- 金币:

-

- 奖励:

-

- 热心:

-

- 注册时间:

- 2006-7-3

|

|

楼主 |

发表于 2009-3-20 16:26

|

显示全部楼层

Tuesday, July 15, 2008B&B Within Daily Hammer - Patriot Coal Corp. (Public, NYSE:PCX); Potash Corp. (Public, NYSE: POT)

Jamie is taking the remainder of this week off. It is OPEX week and the market has been extremely choppy of late. I too was not expecting many good setups this week.

One of the things I do (as a part-time trader) is check the market several times per day and see if anything grabs my attention. As I was checking my watchlist this afternoon, I saw that PCX had hammered off of the daily 50sma (left chart below) with capitulation action intraday and had setup a nice B&B pattern on the 15min chart (right chart below). Notice the matching congestion areas at roughly the same price level on the 15min. Unfortunately, the BO in PCX had just occurred (within 2:00 pm bar) and I felt that I had missed the optimal entry point. As it turned out, I could have entered late and still made a nice profit.

A good practice when you have just missed a solid setup is to quickly look for a similar setup that has yet to BO. Within a minute or two I identified a similar setup in POT. Notice the hammer action (long lower tail) at the daily PP line and the matching congestions on the 15min chart. On the 15min, POT had just retraced to test the rising 20ema (and 5ema) and was starting to bounce. Given the similar of the setups and the relative strength of the POT daily chart, I entered immediately. After further analysis, I realized that POT had sloppier action and less basing (relative to PCX). With this in mind, I took a relative quick exit with my full position just above the round number $225. As it turned out, I left some profit on the table. This is fine as I achieved a nice reward-to-risk ratio and did not have to endure any retracement action in a very choppy market overall.

Jamie will be off for the rest of this week. It is OPEX and choppy action is expected.

[url=] [/url] [/url]

Posted by Jim at 7/15/2008 10:17:00 PM 5 comments

Labels: Base and Break, Capitulation, Daily, Hammer, Matching Congestions

Monday, July 14, 2008Gapper Dummy Trade - Zions Bancorporation (Public, NASDAQ:ZION)

I missed the bear flag entry on ZION, but luckily it carved out a 3 PP base a while later and I was able to get in. My target was the round $ number $20.00 - support on the monthly time frame. I missed the bear flag entry on ZION, but luckily it carved out a 3 PP base a while later and I was able to get in. My target was the round $ number $20.00 - support on the monthly time frame.

CRME - Good for a scalp, but after a lengthy basing period, I was disappointed that this one couldn't take out $11.00. CRME - Good for a scalp, but after a lengthy basing period, I was disappointed that this one couldn't take out $11.00.

Gold stocks were the place to be today. Check out the charts for GOLD and GG.

I'll be off for the rest of this week. If today was any indication, OPEX could get very choppy so this is a good time to get away.

[url=] [/url] [/url]

Posted by Jamie at 7/14/2008 07:16:00 PM 2 comments

Labels: 3 PP Base, Base and Break, Gapper

Pre-Market

Gapping Up: Financials FRE, FMN, LEH, MER, C, BAC, MBI, JPM; Solar CSIQ (earnings), JASO, SOL, SOLF, FSLR; Pharm CRME; AAPL, ATI (earnings), NDAQ, PHG, AA, NOV, APWR, ISIL

Gapping Down: SKF, ZION (downgraded to sell at GS added to conviction list) , CGV, ATMI, RMD

[url=] [/url] [/url]

