- 金币:

-

- 奖励:

-

- 热心:

-

- 注册时间:

- 2006-7-3

|

|

楼主 |

发表于 2009-4-5 21:02

|

显示全部楼层

Wednesday, February 25, 2009USD CAD 5Mins Chart

Posted by Blue Bottle at 1:14 AM 0 comments

AUD/USD Daily

Posted by Blue Bottle at 1:10 AM 0 comments

Tuesday, February 24, 2009Intermarket Analysis

The last one week has been eventful for the western equity markets. In the last article it was mentioned that there are four major trends emerging.

Long term US bonds have formed a top in the last quarter of the calendar year 2008. Commodity market are now in a major bear market which will last for many years including sharp bear markets upside rallies. USD will continue to strengthen, not on risk aversion though. Equity markets may bottom out by H209.

The equity markets declined sharply in the western world and have made new lows. Emerging markets have remained quite resilient and are far from their lows made in November 2008. Accelerating deterioration in the world banking industry may lead all markets lower in the very short term. Intermarket analysis shows that the current downtrend in equity markets is decelerating but is not reflected in the equity market averages. Momentum studies are oversold but the trend remains to the downside. Equity markets remain a sell as the trend remains down, unless proven otherwise. But caution should be exercised as diverging signals are emerging from bond markets and currency markets.

Gold prices have performed quite strongly in comparison to all other asset classes. Gold has continued to move up even with USD holding onto its strength.

Risk aversion sentiment has worked well in favour of gold prices. The USD has seen lot of inflows as it is the least unattractive of the collection of ugly sisters that populate the world’s major currency markets. Gold has a tendency to give trend reversal in the first quarter of a calendar year. This is quite evident from major market bottoms and top that has been formed over the years. The only thing that can work in favour of gold prices now is the continued selling in world equity markets and deteriorating condition of the world currency markets. Taking a cue from the strength in gold prices it can be inferred that market sentiment in equity markets has touched lows which have not been seen in the last ten years. Risk aversion sentiment has worked well in favour of gold prices. The USD has seen lot of inflows as it is the least unattractive of the collection of ugly sisters that populate the world’s major currency markets. Gold has a tendency to give trend reversal in the first quarter of a calendar year. This is quite evident from major market bottoms and top that has been formed over the years. The only thing that can work in favour of gold prices now is the continued selling in world equity markets and deteriorating condition of the world currency markets. Taking a cue from the strength in gold prices it can be inferred that market sentiment in equity markets has touched lows which have not been seen in the last ten years.

Dow Jones:Gold (Dow Gold Ratio)

Equity markets rally in 1999 made Dow Jones most expensive as priced in gold terms. Currently this ratio is off 3 points from its long term average of 10. This means equity prices are getting cheaper in real money terms. This also means as and when stock prices make a cyclical bottom a lot of money will flow out of gold and into equity markets. The first quarter is just the time that it can happen as bullish sentiment in gold scales new peaks and bearish sentiment in stocks makes new troughs.

Now for this to happen, an early indication can be seen from a rebound in banking stocks. If the markets are to rebound, the financials should bottom out first. This would lead to a return to relatively risky securities and lead the gold prices down. This would also mean the USD will strengthen further as faith in the currency markets return to normal.

Continuing with the assumption that US 30 yr govt bonds have started pricing in some growth expectation, US equity markets can well give a sharp upmove after the current selling is over. However there is little evidence of any price reversal in major market averages in the US other than some oversold readings. Some important indicators to be analyzed are the relative performance of market majors.

Johnson and Johnson (JNJ) to S&P 500 ratio

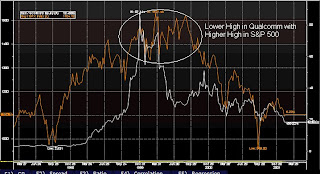

Clearly JNJ to SPX ratio made a high of 0.070 in the bear market of 2000s. The high of this ratio coincided with the bear market low with a lag of 2 months. The stock market did decline by 40% in that bear market and moved up to make new highs. Although the current bear market is much larger in economic deterioration, still the averages would always kick in on a relative basis. There are other sectoral ratios which have gone beyond all previous bear market lows. One such ratio is the relative performance of tech stocks like Qualcomm. In the bull market the major tech stocks like Qualcomm were the first one to make a lower high before the big break came.

