- 金币:

-

- 奖励:

-

- 热心:

-

- 注册时间:

- 2006-7-3

|

|

楼主 |

发表于 2009-3-21 07:37

|

显示全部楼层

Wednesday, February 28, 2007Dummy Trade of the Day - Joy Global Inc. (Public, NASDAQ:JOYG)

JOYG was an earnings gap on the open. It carved out a WR red stick on the open and then consolidated sideways for an eternity. The candlestick patterns were not helpful it determining if this setup would be a gap fade or a short. However, it did carve out several sticks with highs of $45.49-$45.50. After the third such stick, I made a mental note that $45.50 was a pivot point and if it remained the high of the narrow consolidation range by the time the down sloping 5 period ema came in, I would short just below. That happened on the next bar (6th stick). I placed my stop just 5 cents above the pivot point. The trade continued to consolidate sideways and even attempted to retest the pivot point. That 5th and final test proved to be the turning point, as JOYG finally settled into an orderly decent, followed by a small bear flag before the big swing lower. Just as things were getting really interesting, I noticed a huge volume spike. This is often a warning that a reversal is approaching, so I tightened my stop to $44.00 and I was stopped out on the next bar. JOYG was an earnings gap on the open. It carved out a WR red stick on the open and then consolidated sideways for an eternity. The candlestick patterns were not helpful it determining if this setup would be a gap fade or a short. However, it did carve out several sticks with highs of $45.49-$45.50. After the third such stick, I made a mental note that $45.50 was a pivot point and if it remained the high of the narrow consolidation range by the time the down sloping 5 period ema came in, I would short just below. That happened on the next bar (6th stick). I placed my stop just 5 cents above the pivot point. The trade continued to consolidate sideways and even attempted to retest the pivot point. That 5th and final test proved to be the turning point, as JOYG finally settled into an orderly decent, followed by a small bear flag before the big swing lower. Just as things were getting really interesting, I noticed a huge volume spike. This is often a warning that a reversal is approaching, so I tightened my stop to $44.00 and I was stopped out on the next bar.

This is a low grade setup because the candlesticks don't tell us much except that there is a lot of indecision. However, the combination of the pivot point and the tag of the MA, allow for a low risk entry close to resistance. This was my only trade today. The market was too choppy, so I took it easy.

[url=] [/url] [/url]

Posted by Jamie at 2/28/2007 05:14:00 PM 6 comments

Labels: Gapper, Pivot Point

Tuesday, February 27, 2007Dummy Trade of the Day - Apple Inc. (Public, NASDAQ:AAPL)

AAPL gapped down on the open due to delays in Apple TV and general market fears. It rallied towards its 200 MA and downsloping 10 period EMA as it attempted and failed to regain $87.00. I took a low risk, dummy short as AAPL fell out of its narrow trading range on an uptick in volume. AAPL quickly took out its OR low, followed by another lengthy consolidation. Selling picked up in mid-afternoon for another leg down. Around 3:00 I felt that AAPL was capitulating and would reverse so I covered and went long hoping for a bounce into the close. The long entry was traded on a 5 minute chart with a 30 cent stop. It started well and I kept tightening my stop accordingly. Unfortunately, my screen froze and my stop was not executed so I am looking at a loss on the late day long entry. AAPL gapped down on the open due to delays in Apple TV and general market fears. It rallied towards its 200 MA and downsloping 10 period EMA as it attempted and failed to regain $87.00. I took a low risk, dummy short as AAPL fell out of its narrow trading range on an uptick in volume. AAPL quickly took out its OR low, followed by another lengthy consolidation. Selling picked up in mid-afternoon for another leg down. Around 3:00 I felt that AAPL was capitulating and would reverse so I covered and went long hoping for a bounce into the close. The long entry was traded on a 5 minute chart with a 30 cent stop. It started well and I kept tightening my stop accordingly. Unfortunately, my screen froze and my stop was not executed so I am looking at a loss on the late day long entry.

