going, so I had no choice but to focus on NYSE stocks. AL was a low risk base and break setup. Once price took out the low hanging 200 MA, it was easy money. Alcoa's hostile bid for Alcan should make AL an interesting play in the near term, so I added it to my usual suspects list last week. Friday we had problems with NASDAQ quotes in the early going, so I had no choice but to focus on NYSE stocks. AL was a low risk base and break setup. Once price took out the low hanging 200 MA, it was easy money.

VLO was gapper with a base setup in line with the ORH. I took a partial as price rallied up to the 62% Fibonacci extension of the previous day low to the ORH. I was stopped out on the balance with a tight stop. VLO was gapper with a base setup in line with the ORH. I took a partial as price rallied up to the 62% Fibonacci extension of the previous day low to the ORH. I was stopped out on the balance with a tight stop.

AL chart - 5 minute timeframe, VLO 10 minute timeframe.

[url=] [/url] [/url]

Posted by Jamie at 5/13/2007 10:51:00 AM 0 comments

Labels: Base_Breakout, Dummy, Fibonacci, Gapper

Friday, May 11, 2007NASDAQ Technical Problems

NASDAQ is having quote problems this morning.

[url=] [/url] [/url]

Posted by Jamie at 5/11/2007 09:46:00 AM 12 comments

Thursday, May 10, 2007After Hours Trading

Companies moving in after hours trading in reaction to earnings: Trading Up: UEPS +17.5%; SYNM +12.1%; ABTL +10.8%; JOBS +9.9%; NGPS +6.6%; AMPX +6.2%; NVDA +5.1%; TMY +4.8%; SBNY +4.5%; NFI +2.9%; GMET +2.2%; ASYT +1.8%; LCRD +1.8%; COSI +1.6%; BDY +1.4%; CPLA +1.4%; NLST +1.4%; SRVY +1.2%; COGO +1.1%; SPPR +1.1%; STSI +1.0%; CHCI +1.0%...

Trading Down: DESC -23.9%; MAMA -14.6%; BRLC -13.9%; BSQR -12.5%; TMTA -11.1%; INT -10.9%; MED -10.0%; THQI -6.3%; IMH -5.6%; NGAS -4.0%; PRXI 3.9%; AXCA -3.5%; KOG -3.4%; ACTS -3.0%; CEGE -2.7%; CPKI -1.7%; WRSP -1.6%; KNTA -1.5%; TDSC -1.3%; XOMA -1.3%; FACT -1.2%; CNR -1.2%...

Companies moving in reaction to news: Trading Up: PGIC +12.2% (to reschedule Q1 2007 reporting and conference call); TOA +4.5% (double size with acquisition of Dallas/Fort worth division of Newmark Homes); LJPC +4.5% (names Niv Caviar chief business and financial officer); PRST +3.1% (appoints former Kodak executive Jeffrey Jacobson as President and CEO); DYN +1.3% (announces offering of at least $1.1 bln of senior unsecured notes)...

Trading Down: BRLC -13.9% (announces plans to offer $150 mln and certain of its stockholders plan to offer approx $22 mln common stock); FL -10.4% (sees Q1 EPS of $0.10-0.11 vs $0.36 Reuters consensus); MATH -2.1% (announces a $25 mln common stock offering pursuant to an effective shelf regist); DWRI -1.4% (satisfies Nasdaq requirements or continued listing; files form 10-k).

Courtesy of Briefing.com

[url=] [/url] [/url]

Posted by Jamie at 5/10/2007 10:34:00 PM 3 comments

Labels: Gapper

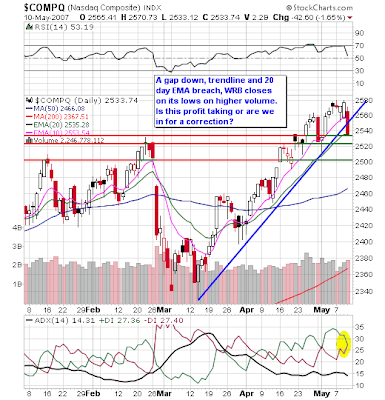

NASDAQ Technical Picture - Profit Taking on Higher Volume

The NASDAQ opened lower for the third straight session, but unlike the previous two days the bulls lacked the strength to lift prices beyond Tuesday's pivot point high. The weakness at the PP level, resulted in a reversal and a steady slide with only one attempt to regain another lost PP in mid-afternoon. It failed and the market swooned lower in the final 45 minutes, closing on its lows. All this profit taking was amid higher volume and judging by the daily timeframe above, it looks like the biggest one day decline since March. In the process we breached our trendline and closed two points below the 20 EMA. The NASDAQ opened lower for the third straight session, but unlike the previous two days the bulls lacked the strength to lift prices beyond Tuesday's pivot point high. The weakness at the PP level, resulted in a reversal and a steady slide with only one attempt to regain another lost PP in mid-afternoon. It failed and the market swooned lower in the final 45 minutes, closing on its lows. All this profit taking was amid higher volume and judging by the daily timeframe above, it looks like the biggest one day decline since March. In the process we breached our trendline and closed two points below the 20 EMA.

