- 金币:

-

- 奖励:

-

- 热心:

-

- 注册时间:

- 2006-7-3

|

|

楼主 |

发表于 2009-3-19 17:38

|

显示全部楼层

Bulls go crazy Posted by downtowntrader | 10/12/2006 06:40:00 PM | 1 comments »

The markets had strong moves higher today as Bulls continues to run through the Bears. We have had a nice move prolonged by shorts covering and reshorting. Although I must admit I have been skeptical of this entire move, I was open to the possibility that this move would occur and have been sticking mostly to the long side. Here is a quote from my July 18, 2006 post.

"Here is a chart of the SP500. Nice candle today confirming support. This level was confirmed as support on the last downturn, so it makes the candle more significant. While I'm not crazy enough to call it, it looks like there is a possibility that the SP500 could form a reverse head and shoulders as marked on the chart. This would be an interesting development if the pattern came to fruition as the short covering would be frenzied (maybe fed pause ;). "

I was thinking that if such a move occurred, the majority would be looking to short each rally. If everyone is trying to short, then it may keep chugging along. I figured the end would come as soon as everyone threw in their short towels and started debating whether this time was different. We're not there yet, but I feel people getting bullish, as non trading co-workers are asking me about this rally and if it's too late. I wasn't foolish enough to call a bottom back then, and I'm not foolish enough to do the same with a top. There has been a lot of strength in the markets recently and it seems that every short position I put on is a small win or loss no matter how good the setup. I would imagine that a top would probably drag out a little as there are still plenty of people that think they missed the bus waiting in the shadows.

On another note, I found it a little perplexing that the indices finished with above average volume, but the ETF's volume was very low. Take a look at an $spx chart and compare the volume to the SPY chart. Same with the Q's. I have no idea what this means other then maybe less program trading today? Another thing that has me a little perplexed is that in a normal cycle, stocks peak before commodities. With stocks making a new high and commodities looking like they topped out, I wonder if there is something else at work here or if commodities have another move left in them as well. Maybe there are clues here for a possible major reversal in the US dollar. Just thinking out loud here, but this market has had some strange behavior to say the least. One thing is for sure, if you love this game, there is always something interesting going on.

No charts tonight, but I may post a few intraday tomorrow.

Good Luck,

DT

Markets Seriously Overbought Posted by downtowntrader | 10/11/2006 10:03:00 PM | 1 comments »

The markets are seriously overbought on all timeframes and probably pretty near to a pullback of some sort. I wouldn't get too aggresive shorting, because this some softness late this week with strength into options expiration next week. That pattern appears plausible with the current state of the charts.

Here are a couple long term charts to chew on.

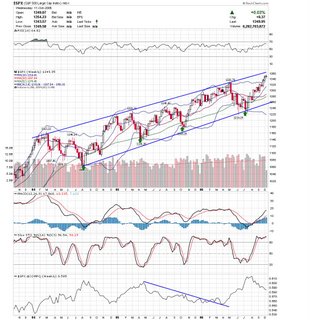

SP500 is near the upper end of this long term channel . It has made a beeline from the lower part of the channel, so there is no way this is shattering the top of this. We can still ride the band for a bit, but we are back to a point where the risk may be greater then the reward.

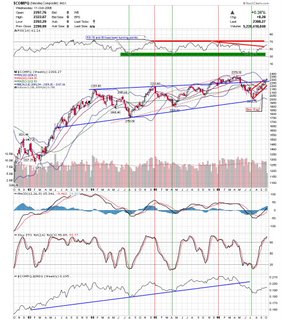

Here is a chart of the weekly nasdaq composite. A couple of interesting points. RSI readings over 70 and near 30 have been fairly reliable indicators of turning points, other then the high 1/06 reading. RSI still has plenty of room here, but this recent leg up still resembles a bear flag. Here is a chart of the weekly nasdaq composite. A couple of interesting points. RSI readings over 70 and near 30 have been fairly reliable indicators of turning points, other then the high 1/06 reading. RSI still has plenty of room here, but this recent leg up still resembles a bear flag.

There is still some strength in the markets as bad news today couldn't "stick" and the indices closed off their lows, but my guess is that we still have some indesicive trading range days ahead this week. Here are a few links: There is still some strength in the markets as bad news today couldn't "stick" and the indices closed off their lows, but my guess is that we still have some indesicive trading range days ahead this week. Here are a few links:

- I a nice post on whether you would hire yourself to manage your money.

Trading plans and money management aren't as sexy as the momentum stock du' jour, but without them, your chances of making it are slim indeed.

Good Luck,

DT

Blog for Sale Posted by downtowntrader | 10/10/2006 07:30:00 PM | 4 comments »

I've decided to put up my blog for sale. If a site full of videos of star wars re-enactments by chubby kids and monkeys sniffing their ass is worth 1.6 billion dollars, then my hard work has to be worth something right. Maybe I should put it up on Ebay? Seriously though, I can see where some of the major players will eventually try and scoop up some bloggers and their loyal readers in an effort to have fresh and exclusive content.

