- 金币:

-

- 奖励:

-

- 热心:

-

- 注册时间:

- 2006-7-3

|

|

楼主 |

发表于 2009-3-20 18:10

|

显示全部楼层

Tuesday, May 22, 2007Trade of the Day - Valero Energy Corporation (Public, NYSE:VLO)

When VLO tried to challenge its morning high, it failed and carved out a doji reversal bar with a long upper shadow. I shorted VLO as price fell below the low of the doji stick. I placed my stop 5 cents above the star prior to the doji because the doji was too wide. I took a partial when my preliminary pivot point target was met. The next target is gap support and I suspect it will reach that target tomorrow. It should bounce either at gap open or gap close. At the moment gap close lines up with the 200 MA. When VLO tried to challenge its morning high, it failed and carved out a doji reversal bar with a long upper shadow. I shorted VLO as price fell below the low of the doji stick. I placed my stop 5 cents above the star prior to the doji because the doji was too wide. I took a partial when my preliminary pivot point target was met. The next target is gap support and I suspect it will reach that target tomorrow. It should bounce either at gap open or gap close. At the moment gap close lines up with the 200 MA.

[url=] [/url] [/url]

Posted by Jamie at 5/22/2007 04:22:00 PM 6 comments

Labels: Doji, Short

Pre-Market - Tuesday May 22nd

Gapping down on weak earnings/guidance: KONG -16.2%, GSOL -7.1%, GIGM -5.5%, APOL -4.1%, SPLS -3.2%, NTES -2.4%... Other news: OMTR -7.1% (announces a 6.8 mln share common stock offering), ACW -6.3% (files for a 5.4 mln share common stock secondary offering by selling shareholders), HRAY -4.9%, ONT -3.5% (announces acquisition of Hantro Products), DYN -3.8% (Chevron to sell Dynegy shares), MNST -2.9% (tier-1 firm suggesting sale of co may be less likely), SSL -2.7% (gives project update for Oryx gas-to-liquids venture).

Gapping up on strong earnings/guidance: PSUN +6.5%, ASEI +4.4%... Casino stocks seeing strength following Tracinda/MGM negotiations: MGM +24.1%, BYD +7.0%, WYNN +4.9%, LVS +3.9%... Mortgage-related stocks moving following FMT developments: FMT +50.6%, NFI +9.9%, LEND +9.4%, IMH +6.6%, AHM +3.9%... Other news: AVNC +20.9% (announces FDA acceptance of Amoxicillin Pulsys NDA), OXPS +6.7% (continued momentum following yesterday's 7% move higher on takeover rumors), EMU +4.9% (light volume, broker comments out of Canada discussed potential sale of co), TSS +4.5% (mentioned by Cramer next co that could be bought), DNDN +4.5% (continuation of strength from yesterday afternoon), STM +2.5% (STM, INTC and Francisco Partners to create a new independent semiconductor co), CTSH +1.8% (positive comments from tier-1 firm).

Short-term Overbought/Oversold candidates -Update- -Technical-

Here's a brief list of stocks that are currently trading at unusually high or low short-term levels. Stocks that are overbought include: JRCC, CFUL, CLRK, RAVN, ICPR, MEK, TBSI, BG, GLDD, TECUA, UA, VCP, CMRG, DDS, RIG, CTRP, OMTR, FRG, OMNI, NM, URZ, ENT, CERS, TOPT, BIVN, PCLN, CRZO, SIL, & WINN. Stocks that are oversold include: IMCL, POP, BBI, MPEL, SOLF, VGZ, GLBC, & IDMI. Watch these stocks for potential continuations or corrections from their current states.

Stocks that closed near or at their session high/lows yesterday on above avg volume -Update- -Technical-

Stocks that closed near or at session highs included: ITW, SBH, EFD, PXP, WYE, SRP, TNE, MVL, VCP, LEG, AMZN, CREE, DJO, CMRG, NRMX, ICE, NYX, TMX, ICGE, LAVA, ALJ, ARA, ACW, AMLN, FEIC, SEPR, & HMIN. Stocks that closed near or at session lows included: SKS, SSL, NVS, & GSK. Watch these stocks for potential corrections or continuations of yesterday's action.

