- 金币:

-

- 奖励:

-

- 热心:

-

- 注册时间:

- 2006-7-3

|

|

楼主 |

发表于 2009-4-6 07:42

|

显示全部楼层

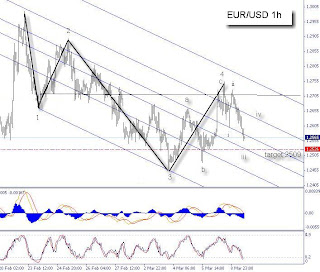

EUR/USD Update March 9. 2009 1h chart

Here is an update. I believe we are in wave V of 5 and this should be the last wave before a significant move up.

2509 is the 161.8 extension of wave I and the target for wave 3.

See the fibonacci channel drawn in the chart as well.

Both indicators are pointing down, reaching their turning points (oversold) a good indication that this is indeed a wave 3 and an indicator that it might stay oversold for a while. As a contra indicator you could see this as a sell signal.

Remember there is still a minor wave iv to form before heading down one more time, so expect some pullback.

|

Filed Under: eurusd

9:54 AM

Psychology in Trading

Approaching Trading With an Empty MindBrett N. Steenbarger, Ph.D.www.brettsteenbarger.comNote: A version of this article appeared on the Trading Markets site, 8/7/06I recently accompanied my father to a real estate sale in the southern part of Florida. That market for homes and condos had been among the hottest in the country. When we looked at the number of properties on the market at present, however, and the (paltry) number that were selling, we could see that most million-dollar units would have to be priced $200,000 or more below their recent, peak values. Nonetheless, sellers, for the most part, were keeping their asking prices fixed, despite the clear reality that they were generating no traffic and certainly no offers. Quite simply, they were slow to update their perceptions in a changing reality.

Cognitive psychologists emphasize that we see what we want to see: we are all prisoners of the mental maps we create. Once a trader forms an opinion, he or she is more likely to overweight information consistent with this view than information that is contradictory. In one behavioral finance experiment, subjects have the opportunity to offer an item for sale. In one condition, the subjects have won that item in a contest. In the other condition, the subjects price the item for sale, but it hasn't been given to them. As you might guess, the subjects who owned the item demanded much more money for the item than those who had no ownership. It was the same item: only the fact of ownership made it valuable. So it is with our market opinions: once we own it, we overvalue it.

Other studies suggest that we see only what we expect to see, and thus become blind to new realities -- much like the Florida sellers.

Laurence Gonzales, in his fascinating book "Deep Survival: Who Lives, Who Dies, and Why", describes a research study from Harvard psychologists. They showed people a film of basketball players passing the ball to each other. During the film, a man in a gorilla costume walks into the middle of the action and stays visible on the screen for about five seconds. One group of subjects was asked to count the number of passes among the players; the other group was simply asked to watch the film. Incredibly, 56% of the subjects who counted the passes didn't ever see the gorilla. Of course, everyone asked to simply watch the film noticed the gorilla man on the basketball court.

The point is that the brain is a kind of search engine: a Googler of reality. If we program our search to look for passes among basketball players, that's the output we receive from the brain. What is extraneous to our search (gorillas) is eliminated. When we conduct a broad search, we receive a wider range of outputs. Focused searches work well if we're looking for a specific item, such as lost car keys. They don't work so well when we need to process all of the information needed to survive in an environment of risk and uncertainty.

It is very easy to approach the markets in focused search mode. We develop a hypothesis about the market (bullish or bearish) and we prime ourselves to look for certain chart patterns or indicator readings. In our haste to find what we're looking for, we can miss the gorillas in the market. Afterwards, we might look back on market action and think, "How in the *^#@ could I have missed that??!!"

Gonzales writes, "The practice of Zen teaches that it is impossible to add anything more to a cup that is already full. If you pour in more tea, it simply spills over and is wasted. The same is true of the mind. A closed attitude, an attitude that says, 'I already know', may cause you to miss important information. Zen teaches openness. Survival instructors refer to that quality of openness as 'humility'. In my experience, elite performers, such as high-angle rescue professionals, who risk their lives to save others, have an exceptional balance of boldness and humility..." (p. 91).

Gonzales has provided a concise formula for trading success: boldness and humility. The exemplary trader has the boldness to act with conviction, and the humility to realize that what is apparent may not be all that is there.

Notice how so many of the excellent market bloggers -- and come readily to mind--track a variety of sectors and indices, examining the market from multiple angles. They're not just looking for the passes on the basketball court; they want to make sure they're not missing any market gorillas.

As I recently emphasized on my research blog, TraderFeed, the dominant themes of the equity markets have changed. Everywhere we look, there is evidence of risk-aversion. Look at which sector funds are growing assets and which are losing them. Look at which sectors have outperformed the market, and which have not. Value is trumping growth, and large caps are outperforming the small and Midcaps. This is no longer 2003 and 2004.

We can fail to update our mental models, like those Florida homeowners, and miss the gorilla in the market, or we can have the humility to accept and work within changing realities. When it comes to the markets, an empty mind goes a long way toward ensuring a full pocketbook.

Brett N. Steenbarger, Ph.D. is Associate Clinical Professor of Psychiatry and Behavioral Sciences at SUNY Upstate Medical University in Syracuse, NY and author of The Psychology of Trading (Wiley, 2003). As Director of Trader Development for Kingstree Trading, LLC in Chicago, he has mentored numerous professional traders and coordinated a training program for traders. An active trader of the stock indexes, Brett utilizes statistically based pattern recognition for intraday trading. Brett does not offer commercial services to traders, but maintains an archive of articles and a trading blog at www.brettsteenbarger.com and a blog of market analytics at www.traderfeed.blogspot.com. His book, Enhancing Trader Performance, is due for publication this fall (Wiley).

|

8:49 AM

EURUSD long term pespective 030609 4h

This is the long term perspective, only a probability. The bottom channel needs to be taken out to confirm a deeper correction.

For now we will go up for a while. I am targetting the blue highlighted area.

|

Filed Under: eurusd

9:14 AM

EURUSD update March 5, 2009 1hr chart

Here is my take. Now remember that B waves are crazy waves, they can go whereever they want to, even a new low, as long as the correction is in 3 waves. My experience the 78.6% fibo usually holds well and it rarely drops below the start of wave A, but this is no guarantee that it will be so in this case. Caution is advised.

|

Filed Under: eurusd

Newer Posts Older Posts Home |

|

|

[复制链接]

[复制链接]