2009 bear market non-confirmation

2000 Bull market non-confirmation

http://www.federalreserve.gov/releases/cp/

The current stats from the Federal Reserve show very little activity in the CP market for Financials. Only Non financial with investment rating of the highest quality has seen some takers. This is in contrast to the rebound seen for financial CP markets ahead to the Dow Jones rally to 9000. The credit market for financial and sub investment securities is still inactive and this is clearly weighing on the market sentiment.

Commodity markets have remained relatively flat in the last one week. Industrial metals have seen a lot of selling along with a fall in the agricultural commodities. Grain markets have seen lot of price erosion and are still looking weak. Commodity index looks set to fall further and make new lows.

30 Year US bonds are consolidating and can continue its downtrend on a break below 125. The activity in the bond market is suggesting that a reversal in stock market is imminent. Equity markets have a tendency to lag by two quarters on an average. This gives us and idea that equity prices in US may find a cyclical bottom in the next few months.

Triangle breakdown in S&P 500 has seen rapid price erosion. Though momentum indicators are quite oversold, there is no indication of a reversal and the trend remains ‘down’ unless proven otherwise.

S&P 500 is now trading well below 2002 lows. A giant double top is also forming which shows weakness for equity prices in the long term is it trades below this level for another quarter.

USD index looks strong. Though there has been some short term correction, the trend still remains up. The pivot trend reversal remains 84 for the USD index. USD index looks strong. Though there has been some short term correction, the trend still remains up. The pivot trend reversal remains 84 for the USD index.

In the current scenario, continue to look for weakness in equity markets across the world. Short term caution is warranted as divergences in market averages are reaching extreme levels. It is important to note that we have conclusively entered the last leg down of the current bear market in emerging market equities and the last leg down for cyclical bottom for western market equities. In the current scenario, continue to look for weakness in equity markets across the world. Short term caution is warranted as divergences in market averages are reaching extreme levels. It is important to note that we have conclusively entered the last leg down of the current bear market in emerging market equities and the last leg down for cyclical bottom for western market equities.

Commodity prices will continue to weaken with agricultural prices leading the way down along with industrial metals.

USD looks strong. USD/JPY will give a strong upmove on a daily close above 95. Look for 102 to be tested as market has formed a cyclical bottom.

US 30 Year bond looks set to fall further on a daily close below 125.

Posted by Sahil Kapoor at 11:03 PM 1 comments

USD/CHF

Posted by Blue Bottle at 7:59 PM 0 comments

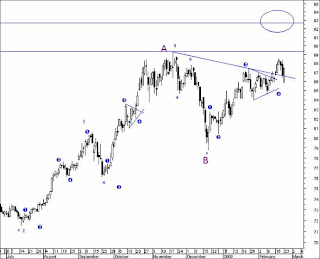

Monday, February 23, 2009GBP/USD HOURLY CHART

HI all,

Cable Hourly...

Yellow color ABC correction is almost near ending stage, think. And this ABC is near the 61.8% fibo of 5 impulse waves..

Wave C from 1.4095 can be subdivided into abc, and sub wave C is equal to 162% of sub wave A.

Posted by Blue Bottle at 8:39 PM 0 comments

USDCHF 5Mins - Update

Posted by Blue Bottle at 7:23 PM 0 comments

Sunday, February 22, 2009EUR/CHF H4 - 22Feb

Posted by Blue Bottle at 11:54 PM 0 comments

USD CAD Weekly - 22Feb

Posted by Blue Bottle at 11:32 PM 0 comments

GBP JPY MONTHLY - 22Feb

Posted by Blue Bottle at 11:28 PM 0 comments

GBP/USD Monthly - 22Feb

Posted by Blue Bottle at 11:27 PM 0 comments

Newer Posts Older Posts Home |

|

|

[复制链接]

[复制链接]