- 金币:

-

- 奖励:

-

- 热心:

-

- 注册时间:

- 2006-7-3

|

|

楼主 |

发表于 2009-3-20 07:28

|

显示全部楼层

Do we still have the same Market Leaders? Posted by downtowntrader | 2/06/2006 08:12:00 PM | 1 comments »

We are having some interesting action in a few "market leaders". Sometime's when market leaders falter, it could be a signal of a market top. Think back to the weeks leading up to aapl, goog and even hans earnings. Analysts didn't have enough good things to say about them, with upgrades and increased price targets. I want you to stop and think about something. Why does an analyst upgrade a stock or increase the target? If they don't own the stock or are buying more, why would the upgrade it? This would just increase the price they have to pay for it. They need buyers to unload their shares, so they upgrade it. Sometimes, there are other institutions that are buying, and sometimes the upgrading institution just wants to pare down the position and the stock chugs along. However, in January, everyone was pumping aapl and goog. If that many instituions felt that strongly about them, then why did they let them slip past the 50 sma (typically a buying point for institutions) so easily. Some people say, well earnings were disappointing, but the name of the game in the stock market is percieved future earnings, not past. Some institutions are worried about the near term future, and decided to lock in their substantial gains. If institutions that typically scarf up shares of market leaders at the 50sma are now letting them slide by, then there certainly is a danger of a market top. However, there is a debate to who the true market leaders are. Some would say the small and even mid caps have been the true market leaders. This could certainly still be the case and we may just be having a rotation take place in a few stocks. The IWM etf is still looking decent, and the SP600 is in much better shape then the other indices. If we are indeed rotating market leaders, then a case has to be made for who the replacements will be. I have listed some charts of possible market leaders moving forward, and interestingly, chip stocks are what's been being bought on dips. Look at AMD, NVDA, and BRCM's charts for proof. The key point here is to not be blind to the possible rocky road ahead. No one can call an exact market top or bottom consistently, but when there are warning signs, it makes sense to be cautious. Here are the charts of the stocks mentioned.

Good Luck,

DT

keep an eye out for another post tonight with a few charts.

Charts of interest Posted by downtowntrader | 2/05/2006 11:05:00 PM | 0 comments »

The markets are at a crossroads right now. I am seeing conflicting signals in the indices so I am tightening my stops and I will keep my trades shorter in time frame. I still don't feel it's time to go predominantly short, but I am seeing some more short setups. Here are some interesting charts from this weekends scans.

Keep an eye onQSSI for a breakout. There is a chance it pulls back and forms a triangle.

ABAX is showing an aversion to dropping below the breakout point. It's a buy if it makes a higher high in my opinion. ABAX is showing an aversion to dropping below the breakout point. It's a buy if it makes a higher high in my opinion.

PETS is pulling out of a quick bull pennant and may be good for a 2-3 day swing. PETS is pulling out of a quick bull pennant and may be good for a 2-3 day swing.

Nice bull pennant on SWSI. Wait for the break of the trendline. Nice bull pennant on SWSI. Wait for the break of the trendline.

ANTP is forming a very loose pennant type consolidation base, and could have a breakout. With the base this sloppy, I would be quick to lock in profits. ANTP is forming a very loose pennant type consolidation base, and could have a breakout. With the base this sloppy, I would be quick to lock in profits.

SNTO broke out of a nice triangle and is pulling back to test breakout area. Keep an eye for a bounce. SNTO broke out of a nice triangle and is pulling back to test breakout area. Keep an eye for a bounce.

Is AAPL still a market leader. We will soon find out. It is looking pretty weak and is setting up for another test of support. Keep an eye on it for a bounce or breakdown. Is AAPL still a market leader. We will soon find out. It is looking pretty weak and is setting up for another test of support. Keep an eye on it for a bounce or breakdown.

DIETS is consolidating substantial gains, and formed a nice hammer. May be ready for a little bounce. DIETS is consolidating substantial gains, and formed a nice hammer. May be ready for a little bounce.

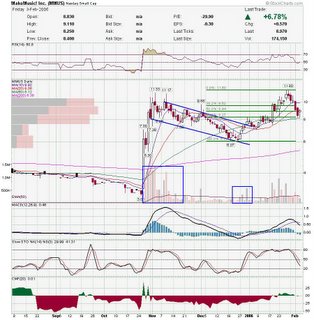

MMUS is a chart I highlighted a few days ago as a possible cup and handle base forming. I think this is the bottom of the handle (61.8% retrace) and that it will resume the uptrend here. Watch for a breakdownnear previous pivot low. MMUS is a chart I highlighted a few days ago as a possible cup and handle base forming. I think this is the bottom of the handle (61.8% retrace) and that it will resume the uptrend here. Watch for a breakdownnear previous pivot low.

TALX had defended the 50 day sma aggresively twice in the past few weeks, but failed to do so again. Now we have a broken trendline. This could be headed toward 200sma. TALX had defended the 50 day sma aggresively twice in the past few weeks, but failed to do so again. Now we have a broken trendline. This could be headed toward 200sma.

ARD is sitting right on support. Watch for a break to either side. ARD is sitting right on support. Watch for a break to either side.

PEET is right at top of channel and struggling to overcome resistance. Could be headed lower if it fails to hold SMA's. PEET is right at top of channel and struggling to overcome resistance. Could be headed lower if it fails to hold SMA's.

If you're looking for more charts, swing by Roberto's Nasdaqtrader blog (link on my sidebar). He posted a bunch of charts this weekend.

Good Luck,

DT

Great day for MCX Posted by downtowntrader | 2/03/2006 06:01:00 PM | 2 comments »

MCX finally closed over 15 and should debut pretty high on the IBD100. I've been posting on them quite a bit lately and the past 2 days have shown a remarkable increase in volume. Not only did they close over 15, they almost challenged their 52 week high. If they make it high on the list, 16's should be eclipsed rather quickly. Here are my updated charts.

Daily looks great and MCX clearly broke a nice base on strong volume.

Weekly looks nice with increased volume in the second base. Weekly looks nice with increased volume in the second base.

Congrats to those who played MCX with me and good luck in the coming week. Congrats to those who played MCX with me and good luck in the coming week.

DT |

|

|

[复制链接]

[复制链接]