Courtesy of Briefing.com

[url=] [/url] [/url]

Posted by Jamie at 5/22/2007 07:23:00 AM 0 comments

Monday, May 21, 2007Dummy Trade of the Day - Amazon.com, Inc. (Public, NASDAQ:AMZN)

The first chart is the daily timeframe of AMZN. As you can see after gapping up and running up on earnings last month, AMZN has been in a basing pattern for almost a month. Friday's bar was NR on low volume. The rising 10 day EMA was supporting price and I was watching it on the open as I anticipated a break. The first chart is the daily timeframe of AMZN. As you can see after gapping up and running up on earnings last month, AMZN has been in a basing pattern for almost a month. Friday's bar was NR on low volume. The rising 10 day EMA was supporting price and I was watching it on the open as I anticipated a break.

The second chart is the 15 minute timeframe which highlights the base and break pattern at the ORH. I took a partial as price weakened just above the 38% Fibonacci extension and tightened the stop to the 25% extension. Once price had taken out the 62% extension it really started to accelerate on high volume. The euphoric volume spike foreshadowed the end of the move so I tightened my stop and was taken out at $68.20. The second chart is the 15 minute timeframe which highlights the base and break pattern at the ORH. I took a partial as price weakened just above the 38% Fibonacci extension and tightened the stop to the 25% extension. Once price had taken out the 62% extension it really started to accelerate on high volume. The euphoric volume spike foreshadowed the end of the move so I tightened my stop and was taken out at $68.20.

The last chart is the 1 minute timeframe, which shows how I scaled into my position. First on a base break at $64.50 and again at $65.00. The last chart is the 1 minute timeframe, which shows how I scaled into my position. First on a base break at $64.50 and again at $65.00.

[url=] [/url] [/url]

Posted by Jamie at 5/21/2007 07:19:00 PM 0 comments

Labels: Base_Breakout, Fibonacci, Gapper

Another Good Day for the NAZ

I had two nice trades with AMZN and THE as discussed in the comments today and over the weekend. I'll post the charts later this evening. It's a really nice day here and a holiday in Canada (Victoria Day) so I want to get out and enjoy the rest of the afternoon.

[url=] [/url] [/url]

Posted by Jamie at 5/21/2007 03:51:00 PM 0 comments

Pre-Market - Monday May 21

Gapping down on weak earnings/guidance: TSL -3.1% (down in sympathy ESLR -2.6%, SOLF -1.1%, JASO -0.6%, FSLR -0.6%), LOW -2.1%... Other news: XFML -12.5% (announced immediate resignation of Shelly Singhal from the Boards of both Xinha Finance and Xinhua Finance Media, as well as from all executive and managerial positions), HTZ -5.1% (files for 45 mln share offering by selling shareholders), HOLX -3.8% (to acquire Cytyc), SEPR -3.5% (C.M.S. updates Medicare billing codes, Xopenex U.D.V. and generic albuterol to be listed under same codes - tgt cut to $40 at FBR; also upgraded to Neutral at Cowen), DJ -3.5% (Murdoch, News Corp prepare to abandon DJ bid, Pali says - Bloomberg.com), SIGM -3.2% (announces CFO resignation, names Thomas Gay as replacement), MNST -2.6% (Don't believe recent deals should be extrapolated to MNST - Wachovia).

Futures indicate a mixed open for the mkt as investors digest another round of Monday-morning M&A activity. AT has agreed to be taken private for $27.5 bln, a 10% premium to Friday's close. HOLX agreed to buy CYTC for $6.2 bln in cash and stock, while EAGL received a revised $1.95 bln takeover bid from CEVA Group. In addition, China is reportedly investing $3 bln in Blackstone, which increased the size of its IPO to $4.75 bln.

Notable pre-market Calls include Upgrades: HOLX at BofA, SHFL at Bear Stearns; Downgrades: CFC at Friedman Billings, CCU at Bear Stearns... On the Earnings calendar: ASEI, APOL, HMIN, KONG, NTES, PSUN, PERY, NCTY and WSTL are confirmed to report after the close... Today's Economic calendar is clear.