Today was a fairly indecisive day and with the markets in need of a breather, I think the best move will be to take a few days off. I am posting a few charts below in case the markets move more then I expect though.

Sykes Enterprises, Incorporated (Public, NASDAQ:SYKE)

SYKE has been holding under resistance and with the 20sma catching up to price, it should be moving soon. This pattern looks more like a continuation pattern, so the move should be to the upside.

Goldcorp Inc. (USA)(Public, NYSE:GG)

GG continues to look like a near term bottoming process is underway. Today was another rejection of prices in the 20-21 range.

Ceradyne, Inc. (Public, NASDAQ:CRDN)

CRDN is a great example of a stock under distribution. Every rally is sold and it looks like it may be turning back down.

America Movil S.A. de C.V (ADR)(Public, NYSE:AMX)

AMX has taken this wedge to its apex. It will be out of room soon, so a move should be in order. I would be more interested in a breakdown at this point.

SINA Corporation (USA) (Public, NASDAQ:SINA)

SINA was one of the charts I liked most from Sundays post, and it is moving along nicely. Keep an eye on the upper pennant line for a breakout.

Muaad wrote in on how I review sectors and I thought it would be best to post my response. Muaad wrote in on how I review sectors and I thought it would be best to post my response.

"I have reviewed the list on StockChart.com's "Market Summary," and I find it a great place to start, but I am aware that there are many Indices and ETFs missing from this list. Can you point me to a definite source that has the most inclusive list of Sector Indices and ETFs? And perhaps the list you track and feel is of importance?"

Before I answer, I will mention that I study the market sectors each weekend to try and determine where to look for a move in the coming week. I also am a proponent of intermarket analysis, so I am keeping a close eye on ratio's and how a specific sector will impact others.

I feel that the

Good Luck,

DT

Semiconductors Rally Posted by downtowntrader | 10/09/2006 09:08:00 PM | 3 comments »

We had a nice move on semiconductors today and it looks like they may follow through over the next few days. This morning, as the indices were weak, the $sox was green giving clues that the indices would turn it around. I didn't like the way the Nasdaq closed, but small caps were looking better today and may be strong tomorrow. Here are a few charts to add to the watchlist.

Illumina, Inc. (Public, NASDAQ:ILMN)

ILMN has been kissing the rising trendline for a few session now. The rule of polarity states that previous support once broken turns to resistance. This is a perfect example of that.

Broadcom Corporation (Public, NASDAQ:BRCM)

BRCM may come back to the bottom of the triangle, but if semiconductors follow through then BRCM should join in the fun. Stochastics is about to crossover.

UTi Worldwide Inc. (Public, NASDAQ:UTIW)

I haven't been too keen on the transports as a whole, but UTIW looks decent after clearing this pennant. It is retesting support and may break the 200sma on the next move.

Thats it for tonight. Go Broncos!!

DT

Advanced Micro Devices, Inc. (Public, NYSE:AMD)

AMD may be close to bouncing here as it pulls backto support. This could be a cup and handle bottom.

SINA Corporation (USA) (Public, NASDAQ:SINA)

Sina is looking bullish and may breakout of this falling wedge / pennant. It should find support here at the lower band and 200 sma.

Baidu.com, Inc. (ADR) (Public, NASDAQ:BIDU)

BIDU may find support at the rising trendline. Stochastic is oversold and looks like it will crossover here.

V.F. Corporation (Public, NYSE:VFC)

VFC is trading a very tight range here and should make a move soon.

Jones Apparel Group, Inc. (Public, NYSE:JNY)

JNY is wedged between a rock and hard place here. It formed a hammer at the rising band and may be ready to break out of this consolidation phase.

Blue Nile, Inc. (Public, NASDAQ:NILE)

Nile is also trading a very tight pattern after making it above resistance. The 20sma caught up to price and it should make a move very soon.

Hittite Microwave Corporation (Public, NASDAQ:HITT)

HITT is trading a nice triangle after getting above a very sloppy base. It may have a very nice move if it can clear this pattern.

EZCORP, Inc. (Public, NASDAQ:EZPW)

EZPW has been consolidating for months now and is trading near support on declining volume. This could be a decent area for early birds who are bullish on EZPW in the intermediate term.

Diodes Incorporated (Public, NASDAQ:DIOD)

I think semiconductors may catch another bid soon and DIOD just came back to fill a gap. It is sitting on a rising trendline and may move from here.

Cascade Bancorp (Public, NASDAQ:CACB)

CACB is a low floater that has been gaining steam. It just broke out of flag type base and has been consolidating the move for a few weeks without giving up too much of the move. Keep an eye on it as it is starting to tick up.

A number of the picks from last week had very good moves, and a few are still looking good for an entry, so make sure to review last weeks posts. I'm a little worried that I see so many bullish charts as this has been a contrarian indicator for me in the past so be careful out there.

Good Luck,

DT |

|

|

[复制链接]

[复制链接]