I'll be watching how price reacts to the pivot points plotted on the 15 minute timeframe above at key reversal times. I'll also be watching the PPI data at 8:30 and Business Inventories at 10:00.

Is this just normal profit taking or are we heading into a corrective phase? It's too soon to tell, but if we breach the next level pivots (green/red lines) on a closing basis, the bulls will be in trouble.

[url=] [/url] [/url]

Posted by Jamie at 5/10/2007 08:02:00 PM 0 comments

Labels: NASDAQ, Pivot Point, Trendline, Volume

Trade of the Day - Amazon.com, Inc. (Public, NASDAQ:AMZN)

AMZN was a short on a break of a bear flag. After closing near its highs yesterday, AMZN gapped down on the open sending a clear reversal signal. After that it was just a matter of finding the best entry point. By late morning, it carved out a bearish flag pattern and I shorted the break. It easily breached the pivot point support. I took a partial on a volume spike and I covered the balance after it carved out a bullish green hammer reversal bar. Notice how the pivot point held as resistance on the afternoon bounce. AMZN was a short on a break of a bear flag. After closing near its highs yesterday, AMZN gapped down on the open sending a clear reversal signal. After that it was just a matter of finding the best entry point. By late morning, it carved out a bearish flag pattern and I shorted the break. It easily breached the pivot point support. I took a partial on a volume spike and I covered the balance after it carved out a bullish green hammer reversal bar. Notice how the pivot point held as resistance on the afternoon bounce.

SMSI was a NR7 on the daily chart yesterday as highlighted by Prospectus on Move the Markets. I moved my stop to breakeven when it looked like it might reverse. I left it there hoping for a bigger move and SMSI finally succumbed to weakness end of day. SMSI was a NR7 on the daily chart yesterday as highlighted by Prospectus on Move the Markets. I moved my stop to breakeven when it looked like it might reverse. I left it there hoping for a bigger move and SMSI finally succumbed to weakness end of day.

MNST was a long on a break of the first 15 minute bar (green hammer). The third bar swoon came close to hitting my stop. I took a partial when price moved back up to $46.60 and I was stopped out on the balance just under $47.00. I don't like these disorderly type trades.

[url=] [/url] [/url]

Posted by Jamie at 5/10/2007 04:19:00 PM 0 comments

Labels: Bearish_Flag, Dummy, Gapper

Pre-Market - Thursday May 10th

Gapping down on weak earnings/guidance: IFON -20.2%, KNOT -16.9% (also downgraded to Sector Perform at CIBC), WFMI -12.0%, CRUS -9.5%, CRYP -9.2%, JACO -8.8%, WNG -8.7%, MEK -7.2%, EGY -6.9%, SIX -4.5%, PGS -4.5%, RMIX -4.4%... Retailers trading down on weak comps: ZUMZ -5.6%, URBN 5.5%, KIRK -4.6%, BEBE -4.5%, CHS -4.0%, PSUN -3.1%, GPS -2.3%, BONT -1.3%... Other news: DNDN -7.9% (downgraded to Sell at BofA; tgt cut to $4), RTP -5.7% & BHP -2.7% (UBS says RTP/BHP merger not illogical, not impossible, but unlikely), FNSR -4.5% (profit-taking after yesterday's move), BPHX -4.4% (names new CFO).

Gapping up on strong earnings/guidance: HSOA +20.0%, TOA +14.9%, PEIX +14.7% (also upgraded to Hold at Hambrecht), MRGE +12.1% (also announces Fusion aXigate order in France), SCI +11.5%, NKTR +10.7% (also upgraded to Equal-Weight at Morgan Stanley), BNE +6.75, MAIL +5.6%, CLAY +5.3%, HLS +5.2%, KG +4.6%, LOCM +3.5% (very light volume), BVF +3.3%, CNTY +3.3%, DK +2.9%, TFSM +1.8% (reports & confirms it is assessing strategic alternatives; also downgraded to Hold at Jefferies)... Retailers trading up on strong comps: JOSB +5.7%, ARO +1.8%, COST +1.8%... Other news: TRU +20.9% (commences cash tender offer for all units of beneficial interest of Torch Energy Royalty Trust), ENTG +11.3% (commences "Dutch auction" tender to purchase up to 20.4 mln shares between $11-12.25), CEA +10.6% & ZNH +3.1% (Air France to add routes throughout China; also CEA and Singapore Air in final talks on stake), SPAR +9.4% (subsidiary receives $107.6 mln in new Orders in Military Vehicles), GGC +4.8% (upgraded to Buy at Citi), CBI +4.1% (Cramer positive on stock), ONT +3.5% (announces agreement with C2 Microsystems), FWLT +1.6% (tgt raised to $129 at Stifel).