Gapping up on strong earnings/guidance: PEGA +5.8%, CCC +3.7%, RTLX +3.5%... M&A: CYTC +30.4% (to be acquired by Hologic in a stock/cash deal), PONR +17.0% (to be acquired by Olin for $35.00/share), VMED +9.3% (private equity considering $15 bln bid for Virgin Media - The Observer), EMU +6.4% (announces it is in exclusive negotiations regarding potential sale of co... sympathy plays: USU, DNN, URZ, FRG, USEG, CXZ), ATLS +6.3% (to acquire DTE's +0.6% Gas & Oil unit for $1.225 bln), AT +5.5% (to be acquired by TPG Capital & GS Capital for $71.50/share), EAGL +3.3% (CEVA Logistics confirms increased proposal to acquire EAGL for $47.50/share in cash)... Other news: LUNA +40.0% (blood circuit monitor receives FDA clearance), ELN +14.2% (co and Wyeth to initiate Phase 3 trial of Bapineuzumab in Alzheimer's), ARTX +12.8% (awarded $9 mln order by U.S. Marine Corps; very light volume), VC +11.6% (Tatas in talks for stake in Visteon - Business Standard), NCTY +11.5% (announces equity investment and licensing agreement by Electronic Arts), CTEL +8.2% (follow-through momentum after Friday's earnings-related range breakout), CBLI +7.9% (announces Protectan CBLB612 produces breakthrough in bone marrow stem cell transplant study; very light volume), DWA +7.6% (Shrek 3 has highest grossing animated film opening of all time; very light volume), DNDN +6.9% (announces presentation of Provenge data at American Urological Association meeting), OMR +6.4% (momentum extension after stock rallied to highs into Friday's close), VCLK +5.5% (target raised to $43 at ThinkEquity), CRUS +5.3% (Insider buying reported at CRUS - Barron's), CRM +4.5% (Google and CRM weigh alliance to battle Microsoft - WSJ), SHFL +3.3% (upgraded to Peer Perform at Bear Stearns), ONT +3.3% (momentum).

Courtesy of Briefing.com

[url=] [/url] [/url]

Posted by Jamie at 5/21/2007 08:26:00 AM 9 comments

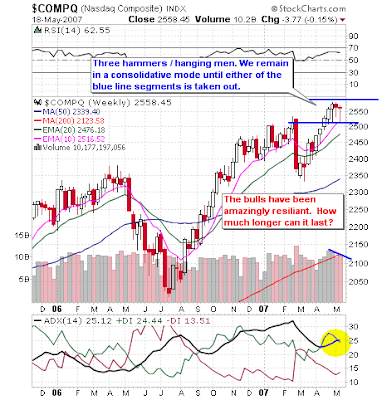

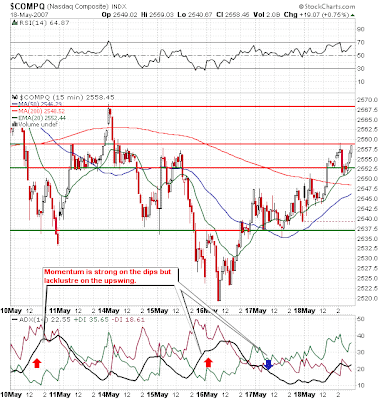

Sunday, May 20, 2007NASDAQ Technical Picture - Weekly Update

Charts courtesy of stockcharts.com Charts courtesy of stockcharts.com

The NASDAQ ended the week on a bullish note but is down four points overall. Last week we noted two hammers/hanging men on the weekly timeframe and now we have three. We are currently in consolidation phase, despite continued bullish strength in the DOW and S&P. The intraday timeframe shows a clear lack of momentum on the upswing. On the daily timeframe, the ADX line is approaching 10, a level it has not seen since March 2005, leading into the May' 05 correction. The SOX is retesting its breakout point for the second time and my guess is that it will fail. The rally appears to be drawing final breath, however, it could remain like this for weeks, before the actual correction takes hold.

[url=] [/url] [/url]

Posted by Jamie at 5/20/2007 11:48:00 PM 0 comments

Labels: NASDAQ, SOX

Saturday, May 19, 2007New Rules

Due to a recent onslaught of malicious comments, I have no choice but to turn the comment moderation feature on. These types of comments get my back up and I have responded to some of them in a condescending manner. I don't want the comments section of this blog to turn into a shit slinging contest. That's not what I'm about. So, going forward, persistent malicious comments from anonymous commenters who don't have the courage to identify themselves, will no longer be tolerated. That's not to say that I don't welcome critiques and different points of view. I certainly do, and long-time readers know that I diligently answer all questions.

I noticed that many of my fellow bloggers, most recently Trader-X and ADD Trader have also been the target of these bugs. Maybe the nuts all escaped from the same asylum, or maybe its the change of seasons. Not sure, but these things seem to come in waves every few months or so.

