- 金币:

-

- 奖励:

-

- 热心:

-

- 注册时间:

- 2006-7-3

|

|

楼主 |

发表于 2009-5-2 14:59

|

显示全部楼层

Tuesday, March 27, 2007Freedom of Choice

Subtle product placement prior to writing this post: buy [url=http://www.amazon.com/gp/redirect.html?ie=UTF8&location=http%3A%2F%2Fwww.amazon.com%2FChart-Your-Way-Profits-Technical%2Fdp%2F0470043504&tag=prophet-20&linkCode=ur2&camp=1789&creative=9325]my book[/url] Better your life! Be the envy of your neighbors and the hero of your friends! God knows you could make your life better than it is now. Better your life! Be the envy of your neighbors and the hero of your friends! God knows you could make your life better than it is now.

I thought my soul-baring post yesterday on why I am a bear would attract some interest, but I didn't quite anticipate what kind. I'm starting to feel like a polemicist. A lot of comments, a lot of linkbacks, and a fair bit of rabble rousing.

Markets aren't typically very easy to explain, but right now, it is. So here we go: if the indexes soon push above the highs we saw last Friday, it's back to wait-and-see, gosh-life-sucks mode for the bears. If we stay in the trading range established over last week and the week prior, we could be stuck there a while. And if we break beneath the low seen two weeks ago, it's party time. Simple as that.

Let me offer one potentially short-term bullish scenario in the graph below. It could be conjectured that the strength we saw last week was the true direction of the market, and the past couple of days have simply been a retracement. It could be argued that this is just a launching-off point for the bulls and we will continue with last week's strength.

Judging at least from this evening's GLOBEX session and the news that a major homebuilder is looking at sweeping Federal fraud charges, maybe the descent of the past couple of days is more representative of the market's direction. After all, plenty of feckless speculators in the real estate world are just starting to get slammed.

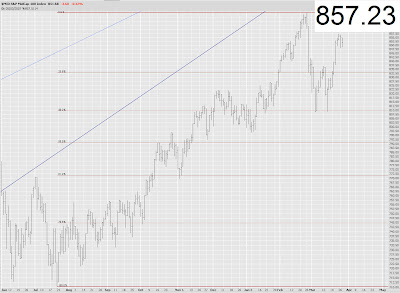

Let me show you what I mean by the highs of last week by way of the S&P 400 MidCap index. $857.23 is the stop price. Bang, it's just that simple. Cross above it, and Tim is unhappy. Continue to sink away from it, and Tim is glad. And the latter is what we all want, isn't it?

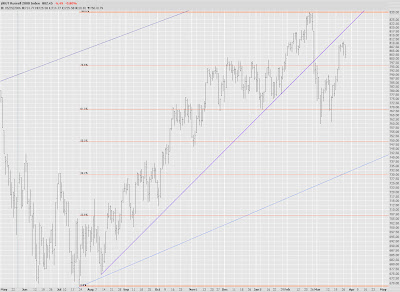

Here's perennial favorite $RUT, the Russell 2000. The lines speak for themselves:

The minute graph of the same index shows the support zone the bulls have on their side. There needs to be a robust run through this for the bears to survive. |

|

|

[复制链接]

[复制链接]