- 金币:

-

- 奖励:

-

- 热心:

-

- 注册时间:

- 2006-7-3

|

|

楼主 |

发表于 2009-3-21 07:31

|

显示全部楼层

Friday, March 16, 2007Dummy Trade of the Day - Zoltek Companies, Inc. (Public, NASDAQ:ZOLT)

ZOLT gapped up on heavy volume and quickly took out the OR high and just as quickly reversed, however it did hold the OR high as support throughout a lengthy consolidation. During the consolidation, it carved out a bearish engulfing bar but quickly regained its composure. I took a long entry on a break of the bearish engulfing bar's high as price had a lot of support from the 5 period EMA. We had a minor consolidation at the 38% Fibonacci extension, followed by a nice move above the 62% level. I thought we might get to 100% which lined up very nicely with daily resistance, however, a false break of the afternoon consolidation highs, resulted in a tighter stop and a stop out. ZOLT closed at 62% extension level. ZOLT gapped up on heavy volume and quickly took out the OR high and just as quickly reversed, however it did hold the OR high as support throughout a lengthy consolidation. During the consolidation, it carved out a bearish engulfing bar but quickly regained its composure. I took a long entry on a break of the bearish engulfing bar's high as price had a lot of support from the 5 period EMA. We had a minor consolidation at the 38% Fibonacci extension, followed by a nice move above the 62% level. I thought we might get to 100% which lined up very nicely with daily resistance, however, a false break of the afternoon consolidation highs, resulted in a tighter stop and a stop out. ZOLT closed at 62% extension level.

After gapping up and fading, FMT retraced 38% of its last leg up (Tuesday's low to Friday's high) and starting to print some green. I took a small low risk position hoping for a rally into the close. A nice way to end the week. After gapping up and fading, FMT retraced 38% of its last leg up (Tuesday's low to Friday's high) and starting to print some green. I took a small low risk position hoping for a rally into the close. A nice way to end the week.

Good news from our student reader from last night, Vivek has informed me that he sold his LEND shares in pre-market this morning for a handsome gain. Good news from our student reader from last night, Vivek has informed me that he sold his LEND shares in pre-market this morning for a handsome gain.

I tried to short LEND today and there were no shares available. I've posted the chart to show that the 39% Fibonacci retracement of the last leg up will coincide nicely with a gap fill, so if we get a clear reversal pattern in this area Monday, it could setup a nice trade.

Have a great weekend!

[url=] [/url] [/url]

Posted by Jamie at 3/16/2007 04:22:00 PM 12 comments

Labels: Dummy, Fibonacci, Gapper

Thursday, March 15, 2007Dummy Trade of the Day - Accredited Home Lenders Holding Co. (Public, NASDAQ:LEND)

As discussed last night, LEND was front and center for me this morning following yesterday's late day surge on high volume. It was very active in the pre-market and gapped up on the open. As discussed last night, LEND was front and center for me this morning following yesterday's late day surge on high volume. It was very active in the pre-market and gapped up on the open.

The first bar closed weak as expected because a lot of traders who picked up the stock late in the session yesterday, sold the open. The second bar was bullish and the third bar was a neutral inside bar. The fact that the third stick closed in the upper third of the previous bullish bar and printed much less volume, was a plus. An entry above the base formed by the second and third bar highs was contemplated, however, I decided to stick to the rules and wait for the OR high to be taken out. The fourth bar edged above the OR high and closed very strong. At this point, I thought the stock was going to run away from me, but luckily it retested the breakout point, allowing for a second chance to get long. I waited for the rising 5 period EMA to edge up even closer and entered at the beginning of the 6th bar.

Based on the heavy pre-market trade, my ultimate target was a gap fill, however, knowing that was extremely ambitious, my strategy was to stay in the trade until the target was met as long as price did not breach the 5 period EMA on a closing basis. Within that strategy I leave myself open to exit, if things get disorderly or suspect. After tagging the 38% Fibonacci extension, things got a little suspect as a series of "out of the money" transactions started printing on the time and sales screen. This action lasted 10 minutes and was extremely disruptive to the chart pattern especially on the lower timeframes. However, it did not affect the level II screens so I hung in. If we remove the long tail on the 8th bar which was caused by the out of the money trades going through, we have a very orderly chart. Volume was momo and much stronger on the green sticks than the red ones. The gap fill and tag of the 100% Fibonacci extension occurred on extremely high volume, almost a euphoric volume spike, marking the end of the move. There were a lot of shorts being covered in this move today because of yesterday's strong close and the absence of more bad news on the sub-prime lending group.