[url=] [/url] [/url]

Posted by Jamie at 2/27/2007 08:28:00 PM 0 comments

Labels: Dummy, Gapper

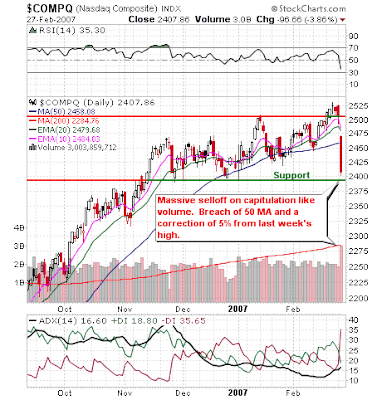

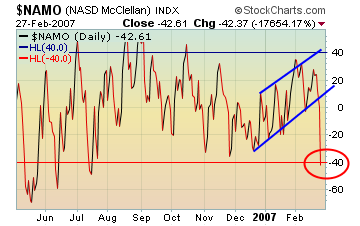

NASDAQ Technical Picture - Massive Selloff on Capitulation Like Volume

U.S. Markets sold off today following China and the overseas leads. Listening to all of the talking heads on CNBC has so far proven to be a waste of time. The only thing worth noting is the expectation of another gap down tomorrow based on the volume of unfilled sell orders left over from today's session. All sectors participated in the selloff. According to the NASDAQ P&F chart we sustained a double bottom breakdown today and the near-term target is 2310. A breach of the line marked support on a closing basis tomorrow will confirm a downtrend. The NASDAQ McClellan Oscillator is approaching oversold. From yesterday's close we lost almost 100 points on a huge volume spike ( over 3.0 bln ). The spikes in volume and VIX could suggest watching for a short-term bounce. U.S. Markets sold off today following China and the overseas leads. Listening to all of the talking heads on CNBC has so far proven to be a waste of time. The only thing worth noting is the expectation of another gap down tomorrow based on the volume of unfilled sell orders left over from today's session. All sectors participated in the selloff. According to the NASDAQ P&F chart we sustained a double bottom breakdown today and the near-term target is 2310. A breach of the line marked support on a closing basis tomorrow will confirm a downtrend. The NASDAQ McClellan Oscillator is approaching oversold. From yesterday's close we lost almost 100 points on a huge volume spike ( over 3.0 bln ). The spikes in volume and VIX could suggest watching for a short-term bounce.

Economic calendar: GDP prelim and chain deflator 8:30; Chicago PMI 9:45; New home sales 10:00; Crude 10:30.

[url=] [/url] [/url]

Posted by Jamie at 2/27/2007 07:30:00 PM 0 comments

Labels: NASDAQ

Sudden Decline in End of Day Trade Triggered by Computer Glitch

Sudden, sharp decline in DJIA around 3 due to tab delay, according to WSJ

DJ reports that the sudden, sharp decline by the Dow Jones Industrial Average shortly before 3 p.m. Tuesday was triggered by a tabulation delay by Dow Jones data systems, which calculates the average. There was a temporary lag in calculation of the 30 large-stock average due to a surge in order flows as the market continued to tumble in afternoon trading, much like a clogged pipe. Shortly before 3 p.m. Eastern, Dow Jones Indexes switched over to a backup system to calculate the average, which nearly instantly registered the huge move. The glitch wasn't the cause of the decline, but it did cause the drop to register far more quickly than it otherwise would have. Other indexes fell at the same time, but more gradually. Some traders noticed a discrepancy between futures contracts tied to the Dow industrials and the index, which directly tracks the stocks. Usually, the futures contracts closely track the overall average.

Courtesy of Briefing.com

On a personal note, my stop didn't trigger and my screen froze. I was long AAPL at $84.00 for a bounce in the last hour. At 3:45 I tightened my stop to $84.55. My stop didn't trigger. I'm still holding and currently looking at a small loss. It's hard to get rid of shares when something like this happens because all the bids dry up.

