- 金币:

-

- 奖励:

-

- 热心:

-

- 注册时间:

- 2006-7-3

|

|

楼主 |

发表于 2009-3-19 18:19

|

显示全部楼层

Options pinning Posted by downtowntrader | 6/15/2006 10:12:00 PM | 3 comments »

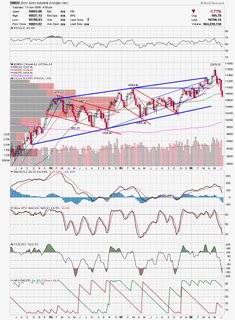

Well we got to the top of some downtrend channels pretty quickly after a really strong day today. How much of this is short covering or options pinning remains to be seen, but channels this steep cannot be sustained for very long. I would expect some trouble with these resistance levels but I don't think a quick reversal is in the cards.

Tomorrow is options expiration Friday and as such I will not be daytrading. I was expecting a strong move to the upside and there may be more of the same early tomorrow. By the end of the day the program trading will really kick in. I would expect that we would see some weakness early next week, especially if tomorrow is a strong day.

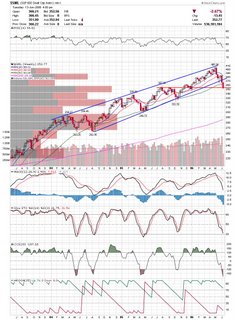

Here is a chart of the SP500. Note the steep downtrend channel and how we have moved pretty quickly to near the top of the channel. There are some signs that we will edge our way higher after the next few days of choppiness. Take a look at the stocks trading above the 50sma indicator and notice it is at an important low that marked the October low.

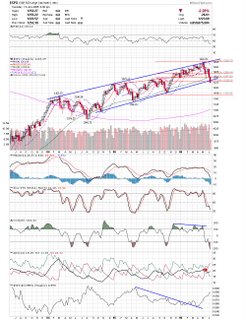

Here is the Nasdaq chart showing similar indicators, however, the Nasdaq is clearly below important support. Something that is interesting, is that the Nasdaq outperformed today and the Nas/SP500 ratio is starting to turn up a little signifying that market participants may be ready put some money to work. Here is the Nasdaq chart showing similar indicators, however, the Nasdaq is clearly below important support. Something that is interesting, is that the Nasdaq outperformed today and the Nas/SP500 ratio is starting to turn up a little signifying that market participants may be ready put some money to work.

I mentioned that I don't trade on Options expiration and the main reason is the program trading and pinning of prices by the institutions. Keep in mind that in general, it is the institutions that write options and retail investors that buy them, and since they have more money they can protect their positions. If you are in a position or are trading, keep an eye on the open interest and try to look at it from the perspective of an institution that has written all these options to the retails. Here is an example, although it is a little harder to manipulate the SPY's. Look at the SPY chart and where it closed (126).

Now take a look at open interest for June Calls and Puts. There are a lot more puts out there then calls, therefore there will be more people in pain if the price runs up tomorrow. I would expect that there would be no way they let it fall below 125 so I would not be short tomorrow.

Although I expect some continued stength in the coming weeks, I believe that we have topped and a new downtrend will begin in the near future. I just don't think it will happen in the next week. I will be playing to the longside for daytrades or short swings for now while keeping my eye on the recent lows.

Good Luck,

DT

No Update Tonight Posted by downtowntrader | 6/14/2006 09:31:00 PM | 0 comments »

Sorry, but there will be no update tonight.

DT

Some Chart Damage being done Posted by downtowntrader | 6/13/2006 11:23:00 PM | 0 comments »

There has been some serious chart damage the past few sessions on all the indices. While I still maintain that we are near a bounce, it really looks like we still have lots more downside before the year is up. I think it's a dangerous to initiate new shorts here and there is not much to be had on the long side. I am posting my weekly charts of the major indices for a little perspective on where we stand.

Here is the Nasdaq Composite breaking all kinds of support.

Here is the Dow Industrial Average which has broken some support levels but remains well within the long term channel.

Here is the Russell who still has a decent shot of closing the week within the channel. Here is the Russell who still has a decent shot of closing the week within the channel.

The smallcap SP600 is trying to hold a horizontal trendline but there are clear signals that there is major distribution occuring. The smallcap SP600 is trying to hold a horizontal trendline but there are clear signals that there is major distribution occuring.

The SP500 is trying to cling to the channel. The SP500 is trying to cling to the channel.

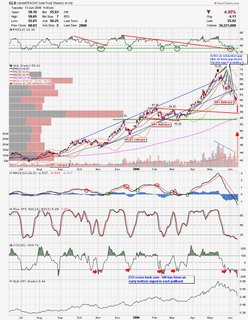

Has Gold capitulated? Today's move in GLD seemed like a panic move and may signal the short term bottom. Looking at the chart I see all sorts of gaps down followed by this large gap on the largest volume since inception. I will be watching the gold stocks here. Has Gold capitulated? Today's move in GLD seemed like a panic move and may signal the short term bottom. Looking at the chart I see all sorts of gaps down followed by this large gap on the largest volume since inception. I will be watching the gold stocks here.

EXPD has held gap support and may get a bounce here near previous resistance. EXPD has held gap support and may get a bounce here near previous resistance.