Posted by Jamie at 7/14/2008 08:32:00 AM 2 comments

Labels: Pre-Market

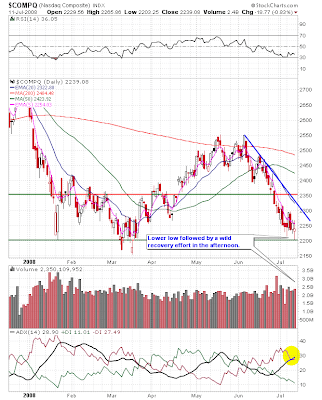

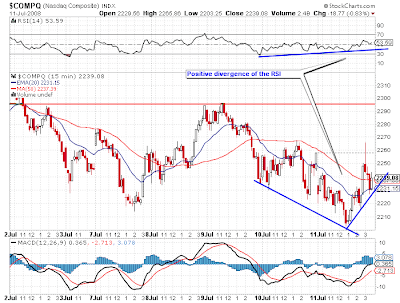

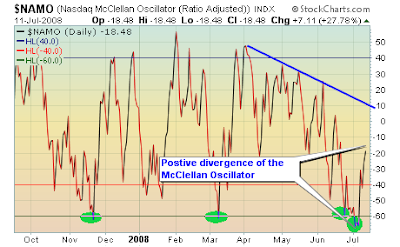

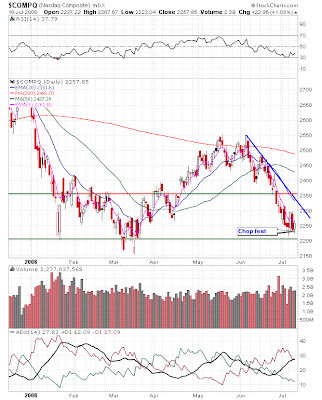

Sunday, July 13, 2008NASDAQ Technical Picture - Intraday Bearish Expansion

All of the major U.S. averages undercut their previous lows early Friday, but only the NASDAQ managed to stave off a new closing low. Volume, along with the fear factor as measured by the $VXN and $VIX, rose on increased worries of insolvency for mortgage giants Freddie and Fanny. Lehman also fell sharply on rumors, and Merrill fell another 4% and is trading near 10 year lows. Sector strength came from Gold/Silver +4%, Mining +3.6%, Coal +3.5%, Casino +2.4%, Crude Oil +2.3%. Everything else was pretty much red.

Next week is options expiration, so watch for choppiness starting Wednesday through Friday.

[url=] [/url] [/url]

Posted by Jamie at 7/13/2008 08:59:00 PM 0 comments

Labels: NASDAQ

Trading Rules

Trading rules are an important part of the trading strategy. Without them you might end up in some messy trades and feel almost as bad as this guy.

[url=] [/url] [/url]

Posted by Jamie at 7/13/2008 06:55:00 PM 0 comments

Labels: Trading_Rules

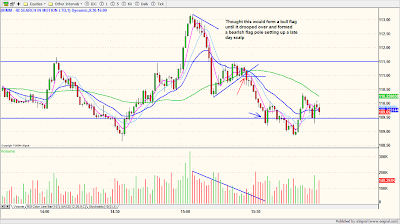

Friday, July 11, 2008Bear Flag - Research In Motion Limited (USA) (Public, NASDAQ:RIMM)

The first chart is RIMM's daily time frame. I've been watching it since the gap down on weak earnings. The consolidation on declining volume at support of 200 DMA was starting to look like a bearish pennant. Keep this one on the WL for next week. Potential continuation if RIMM doesn't regain its 200 DMA on Monday. The first chart is RIMM's daily time frame. I've been watching it since the gap down on weak earnings. The consolidation on declining volume at support of 200 DMA was starting to look like a bearish pennant. Keep this one on the WL for next week. Potential continuation if RIMM doesn't regain its 200 DMA on Monday.

Intraday RIMM formed a bearish flag after breaching its recent daily consolidation lows. This set up a perfect storm. It's easier to see the declining volume on the flag formation on the 3 min. chart below. Short on BO. You'll feel the volume as price breaks out of the pennant and that acts as confirmation that the setup is real. Intraday RIMM formed a bearish flag after breaching its recent daily consolidation lows. This set up a perfect storm. It's easier to see the declining volume on the flag formation on the 3 min. chart below. Short on BO. You'll feel the volume as price breaks out of the pennant and that acts as confirmation that the setup is real.

My target was the round $ number $110.00 and I covered as price approached my target. You also feel the capitulation volume when it's done.

The afternoon was basically a chop fest, but a late day failed bull flag pole led to a bearish flag formation and a low risk scalp back down to the morning swing low. The afternoon was basically a chop fest, but a late day failed bull flag pole led to a bearish flag formation and a low risk scalp back down to the morning swing low.

[url=] [/url] [/url]

Posted by Jamie at 7/11/2008 04:16:00 PM 10 comments

Labels: Bearish_Flag, Bearish_Pennant

Pre-Market

Gapping Up: WYNN, LVS, ROYL, OXY, CHK (select Oil) , MA, JEC, BEXP, GOLD, GG

HPQ upgraded to Strong Buy at Raymond James; QCOM added to GS conviction list.

Gapping Down: WCG, AIB, PHG, WB, LEH, BAC, DB, UBS, MS, FRE, FMN, NY Times reported Bush administration officials are considering a plan to have the govt take over both cos and place them in a conservatorship if their problems worsen. The shares of FNM and FRE would be worthless, and any losses on mortgages they own or guarantee would be paid by taxpayers.