[url=] [/url] [/url]

Posted by Jamie at 5/19/2007 08:41:00 AM 18 comments

Labels: Housekeeping

Friday, May 18, 2007Dummy Trade of the Day - Focus Media Holding Limited (ADR) (Public, NASDAQ:FMCN)

FMCN was an earnings gap which retraced 38% of the move from yesterday's low to the ORH then consolidated sideways for over an hour until the 5 period EMA caught up to price. At first this setup did not seem all that compelling because the consolidation candles had upper shadows. However, I placed a buy stop order above the highest shadow and when price broke and held above the shadow on a closing basis, I had confidence in my decision. Although price did not reach the 38% Fibonacci extension, it did generate a +1 pt. profit. FMCN was an earnings gap which retraced 38% of the move from yesterday's low to the ORH then consolidated sideways for over an hour until the 5 period EMA caught up to price. At first this setup did not seem all that compelling because the consolidation candles had upper shadows. However, I placed a buy stop order above the highest shadow and when price broke and held above the shadow on a closing basis, I had confidence in my decision. Although price did not reach the 38% Fibonacci extension, it did generate a +1 pt. profit.

[url=] [/url] [/url]

Posted by Jamie at 5/18/2007 04:40:00 PM 2 comments

Labels: Base_Breakout, Dummy, Fibonacci, Gapper

Gapping Down

Better late than never:

Gapping down on weak earnings/guidance: HURC -14.0%, DEEP -4.5%, ADSK -2.9% (also downgraded to Neutral at Amtech)... Cramer cautious on solar stocks: CSUN -4.6%, JASO -3.2%, SOLF -2.8%, FSLR -2.4%... Weakness in tanker stocks (still checking for reason): GNK -5.0%, DSX -4.1%, EGLE 4.0%, QMAR -3.0%, DRYS -0.9%... Other news: VSGN -9.1% (raises $16 mln through sale of common shares and warrants), SNIC -7.3% (downgraded to Hold at Roth), SEPR -6.5% (boutique firm downgrade), DUSA -5.5% (profit-taking after yesterday's gap up), DNDN -4.1% (will delay Provenge, cuts jobs - Seattle Post-Intelligencer).

[url=] [/url] [/url]

Posted by Jamie at 5/18/2007 09:45:00 AM 0 comments

Pre-Market - Friday May 18th

Futures indicate a higher open for stocks. M&A news is leading this morning's headlines as MSFT has agreed to acquire AQNT for $66.50/sh, an 85% premium from yesterday's closing price. In addition, GE is reportedly near a deal to sell its plastics unit for ~$11 bln. On the Earnings front, retailers KSS and JWN reported better than expected earnings and raised fiscal year guidance. It's also worth noting China said today it will widen the Yuan trading band, while increasing deposit and lending rates.

Notable pre-market Calls include Upgrades: PCLN, VZ and REP at Citi, NYX at JP Morgan; Downgrades: JNPR at Citi, MO at Matrix, VCLK at Needham... On the Earnings calendar, no cos are confirmed to report today... On the Economic calendar, preliminary May Michigan Sentiment (consensus 86.5) will be released at 10:00ET.

Gapping up on strong earnings/guidance: INTU +11.0%, FMCN +6.8%, RDY +5.6%, TOPT +4.4%... M&A: AQNT +78.3% (to be acquired by Microsoft for $66.50/share... up in sympathy: DGIT +9.4%, VCLK +9.0%, THK +8.1%, VSCN +6.2%, MCHX +4.2%, ONSM +3.3%), TONE +32.0% (to be acquired by CapitalSource for $34.46/share)... Other news: CHIP +17.8% (profiled in BusinessWeek Online), OMR +41.7% (Deep-sea explorers discover possible richest shipwreck treasure in history - Fox News), TRMP +14.8% (announces status of strategic review), APKT +3.8% (upgraded to Buy at Cantor), BWLD +3.4% (to acquire Las Vegas franchised restaurants, announces 2 for 1 split), CY +2.9% (bullish comments from Cramer).

Courtesy of Briefing.com

[url=] [/url] [/url]

Posted by Jamie at 5/18/2007 08:54:00 AM 0 comments

Newer Posts Older Posts Home |

|

|

[复制链接]

[复制链接]