- 金币:

-

- 奖励:

-

- 热心:

-

- 注册时间:

- 2006-7-3

|

|

楼主 |

发表于 2009-5-9 06:33

|

显示全部楼层

Friday, September 15, 2006Friday Follies

Greetings from downtown Palo Alto, heart of all things technical and headquarters of the world's wildest bear blog. Your host: Tim Knight.

Since July 18, the markets have been on a tear. A bullish tear. The kind we don't like. The Dow is up over 8%, as is the S&P 500. The NASDAQ Composite is up even more, over 13%. Not a pretty picture, people. And, except for the recent softness in gold & oil, it's been a really nasty market for us ursine types.

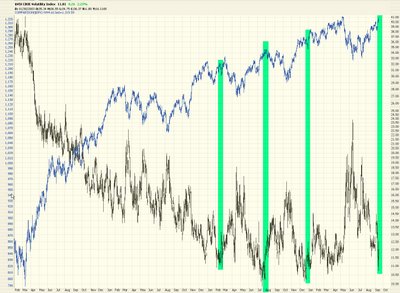

The $VIX has ground down to almost never-before seen levels of complacency. I'm just waiting for Wired to publish another "40 Years of Prosperity" cover stories again.

If you look at the VIX relative to the SPX, there's a pretty strong inverse relation. Not foolproof, certainly, but it's clearly there.

The Dow is within spitting distance of its lifetime high. Astonishing. The bulls have shown amazing strength.

If you look at the $OEX, and many other indices today, you'll see that it formed a shooting star candlestick. It's not an amazing one, and option antics probably had a lot to do with today's volatility. Hey, at least it didn't close at the highs! I'll take what I can get!

Oil, which has been very kind to us the past couple of weeks, paused for a rest today. The H&S pattern is complete, and it's in a position to get really clobbered. But it's resting right now, deciding whether to recover some of its losses or resume the swoon. |

|

|

[复制链接]

[复制链接]