A student reader bought LEND in the upper range on today's action and asks what to do now that the stock closed lower than the purchase price. I can't give investment advice, however, I can read the chart for you. Based on today's close, we have an unconfirmed bullish island reversal. In order for this bullish reversal to confirm, we need to keep today's opening gap, at least partially unfilled. A student reader bought LEND in the upper range on today's action and asks what to do now that the stock closed lower than the purchase price. I can't give investment advice, however, I can read the chart for you. Based on today's close, we have an unconfirmed bullish island reversal. In order for this bullish reversal to confirm, we need to keep today's opening gap, at least partially unfilled.

LEND has been on a path of lower highs and lower lows for quite some time. We need a trend change which means higher lows and eventually higher highs. I know that the stock is trading lower in after hours, however, today's bullish volume spike could signal a reversal is at hand. One thing is for sure, expect more volatility.

Here is an interesting comment courtesy of Briefing.com:

Floor Talk: More on short-covering in the subprimes : As we've mentioned a number of times in the past couple of days, the short-covering in the subprime lenders continues at an aggressive pace. The notable movers today include NEWC.PK, LEND, NFI, FMT, DFC, CCRT, FED, CFC, IMH, and NDE, although basically the whole group is moving higher. Essentially, when everyone is leaning on the same names -- and they stop going down -- everyone starts to cover at the same time, which in this case has led to a truly impressive short squeeze... In addition, a couple of other factors have given further incentive for shorts to cover: 1) the morning bombshell headlines from the group have (at least temporarily) stopped appearing each morning, so the morning headline risk has subsided somewhat; and 2) there has been chatter that some of the big brokers (BSC, GS, etc) could start shopping for assets among the subprime wreckage; the WSJ ran a story on GS to that effect on Wed, and BSC and LEH suggested during their conference calls that they might start looking for opportunities in the subprime area... One final observation is that the markets have been hammering the subprimes for weeks now (i.e. pricing in the bad news), yet the US Congress seems to have just noticed it this week when various members threatened to hold hearings/sponsor legislation on subprime lending practices. In other words, the sound and fury that is starting to emanate from Congress is occurring after some major damage has already been done (in the past, Congress has at times served as a contrarian indicator in situations like this... for example, think of the oil profiteering hearings that occurred right around the time that crude oil peaked)... In short, it's impossible to tell how far the short-covering of the past two days will take the subprime stocks, but the one thing traders can count on in the coming days & weeks is extreme volatility.

[url=] [/url] [/url]

Posted by Jamie at 3/15/2007 07:40:00 PM 5 comments

Labels: Dummy, Fibonacci, Gap_Fill, Gapper

Accredited Home Lenders Holding Co. (Public, NASDAQ:LEND) Gap Filled

Yesterday I mentioned keeping LEND on the radar for today and it delivered a nice gap fill. Sweet. I'll explain my trade in more detail this evening. Yesterday I mentioned keeping LEND on the radar for today and it delivered a nice gap fill. Sweet. I'll explain my trade in more detail this evening.

[url=] [/url] [/url]

Posted by Jamie at 3/15/2007 01:03:00 PM 6 comments

Labels: Dummy, Gapper

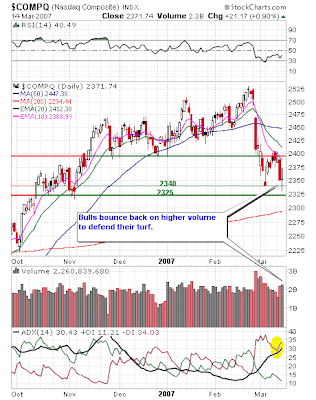

Wednesday, March 14, 2007NASDAQ Technical Picture - Bulls Defend 38% Retracement of the July - February Rally

The first chart shows that we tagged the 38% retracement level of the July - February rally and reversed from there. So basically the bulls came in on higher volume to defend their turf at a key technical level. A quick review of the Qs intraday, showed that volume was much higher on the buy side than the sell side. We also note some positive divergence of the RSI on lower prices, however, the ADX clearly favors the bears. The first chart shows that we tagged the 38% retracement level of the July - February rally and reversed from there. So basically the bulls came in on higher volume to defend their turf at a key technical level. A quick review of the Qs intraday, showed that volume was much higher on the buy side than the sell side. We also note some positive divergence of the RSI on lower prices, however, the ADX clearly favors the bears.

Economic calendar: Tomorrow's calendar is loaded starting with PPI, Initial Claims and NY Empire State Index at 8:30; Net Foreign Purchases at 9:00 and Philadelphia Fed at noon.

[url=] [/url] [/url]

Posted by Jamie at 3/14/2007 10:32:00 PM 0 comments

Labels: Fibonacci, NASDAQ

Newer Posts Older Posts Home |

|

|

[复制链接]

[复制链接]