[url=] [/url] [/url]

Posted by Jamie at 2/27/2007 04:58:00 PM 2 comments

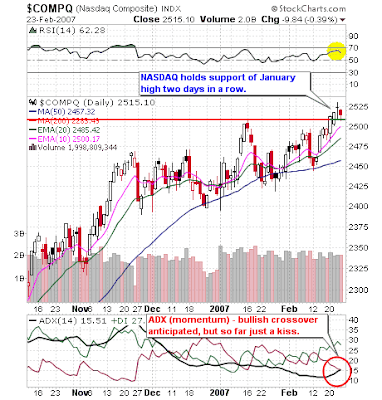

Monday, February 26, 2007NASDAQ Technical Picture - End of Day Chart Damage Limited

Despite the 33 point drop from the OR high to the midday lows, the end of day chart damage is limited. The NASDAQ gapped up on the open and minutes later went into a free fall, taking out its trendline and ascending triangle support within the first hour. It almost reached the measured move target of 2490, before abruptly reversing at around 2493 and closing at 2504.5 which is just above the January closing high. Volume for the session was below average. The Fibonacci retracement from the Feb. 12 lows to last Thursday's highs fell somewhere between 38% and 50% at the session lows. Despite the 33 point drop from the OR high to the midday lows, the end of day chart damage is limited. The NASDAQ gapped up on the open and minutes later went into a free fall, taking out its trendline and ascending triangle support within the first hour. It almost reached the measured move target of 2490, before abruptly reversing at around 2493 and closing at 2504.5 which is just above the January closing high. Volume for the session was below average. The Fibonacci retracement from the Feb. 12 lows to last Thursday's highs fell somewhere between 38% and 50% at the session lows.

Going forward, I would like to see price regain its base around 2510, before getting optimistic again.

Tomorrow's economic data includes Durable Orders at 8:30, Consumer Confidence, and Existing Home Sales at 10:00.

[url=] [/url] [/url]

Posted by Jamie at 2/26/2007 09:23:00 PM 0 comments

Labels: Ascending_Triangle, Fibonacci, NASDAQ, Trendline

Dummy Trade of the Day - Force Protection, Inc. (Public, NASDAQ:FRPT)

FRPT gapped down on the open and fell hard. Midday it consolidated sideways until the declining 10 period EMA caught up to price. Just before taking another dive, it conveniently carved out an NR7 stick. Short on a break of the narrow trading range. I took a partial at $17.00 as I noted it was a support area on the daily timeframe and I covered the balance into the close. FRPT gapped down on the open and fell hard. Midday it consolidated sideways until the declining 10 period EMA caught up to price. Just before taking another dive, it conveniently carved out an NR7 stick. Short on a break of the narrow trading range. I took a partial at $17.00 as I noted it was a support area on the daily timeframe and I covered the balance into the close.

Victoria also traded FRPT on the 10 minute timeframe allowing for a more aggressive entry than mine.

UCTT was Friday's dummy trade of the day. Today it gapped up slightly and immediately pulled back with the market. It found support near the 10 period ema and attempted to rally. I decided to take a low risk dummy entry after the NR7 bar because I felt it could rally back up to its OR (opening range) high. Notice that the NR7 bar has virtually no volume and these generally are very effective in predicting price expansion. I closed my entire position as soon as it tagged the target. UCTT was Friday's dummy trade of the day. Today it gapped up slightly and immediately pulled back with the market. It found support near the 10 period ema and attempted to rally. I decided to take a low risk dummy entry after the NR7 bar because I felt it could rally back up to its OR (opening range) high. Notice that the NR7 bar has virtually no volume and these generally are very effective in predicting price expansion. I closed my entire position as soon as it tagged the target.

THE gapped up on the open and rallied nicely. After an orderly midday swoon, price stabilized on the 10 period EMA. I took a low risk entry, hoping for a retracement back to the morning resistance level (blue line) and exited the entire position when the target was met. THE gapped up on the open and rallied nicely. After an orderly midday swoon, price stabilized on the 10 period EMA. I took a low risk entry, hoping for a retracement back to the morning resistance level (blue line) and exited the entire position when the target was met.