Futures indicate a lower open for stocks. The bulk of April same-store sales figures (ANF, ANN, ARO, DDS, FD, GPS, JCP, WMT) checked in below expectations, raising concerns about the health of the consumer and giving investors an excuse to take some money off the table. In economic news, weekly Initial Claims unexpectedly fell 9K to 297K (consensus 315K), but the Mar Trade Deficit widened a larger than expected $63.9 bln (consensus $60.0 bln) and Apr Import Prices surged a larger than expected 1.3% in Apr, stirring inflation concerns.

Notable pre-market Calls include Upgrades: MA at Stifel Nicolaus, PEIX at WR Hambrecht; Downgrades: TFSM at Jefferies, DNDN at BofA, RSH at Credit Suisse, WFMI at HSBC, RTP at BMO Capital... On the Earnings calendar, SYNM is confirmed to report sometime during trading hours. After the close, 33 cos are confirmed to report including NVDA... On the Economic calendar, the Apr Treasury Budget (consensus $143.0 bln) will be released at 14:00ET.

[url=] [/url] [/url]

Posted by Jamie at 5/10/2007 09:07:00 AM 0 comments

Technical Trade Idea - Monster Worldwide, Inc. (Public, NASDAQ:MNST) Flag Pole

Click on chart to enlarge Click on chart to enlarge

[url=] [/url] [/url]

Posted by Jamie at 5/10/2007 12:14:00 AM 4 comments

Labels: Bull_Flag

Wednesday, May 09, 2007Narrow Base & Break Patterns

Here are two B&B patterns I traded today from my usual suspects list. I noticed quite a few more such as MA and ICE. I close all of my positions before the FOMC release and I didn't care for the wild swings after so I waited a while before deciding if I wanted to wade back in. FFIV gave me a second chance so why not. Here are two B&B patterns I traded today from my usual suspects list. I noticed quite a few more such as MA and ICE. I close all of my positions before the FOMC release and I didn't care for the wild swings after so I waited a while before deciding if I wanted to wade back in. FFIV gave me a second chance so why not.

[url=] [/url] [/url]

Posted by Jamie at 5/09/2007 04:45:00 PM 8 comments

Labels: Base_Breakout

Dummy Trade of the Day - Foster Wheeler Ltd. (Public, NASDAQ:FWLT)

This is a 15 minute timeframe of FWLT. It gapped up on earnings and retraced about 25%. It carved out a hammer reversal bar and then set up series of mini base and break patterns on the 5 minute timeframe below. As you can see from the 5 min. chart, I actually entered before the ORH was taken out on a bullish base and break pattern. My exit was the 38% Fibonacci extension of the previous day low to the ORH. Classic Trader-X I think. This is a 15 minute timeframe of FWLT. It gapped up on earnings and retraced about 25%. It carved out a hammer reversal bar and then set up series of mini base and break patterns on the 5 minute timeframe below. As you can see from the 5 min. chart, I actually entered before the ORH was taken out on a bullish base and break pattern. My exit was the 38% Fibonacci extension of the previous day low to the ORH. Classic Trader-X I think.

B was a failed gapper dummy setup. The blue and red arrows indicate my entry and exit. Why did it fail? What went wrong? B was a failed gapper dummy setup. The blue and red arrows indicate my entry and exit. Why did it fail? What went wrong?

[url=] [/url] [/url]

Posted by Jamie at 5/09/2007 04:24:00 PM 7 comments

Labels: Dummy, Fibonacci, Gapper

Tuesday, May 08, 2007Trade of the Day - Valero Energy Corporation (Public, NYSE:VLO)

The VLO setup on a pullback to the pivot point support area used to be one of my bread and butter patterns when I first started trading. So I guess you could say that I went back to my roots on this trade. VLO broke above its 2 day slope allowing for a low risk entry. I took a partial as price started to consolidate midday and moved my stop just under the last WRB preceding the consolidation. As I tightened my stop near the end of the session, I was stopped out. The VLO setup on a pullback to the pivot point support area used to be one of my bread and butter patterns when I first started trading. So I guess you could say that I went back to my roots on this trade. VLO broke above its 2 day slope allowing for a low risk entry. I took a partial as price started to consolidate midday and moved my stop just under the last WRB preceding the consolidation. As I tightened my stop near the end of the session, I was stopped out.

AAPL carved out a NR7 bar within a flat base consolidation just prior to breaking out of the base. After that it held it 5 period MA on a closing basis throughout the afternoon. A doji in the last hour forced me to tighten my stop and I was taken out. AAPL carved out a NR7 bar within a flat base consolidation just prior to breaking out of the base. After that it held it 5 period MA on a closing basis throughout the afternoon. A doji in the last hour forced me to tighten my stop and I was taken out.

[url=] [/url] [/url]

Posted by Jamie at 5/08/2007 09:03:00 PM 6 comments

Labels: Base_Breakout, NR7, Pivot Point

Newer Posts Older Posts Home |

|

|

[复制链接]

[复制链接]