- 金币:

-

- 奖励:

-

- 热心:

-

- 注册时间:

- 2006-7-3

|

|

楼主 |

发表于 2009-5-2 06:26

|

显示全部楼层

Thursday, April 05, 2007Pickle Surprise!

Six up days in a row on the $INDU. I'm glad this week is over. Hopefully, after a three day descent, we'll be resurrected a la Jesus on Monday. Who knows......

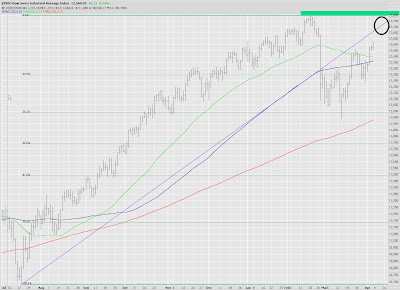

It's the same story I've been citing on the major indexes. Although we're pushing higher and higher, we're still under that major trendline that was broken on February 27th. I've circled the highest target area. Of course, if we cross above that tinted zone (the former high in February), it's time to return to aluminum siding sales, door-to-door.

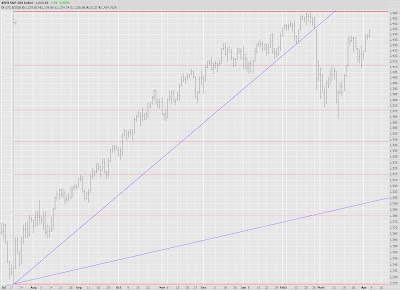

Here's an interesting chart for you. These are three moving averages (50, 100, and 200 day) against the $NDX, but I've hidden the prices. I've put an arrow at each recent instance where the 50 day crossed below the 100 day while the 200 day was still moving up.

Now let's take a look at the same graph, but this time with prices. I've highlighted the price action (all the way to the turnaround point) after each of these instances. Interesting.

I am deeply disappointed - and maybe even a tad disillusioned - that the indexes have pushed past their late March highs. That's not good. It indicates more strength on the bulls part than I anticipated. My waning confidence makes me consider that it is a real possibility we could push onto new highs this month.

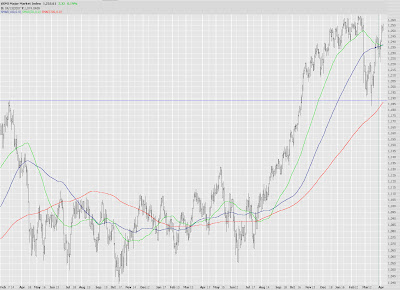

The $XMI graph still gives me some hope. The spurt from July to February made sense. In fact, I mentioned late last summer how bullish the $XMI looked, because it was emerging from a pretty substantial base. But there's no base this time. This is a retracement.

To lift our spirits from such a crummy week, I offer not just one but two videos - - and no clowns are involved. The first one might be handy for that big Easter brunch you are planning. I present.......Pickle Surprise:

at 4/05/2007 52 insightful comments

Links to this post Links to this post

Newer Posts Older Posts Home |

|

|

[复制链接]

[复制链接]