NETL, AIG, YHOO, TEVA,

Markets setting up for a very negative start S&P -16.75, NQ -21.5, YM -135 due to trade balance which came in well below economists expectations. Is this going to be the capitulation day we've been waiting for???

Sectors: Higher oil, gold. Weak airlines, financials, and home builders. Most sectors this color in pre-market.

[url=] [/url] [/url]

Posted by Jamie at 7/11/2008 08:45:00 AM 0 comments

Labels: Pre-Market

Thursday, July 10, 2008NASDAQ Technical Picture - Chop Fest

Sloppy, choppy and volatile. The intraday chart tells the story. Energy/commodities were strong and an intraday spike in oil cracked the rising wedge. Sloppy, choppy and volatile. The intraday chart tells the story. Energy/commodities were strong and an intraday spike in oil cracked the rising wedge.

The light sweet crude chart below shows some negative divergence of the MACD and RSI to higher prices. Two NRIBs on the base of the trend line look promising.

[url=] [/url] [/url]

Posted by Jamie at 7/10/2008 10:58:00 PM 0 comments

Labels: NASDAQ

Dummy Gapper Trades - Nordstrom, Inc. (Public, NYSE:JWN); FCStone Group, Inc. (Public, NASDAQ:FCSX)

Mailbag

The first trade in JWN was submitted by a reader. The entry and partial are his and he asks how he could better manage the trade. He was targeting a 50% Fib. extension.

The first point is that JWM is a regular gap with an expected target of 38% from the previous day high to the ORL (Trader-X). That target as we can see from the chart, was achieved within a tiny margin of error. Always sell/cover into strength, so plan to exit at least a partial as price approaches the target. After that don't allow price to retrace more than 38%. That is a normal retracement, and if it takes place on declining volume, there's a good chance that the trade can continue to move in our direction. I measure 38% including the trigger bar and estimate that $28.10 plus wiggle of 5 cents was a good place to set a stop.

The story is a bad retail sales report, but nothing over the top. The main observation I have is that the entry takes place after 3 WRBs so the main thrust is behind us.

If we look at the 3 minute time frame, we see that after the first two 15 min. bars, it carved out a 3 PP base at the ORL, with three consecutive lower highs (ABC). That setup is a relatively low risk scalp. Take a partial after 3 WRBs. If we look at the 3 minute time frame, we see that after the first two 15 min. bars, it carved out a 3 PP base at the ORL, with three consecutive lower highs (ABC). That setup is a relatively low risk scalp. Take a partial after 3 WRBs.

If you use multiple time frames, watch for candles with upper wicks on the lower time frame as potential areas of resistance, if they don't hold, take some money off.

The next trade was my gapper trade today. FCSX was an earnings miss with a really wide gap, trading in the daily spot (all time lows) with no support. If a stock gaps too wide don't use the regular Fib. extensions because they don't work. The next trade was my gapper trade today. FCSX was an earnings miss with a really wide gap, trading in the daily spot (all time lows) with no support. If a stock gaps too wide don't use the regular Fib. extensions because they don't work.

Here I'm trading a pattern - bearish flag, so my extension is from the top of the pattern to the base. The normal expectation for patterns is 100%. But this is a $17.00 stock, so I have to be realistic in my expectations. Also there's a caveat here because the flag breaks when the down sloping 5 period EMA is still a good distance above price. So I took a partial after almost 1 pt. to mitigate any potential reversal. FCSX didn't reach the full extension. But I'm keeping this one and VMW from the other day, on the WL for potential future weakness.

[url=] [/url] [/url]

Posted by Jamie at 7/10/2008 07:47:00 PM 11 comments

Labels: Bearish_Flag, Fibonacci, Gapper

Pre-Market

Gapping Up: WMT, HUN, CLR, SPWR, GLD, AIR, SGR, GE

Gapping Down: WFR, JASO, WB, BAC, FCSX, C, FNM, FRE (bringing whole financial sector of FED Poole comments re. solvency issues) HUM, LEH, MER, MCO, VLO

Initial Claims 346k vs 395k consensus

Futures edging lower - a substantial slide from earlier this morning - same store sales for many retailers have missed estimates - JWN, ANF, LTD, AEO. Some of the better reports include WMT, TGT and COST.

[url=] [/url] [/url]

Posted by Jamie at 7/10/2008 08:50:00 AM 0 comments

Labels: Pre-Market

Newer Posts Older Posts Home |

|

|

[复制链接]

[复制链接]