[url=] [/url] [/url]

Posted by Jamie at 2/26/2007 04:18:00 PM 4 comments

Labels: Dummy, Gapper, NR7

Update - Varian Semiconductor (VSEA)

Varian Semi awarded largest service contract in its history by major U.S. logic chipmaker

Co announces it has been awarded two service contracts by a major U.S. logic chipmaker totaling more than $30 mln. Under terms of the contracts, Varian Semiconductor will provide comprehensive service and support to this customer covering a multitude of VIISta single wafer medium and high current ion implanters at a 300mm and a 200mm wafer processing fab. The contracts include world-class 24X7, 365 days-a-year support by VSEA's dedicated onsite engineers. (Courtesy of Briefing.com)

Currently gapping up to $51.05

[url=] [/url] [/url]

Posted by Jamie at 2/26/2007 09:18:00 AM 0 comments

Labels: Technical

Technical Trade Setup - Varian Semiconductor (Public, NASDAQ:VSEA)

Long above $49.70 on higher volume. A gap up on the open invalidates the setup and must be traded as a gapper dummy trade. Long above $49.70 on higher volume. A gap up on the open invalidates the setup and must be traded as a gapper dummy trade.

[url=] [/url] [/url]

Posted by Jamie at 2/26/2007 01:46:00 AM 0 comments

Labels: Ascending_Triangle

Sunday, February 25, 2007NASDAQ Technical Picture - Weekly Update

The NASDAQ ended the week on a consolidative note, peaking with Thursday's gap higher on the open. Since then we have successfully tested the January high as support twice. In so doing, we have carved out a series of lower highs on the 15 minute time frame above. We are about to test the trendline (red line) which has been in play since Feb. 12th. Moreover we are currently developing a descending triangle. If the trendline is breached and price falls below the January high (2509) on a closing basis, we could see a measured move lower to the green line 2490. This would bring us back to our phase 3 consolidation level. If, on the other hand the trendline holds, we could see the triangle break to the upside. Nothing too worrisome, just a time when we want to be selective.

Earnings of note in the coming week:

Mon. - XMSR, MRVL

Tues. - HANS, SIRI, ADSK

Wed. - JOYG

Thurs. - DELL

[url=] [/url] [/url]

Posted by Jamie at 2/25/2007 11:16:00 PM 0 comments

Labels: NASDAQ, Trendline

Friday, February 23, 2007Dummy Trade of the Day - Ultra Clean Holdings, Inc. (Public, NASDAQ:UCTT)

UCTT gapped up on the open and rallied and pulled back to it base. With the exception of stick #5, it held the OR high as support on a closing basis. As price consolidated just above the rising 10 period EMA, UCTT printed a NRB at the base of resistance. I entered a low risk dummy long on a break of the NRB. My preliminary target was the thick blue line which represents resistance on the daily timeframe. I took a partial at the 62% Fibonacci extension (yesterday's low to the OR high) which was just 10 cents below the target because I didn't want to miss the exist over 10 cents. Price eventually hit the target and immediately pulled back to the rising 10 period EMA. Since I had already taken a partial, I stayed in the trade and price eventually rose above resistance. I exited the balance into the close. UCTT gapped up on the open and rallied and pulled back to it base. With the exception of stick #5, it held the OR high as support on a closing basis. As price consolidated just above the rising 10 period EMA, UCTT printed a NRB at the base of resistance. I entered a low risk dummy long on a break of the NRB. My preliminary target was the thick blue line which represents resistance on the daily timeframe. I took a partial at the 62% Fibonacci extension (yesterday's low to the OR high) which was just 10 cents below the target because I didn't want to miss the exist over 10 cents. Price eventually hit the target and immediately pulled back to the rising 10 period EMA. Since I had already taken a partial, I stayed in the trade and price eventually rose above resistance. I exited the balance into the close.

[url=] [/url] [/url]

Posted by Jamie at 2/23/2007 08:52:00 PM 6 comments

Labels: Dummy, Fibonacci, Gapper

Newer Posts Older Posts Home |

|

|

[复制链接]

[复制链接]