- 金币:

-

- 奖励:

-

- 热心:

-

- 注册时间:

- 2006-7-3

|

|

楼主 |

发表于 2009-5-1 07:58

|

显示全部楼层

Thursday, April 19, 2007Just. Plain. Weird.

Well, we bears started off with every advantage this morning. The Nikkei had fallen hundreds of points. China had gotten clobbered. The currency situation looked eerily similar to what caused the February 27th mini-crash. The GLOBEX was way down. And the market opened down, soon more than 60 points off the Dow.

And then what happened? Of course. The bulls came to the rescue. Incredibly, inexplicably, disgustingly, the market shook off the barrel-full of bad news and actually went into the green for the 700th day in a row. Un-{Nixonian expletive deleted} believable.

The most important "index" to me is my own portfolio, and I was glad to see that it actually moved reasonably higher today. Someone was asking in the comments section why I'm so hung up on the Dow. Two reasons. First, it's the most widely recognized and used index by the public. And second, I deliberately am seeking out the strongest index (currently, at least). If I'm bearish, I want to be in tune with the least bearish of the major indexes to keep an eye on its strength.

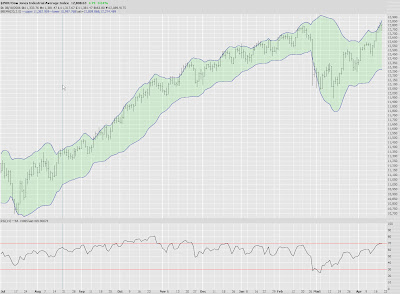

Perennial favorite $RUT (the Russell 2000) fell down today. It's interesting to see the candlesticks here. Three down days in a row, each one a little more strongly down than the prior one.

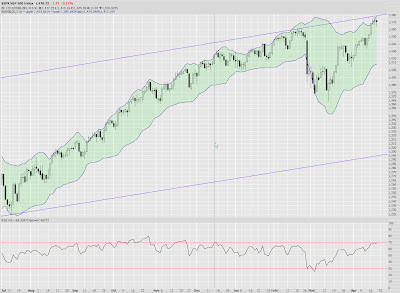

The S&P 500 was also down just a touch today. I see in after-hours trading that Google (GOOG) blew away its estimates (I have no position in GOOG) and it is up something like $13 per share. Obviously it will be interesting to see what the stock does in "real life" tomorrow. But the company's ability to print money is clearly undaunted.

My puts in $XAU are going great. The lower lows/lower highs is as plain on the nose on your face.

The NZD/USD has got to fall in order for us to see real weakness. It looks ready to turn, based on what I've marked here.

I haven't done this in a while, but below are my current positions. All of them are bearish. The bold ones are puts, and the regular ones are shorts.

Lastly, I haven't provided a video in a while. One of my favorite groups ever, Devo, did this video back in the early 80s (my own personal musical nirvana). With the crappy time we bears have had over the past two months, I thought it was time to "take a break".......

at 4/19/2007 53 insightful comments

Links to this post Links to this post

Labels: $indu, $rut, $spx, nzd/usd |

|

|

[复制链接]

[复制链接]