- 金币:

-

- 奖励:

-

- 热心:

-

- 注册时间:

- 2006-7-3

|

|

楼主 |

发表于 2009-3-20 16:10

|

显示全部楼层

Pre-Market

Futures are selling off again this morning. Shares of AIG (AIG) are plunging again this morning, after Fitch and A.M. Best last night joined S&P in downgrading the co's ratings and placing it on credit watch. Shares of Goldman Sachs (GS) are off more than 10% after the co reported mixed Q3 results, as annualized return on avg tangible common shareholders equity fell to 8.8% from 23.5% in Q2. Outside of finance we have shares of Best Buy (BBY) down 9.0% after the co missed by $0.09. CPI fell for the first time since Oct '06, coming in as expected. Reminder - the highly-anticipated FOMC rate decision and policy statement is due out at 2:15 EST. Most economists expect no change, but fed funds futures are currently pricing in a 100% chance of a 25 basis point cut to 1.75%.

Gapping Up: Select airlins on lower oil UAUA, AMR, LCC,

Gapping Down: AIG, ING, WB, GS, UBS, MS, DELL, GE, GOLD, RSX, OI, BBY,

AAPL removed from Goldman conviction list.

[url=] [/url] [/url]

Posted by Jamie at 9/16/2008 08:49:00 AM 0 comments

Labels: Pre-Market

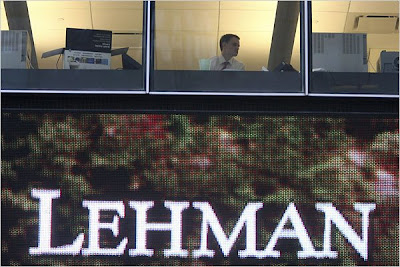

Monday, September 15, 2008Technical Picture - Global Markets Sell-Off as Lehman, AIG Stoke Wall St. Crisis

It was sad to watch all those Lehman employees leaving the building with boxes of personal belongings in tow, last night on CNBC. It was sad to watch all those Lehman employees leaving the building with boxes of personal belongings in tow, last night on CNBC.

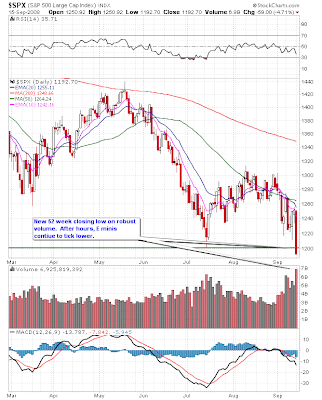

The financial sector headlines (LEH, MER, BAC, AIG) drubbed global markets, with the DOW down 500+ points and the S&P taking out 52 week lows as volatility spiked. The financial sector headlines (LEH, MER, BAC, AIG) drubbed global markets, with the DOW down 500+ points and the S&P taking out 52 week lows as volatility spiked.

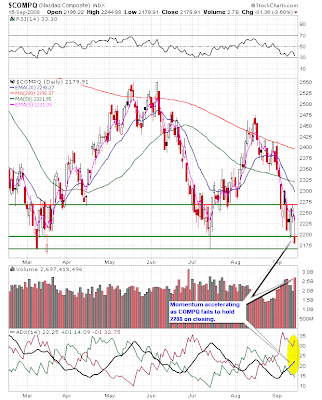

The NASDAQ has yet to take out the 52 week lows, but momentum is building as prices ready to test those levels. The NASDAQ has yet to take out the 52 week lows, but momentum is building as prices ready to test those levels.

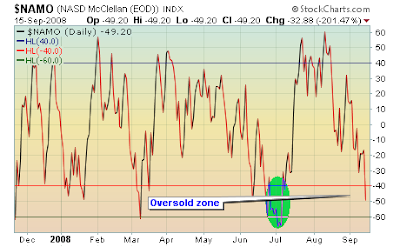

We are in the oversold zone, but we can stay oversold for a very long time as the July section of the NAMO chart highlights.

Economic Calendar: CPI in pre-market and FOMC policy statement at 2:15.

GS reports before the open. HPQ has announced a 7% workforce layoff as it integrates its operations with EDS.

Eminis continue to tick lower after hours as Asian markets print red -NIKKEI currently off by 500+ pts.

[url=] [/url] [/url]

Posted by Jamie at 9/15/2008 09:30:00 PM 2 comments

Labels: NASDAQ

Dummy Trades - American International Group, Inc. (Public, NYSE:AIG); DryShips Inc. (Public, NASDAQ:DRYS)

With all the headlines (LEH, MER BAC, AIG), I found today's markets were jittery and choppy so I stuck to the most orderly setups. AIG was a wide gap so I was looking for confirmation on the 1 minute time frame (3 pivot point base & break). With all the headlines (LEH, MER BAC, AIG), I found today's markets were jittery and choppy so I stuck to the most orderly setups. AIG was a wide gap so I was looking for confirmation on the 1 minute time frame (3 pivot point base & break).

After a fast move to the downside and capitulation volume, it carved out a V bottom with handle for a low risk long.

DRYS was a low risk short on price/volume contraction at the base $50.70. Partial after 3WRBs and 38% Fib. extension of the previous day high to the ORL. A whip lash reversal resulted in a stop out with slippage on the balance of the trade. My Esignal platform was unstable most of the day, so I was caught in a dead screen, otherwise, I might have been able to anticipate and get a better exit on the second half. DRYS was a low risk short on price/volume contraction at the base $50.70. Partial after 3WRBs and 38% Fib. extension of the previous day high to the ORL. A whip lash reversal resulted in a stop out with slippage on the balance of the trade. My Esignal platform was unstable most of the day, so I was caught in a dead screen, otherwise, I might have been able to anticipate and get a better exit on the second half.

[url=] [/url] [/url]

Posted by Jamie at 9/15/2008 04:57:00 PM 3 comments

Labels: 3 PP Base, Fibonacci, Gapper, NR7

Sunday, September 14, 2008NASDAQ Technical Picture - Historic Events Driving Markets

Lehman will file for bankruptcy tomorrow. BAC has agreed to buy Merrill Lynch at a premium. Is this a turning point for the markets? This will be a historic, event driven week for the markets. The broker/dealer business model appears to be going the way of the dinosaur. To come - GS earnings on Tuesday morning; FOMC policy Tuesday afternoon; OPEX on Friday. And what of AIG? Hearing that U.S. Treasury and the Federal Reserve are expected to say they are prepared to be more generous in the Fed's emergency lending program for commercial and investment banks.

CNBC currently reporting live as all this unfolds - USD falling, futures falling, Gold rising...

[url=] [/url] [/url]

Posted by Jamie at 9/14/2008 08:50:00 PM 4 comments

Labels: NASDAQ

Friday, September 12, 2008Pre-Market

Weak retail sales and financials continue to weigh on the markets with the fate of LEH in suspense if a buyer isn't found by the end of the weekend. Futures much lower as we approach the open.

Gapping Up: FWLT, HUN, AAUK,

Gapping Down: CMG, PDGI, ASML Select financials LEH, MER AIG, WB, IBN, ABK...

[url=] [/url] [/url]

Posted by Jamie at 9/12/2008 09:20:00 AM 0 comments

Labels: Pre-Market

Newer Posts Older Posts Home |

|

|

[复制链接]

[复制链接]