LIFC came back and filled the gap and quickly reversed. Watch to see if this was the bottom for now. LIFC came back and filled the gap and quickly reversed. Watch to see if this was the bottom for now.

UARM could have an explosive move to either side of this triangle with the odds being higher right now. UARM could have an explosive move to either side of this triangle with the odds being higher right now.

Good Luck,

DT

Traders Expo Posted by downtowntrader | 6/11/2006 10:37:00 PM | 4 comments »

I had a good time this last week at Traders Expo getting to listen to the likes of Martin Pring, Oliver Velez, and John Person. I also got a chance to speak with vendors about trading products that I use and have been looking at.

I have been looking at possibilities for mechanical systems lately and I was interested in looking at products that would help me back test and possibly implement trading systems. On my list were Tradestation, Wealth Lab's Pro, ESignal, and speaking to the team at my current platform, Cybertrader.

I have been a little disappointed with Cybertrader for a few reasons. I think their back testing of strategies is pretty pathetic. They don't let you modify many of the entry and exit methods and the indicators available are slim. I asked them about any future enhancements and they were pretty vague about their plans. I hope to get a better response soon, as I have been pretty happy with several aspects of their platform such as execution speed, slippage, and commisions.

I visited Tradestation with great hopes and left a little disappointed. While their backtesting looked good, they don't let you implement pieces of it as an exit strategy and they left much to be desired as a trading platform. The following are drawbacks that led me to quickly take them off my list.

No Server side alerts: Cyber let's you setup trading alerts and keep them on their servers. This is pretty cool because if you have a communications problem or PC issues, your alerts are still active.

No Mobile Platform: I use my Treo 650 to keep tabs on my positions and can enter orders at any time. Tradestation has no mobile support.

Commisions: At least for equities, Tradestation does not come close to Cybertrader for commisions. Tradestation charges 1 penny per share up to 500 shares, and then .005 per share after that. Cyber charges .006 per share. This doesn't seem like much, but for active traders it can be a drastic difference. This works out to a $2 difference on 1000 shares, so if you trade 100K shares a month you are paying up $200 bucks for Tradestation, and I typically trade well over that.

Unfortunately ESignal did not have a booth at the show so I didn't get a chance to look at it. I did get the software though and plan on testing it out. If anyone has experience with ESignal and especially with the strategy testing piece, please feel free to drop me a note on it.

As I mentioned before, I enjoyed some of the presentations at Traders Expo and I was able to find web articles that were pretty much what was presented at a few of the sessions.

This link is to the actual slides Martin Pring used for a session on Short Term Bar Patterns. This was a pretty good session, although fairly basic. I did realize though, how few traders in general truly understand bars/candles and the underlying psychology behind them. I highly recommend reading a Pring or Nison book for all traders.

Pring

This link is an article detailing how market makers hide their actions on level II (fairly obvious but worth looking at)

Pugliese

This is a good article by John Person showing how he uses Pivot points (which I use on my intraday charts)

Person

No charts tonight.

Good Luck,

DT

Sunday Night Charts Posted by downtowntrader | 6/11/2006 09:20:00 PM | 0 comments »

One of the things I do each Sunday night is to review the updated Investors Business Daily 100 list. I keep a chart list on my stockcharts account of the 100 and keep it current to the list on IBD. The list is generated electronically and takes their propietary fundamental ratings and technical ratings into account. They have certain criteria such as where in the yearly range the stock is. One clue that the market has been deteriorating is that there are some pretty weak stocks making the list each week. SNDK for example was off the list and made it back despite falling further from their 200 sma last week. I still think we are oversold and due a bounce, so I am not looking to short right now. I am looking strictly at stocks that are hovering near support and showing good one or two day candle patterns.

ADM is still holding the trendline and showing some indecision at falling lower.

CELG has been consolidating and looks like it wants to test resistance. CELG has been consolidating and looks like it wants to test resistance.

SAFT may be bouncing off a previous breakout point after failing to hold gap support. SAFT may be bouncing off a previous breakout point after failing to hold gap support.

CL is a nice consumer staple stock that can be added to a portfolio for nice steady move higher. CL is a nice consumer staple stock that can be added to a portfolio for nice steady move higher.

ETP has a nice trend going here and may be getting a bounce off the 20sma. ETP has a nice trend going here and may be getting a bounce off the 20sma.

I mentioned a couple weeks ago that FMD looked like it would head to top of triangle and now that it is there it looks like it is struggling near long time resistance. If it gaps lower tomorrow it may be done. I mentioned a couple weeks ago that FMD looked like it would head to top of triangle and now that it is there it looks like it is struggling near long time resistance. If it gaps lower tomorrow it may be done.

GYMB looks like it may be forming a second base here. GYMB looks like it may be forming a second base here.

IFO has had a wild ride recently and may be forming a little bear flag here. IFO has had a wild ride recently and may be forming a little bear flag here.

MED may get a nice bounce off the 20sma. MED may get a nice bounce off the 20sma.

XPRSA may be breaking out of a triangle here. XPRSA may be breaking out of a triangle here.

I think Market participants are pretty confused right now so it's best to be overly cautious now. Good Luck,

DT |

|

|

[复制链接]

[复制链接]