- 金币:

-

- 奖励:

-

- 热心:

-

- 注册时间:

- 2006-7-3

|

|

楼主 |

发表于 2009-3-20 08:53

|

显示全部楼层

Bounce back day Posted by downtowntrader | 12/01/2005 10:57:00 PM | 0 comments »

We had a nice strong up day today as bulls came back into the market. Funny enough, the energy sector participated this time, and most of the stock I highlighted a few nights ago were up nicely. I'm in the process of testing out a stock scanning tool that will hopefully speed up my evening study time, so until then, I think the updates will be brief. Here are a couple charts.

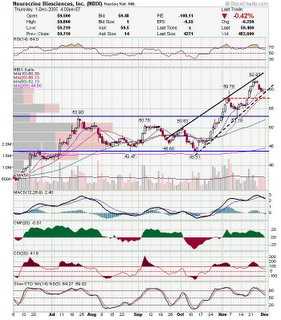

NBIX: Looking to re-enter if it makes a higher high tomorrow. Selling may be done for now.

CMT:I can't believe I let this slip away today. I've been watching CMT for a week now, waiting for today, and unfortunately, I missed it. I will look to enter on any weakness, as I think this is just getting started.

I highlighted IIJI a few nights ago, and today was what I was looking for. Nice volume too. I will lock in some profits tomorrow if it runs again, and start following it up with a trail stop. I highlighted IIJI a few nights ago, and today was what I was looking for. Nice volume too. I will lock in some profits tomorrow if it runs again, and start following it up with a trail stop.

A couple others that turned up on my scans were ndaq, hban, urbn and lend. Check them out in your charting software.

Good Luck,

DT

Tuesday Posted by downtowntrader | 11/29/2005 10:09:00 PM | 0 comments »

Just a quick update tonight. Also, there will not be an update tomorrow night as I will not be home till late.

QDEL: Got a bullish on Cramer and was trading up in after market. Keep an eye on it as sell off was a little overdone on Monday.

VPHM: Despite the negative news and resulting gap down, VPHM finished quite well. Could be a double bottom at support so watch for a higher high tomorrow. Pivot point would be 18.74. VPHM: Despite the negative news and resulting gap down, VPHM finished quite well. Could be a double bottom at support so watch for a higher high tomorrow. Pivot point would be 18.74.

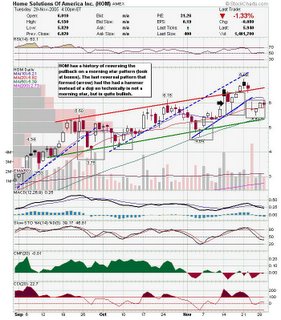

HOM: May be another reversal here. Didn't hit lower trendline or even 50 day sma after share dilution news which may be a bullish signal.

I also found these that look pretty good. Put these into stockcharts candleglance. A few of these look pretty good and I will look at them more closely in the morning. I also found these that look pretty good. Put these into stockcharts candleglance. A few of these look pretty good and I will look at them more closely in the morning.

apcs,fdry,rvsn,pwei,endp,joyg,eagl,webm,radn,ctlm

Good Luck tomorrow,

DT

Monday Night Update Posted by downtowntrader | 11/28/2005 09:31:00 PM | 0 comments »

I can't say today was unexpected as I have even warned in the past few updates of a market reversal looming. That said, even while taking profits and tightening my stops, I still lost more then I wanted. And, I guess the energy rally I thought might happen fell apart. Maybe I'm early, but every energy stock I highlighted last night tanked today. Not sure how tomorrow will play out as sometimes there is an immediate bounce, but I will be suspect of a strong open. There will be risk of a late day reversal if the market opens strong. I will start tonight with a 1 year NASDAQ chart.

I don't know that we will retrace a full 38.2% here, but we will have a healthy retrace at some point. One thing that scares me, is everyone is expecting a Santa Clause rally, including me, but when the market has a funny way of doing the opposite of what everyone expects.

I actually bought IIJI today on the higher high. They held above the trendline so I'm optimistic. This stock has had it's share of drama with the whole IPO deal, but it looks like the worst may be over. If it makes a new 52 week high, I think it could get explosive. I actually bought IIJI today on the higher high. They held above the trendline so I'm optimistic. This stock has had it's share of drama with the whole IPO deal, but it looks like the worst may be over. If it makes a new 52 week high, I think it could get explosive.

Also went long LMIA today. Strong move in the face of a weak market. Also went long LMIA today. Strong move in the face of a weak market.

I thought HAUP may of retraced 38.2% but they ended up near a 50% retrace. I took a small position and will keep an eye on it. I thought HAUP may of retraced 38.2% but they ended up near a 50% retrace. I took a small position and will keep an eye on it.

I have a few more on my watch list including HOM, CMT, SVA, NBIX, KOMG, QCOM and MRVL. Good Luck tomorrow,

DT

HAUP Posted by downtowntrader | 11/28/2005 01:45:00 AM | 0 comments »

An anonymous reader asked me to look at HAUP, and it looks very interesting. These kind of moves are hard to trade because it moved so much and so fast in one day. I will watch this one and if it takes off, then I may go long. Read on the chart for some analysis, but the main thing I like here is the volume. It's not a lot relatively speaking, but it is substantially more then this stock trades normally. This will show up on a lot of stock scans over the weekend, so I expect another high volume day. The question is does it try to pull back or does it just keep going up. Should be interesting. Thanks to anonymous for mentioning it. Good Luck and I hope this helps.

DT

Strategy for three current positions Posted by downtowntrader | 11/28/2005 01:27:00 AM | 0 comments »

Most sites post stock picks, but you never hear what happened to the trades, so I'm gonna try and go through my thought process on three current holdings. I've chosen stocks that I'm still in, as opposed to stocks that I got stopped out of such as BRCM or SVA. Also, I feel that these stocks are still playable. I am also highlighting a new stock that looks like a possible swing setup for this week.

NGPS: My plan was to give this one a little room because the reward greatly outweighs the risk. I feel that NGPS can trade to $36 based on the double bottom base. It also broke through a long downtrend. I'm keeping my stop below the 10 day sma at this point and I may add if it makes a higher high.

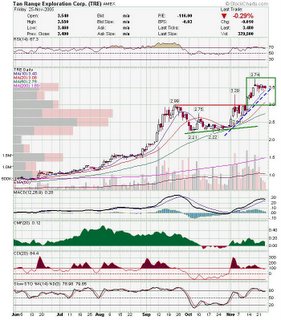

TRE: I bought this at 3.19 and had an initial target at the upper range of the box ased on the triangle breakout. I took profits on half of my position at 3.69. I bought those shares back and a few more at 3.40. The reason I bought the shares there was that my stop at the time was 3.30. I sometimes buy more shares when the stock pulls back to my stop, because I choose my stops based on where I feel support will be and the risk reward justifies adding there IMO. Not all trades work out and I get stopped out plenty of times. But when it works, the reward is usually substantial. I think TRE is geting close to moving higher again. They have pulled back gently to the 10 day sma and near the trendline. Look down the chart and see what happened last time this happened. TRE: I bought this at 3.19 and had an initial target at the upper range of the box ased on the triangle breakout. I took profits on half of my position at 3.69. I bought those shares back and a few more at 3.40. The reason I bought the shares there was that my stop at the time was 3.30. I sometimes buy more shares when the stock pulls back to my stop, because I choose my stops based on where I feel support will be and the risk reward justifies adding there IMO. Not all trades work out and I get stopped out plenty of times. But when it works, the reward is usually substantial. I think TRE is geting close to moving higher again. They have pulled back gently to the 10 day sma and near the trendline. Look down the chart and see what happened last time this happened.

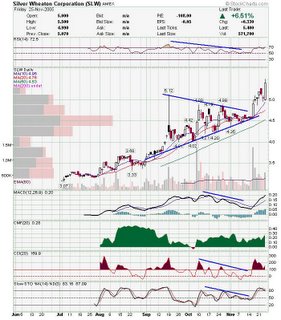

SLW: This is one that I screwed up on early, but I bought it back when I saw I was wrong. I let this one get away from me on the first breakout day out of the triangle. I chased it a little, but still bought where I thought was decent (4.85). It traded to resistance and I didn't get filled. I had my stop at 4.90 and was stopped on the hammer day (next day). When it traded higher the next day, I felt that the hammer would be the low for this pullback, so I bought back my position at 5.12. I then bought more at 5.00 the Wednesday because it was close to my stop and I fel there would be support. I am still holding this as I think this is the start of a new leg up. I am keeping my stop below Fridays low for tomorrow and will adjust accordingly tomorrow night.

CMT: They are trading in a loose bull pennant. If the upper trendline is broken it can be played. If 8 is broken then this could get exciting. 10 day crossed the 200 and 20 is trying. Keep an eye on it. CMT: They are trading in a loose bull pennant. If the upper trendline is broken it can be played. If 8 is broken then this could get exciting. 10 day crossed the 200 and 20 is trying. Keep an eye on it.

Also on my watch list for the week are lmia,cbg,iiji, ipii,antp, rnwk,sva,mrvl, brcm,qcom. Also on my watch list for the week are lmia,cbg,iiji, ipii,antp, rnwk,sva,mrvl, brcm,qcom.

Good Luck,

DT |

|

|

[复制链接]

[复制链接]