Join Corey at the LA Trader’s Expo in June

March 16th, 2009 by Corey Rosenbloom

I wanted to invite readers to join me at the Los Angeles Trader’s Expo from June 3-6 2009 - I’ll be speaking there in a seminar entitled “Idealized Trading Tactics for the Intraday Trader.”

For full details, visit the Los Angeles Trader’s Expo home page (for details and free registration) to see the full schedule and information. Attending is free and it really is a wonderful time to meet speakers as well as many fellow traders and get to know others who share your passion for trading the markets.

I wanted to include the description/introduction to my session to give a little more detail:

“Do you feel like your intraday price charts resemble random squiggles of chaos? Join Corey Rosenbloom of AfraidtoTrade.com as he describes how to place intraday price action with trade set-ups into context and how to identify the day’s structure as it develops. Finally, learn how keeping an end-of-day “idealized trade journal” can enhance your pattern recognition skills, reduce stress, and improve real-time performance.”

I’ll be discussing some behind-the-scenes information on the background of my end-of-day “Idealized Trades” posts I detail frequently here on the blog. I’ll also emphasize why keeping your own “Idealized Trade” Journal can help crystallize key intraday patterns and structure so you’ll be able to recognize then act upon them as they develop in real time.

I’ve always benefited from attending Trader’s Expo Conferences and strongly encourage anyone who’s able to do so to attend - it’s four days of information packed seminars, new product/software demonstrations, social activities, and other educational events designed to give a boost to your trading performance.

I’m excited about this opportunity and look forward to seeing you there!

6 Comments | add comment

Fibonacci Confluence and Projection on NIFTY Index

March 15th, 2009 by Corey Rosenbloom

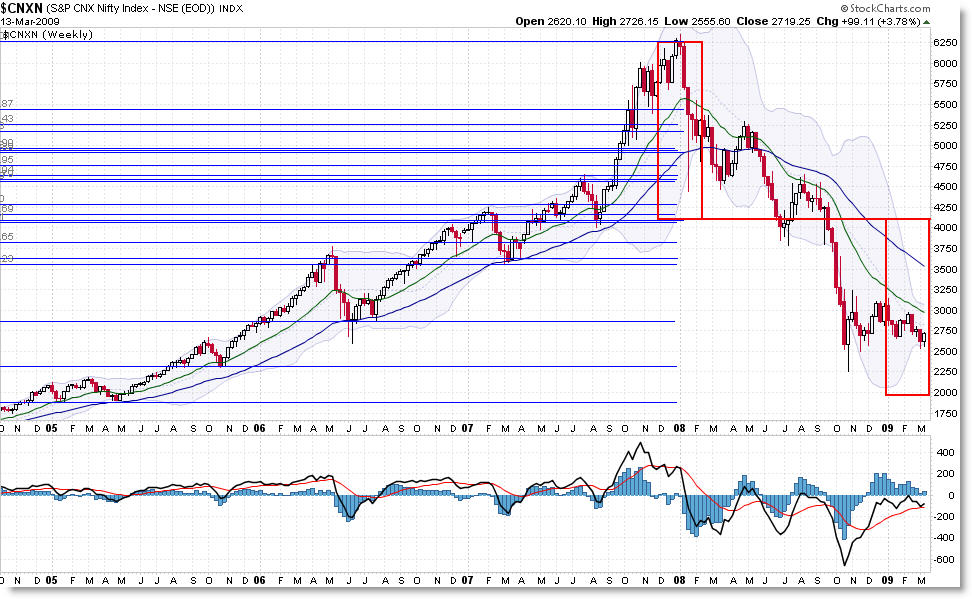

I thought I’d do something a little different in my weekly take of India’s “Nifty” Stock Index ($CNXN) and describe a Fibonacci Confluence Resistance Zone and also run a Fibonacci Price Projection Point as well.

“Nifty” Confluence Fibonacci Grid:

Without giving away too many of my secrets, or the method behind the madness, we see key Confluence Fibonacci overhead resistance at the 3,580 level which also corresponds currently with the falling 50 week EMA. Should price break-out above the current range and 20 week EMA (both of which could be extremely difficult), we would expect significant supply coming in at that level.

I was going to write another daily update, but the analysis is the same as last week, as price still remains in a consolidation.

Now let’s really do something interesting and try to make a Fibonacci Price Projection low using advanced Fibonacci methods.

“Nifty” Fibonacci Price Projection:

Fibonacci grids are drawn off the 6,300 truncated high down to key support levels in the past. A confluence zone was identified and then the vertical distance was measured from the peak down to this confluence level, and then I came forward and projected this same vertical distance (the size of the rectangle is irrelevant) down (subtracted) from the confluence zone (at 4,100) to get a final price projection target of 1,970.

I’m not necessarily saying we’ll go down to that target, but if price begins to fall from here, the 1,970 level would be an excellent area to watch for advanced Fibonacci support.

In summary, we have Confluence Fibonacci Resistance at 3,580, and a Fibonacci Price Projection possible Low at 1,970. It’s up to the market to determine which area it will test next, but - unless the trend and structure (via moving averages and swing lows and highs) changes, odds as I seem them are slightly more favorable that we break-down to test the 2,000 level.

As always, your comments and thoughts (and links to other sites) are welcome.

Corey Rosenbloom

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Register (free) for the Afraid to Trade.com Blog to stay updated

8 Comments | add comment

Which Sectors Outperformed Last Week?

March 15th, 2009 by Corey Rosenbloom

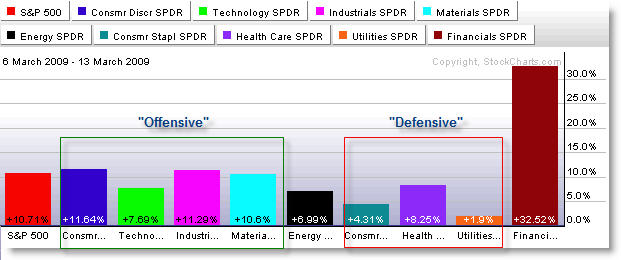

Let’s take a quick look at which key sectors outperformed all others last week - during a rally week where we saw all major sectors advance.

First, from StockCharts.com:

I separated the AMEX Sectors into traditionally “Offensive” or sectors that reflect market confidence and “Defensive” or sectors that generally hold their own during market pessimism and downturns.

The Financials should be grouped with the “Offensive Sectors” because strength there - and in Retail, Consumer Discretionary, Technology - show that investors and funds might be more confident in trying to put their money to work where they expect to get the biggest ‘bang for the buck.’

On the flip-side, investors try to ‘hide’ in Defensive Sectors like Health Care and Consumer Staples that should hold their own (though still decline slightly) during downturns. Strength here reflects investor pessimism.

Seeing the strongest advance - 30% - in the Financials is a wonderful and welcome sign for belagured investors. To envision any sort of Market Bottom, we would need to see continued strength in the Financial and “Offensive” (Discretionary/Retail) Sectors that have been punished the most. For now, investors can be encouraged.

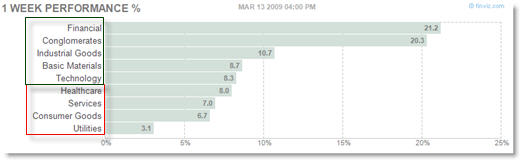

Let’s take a look at a similar chart on FinViz.com (Groups):

I also separated these by “Offensive” (green) and “Defensive” (red) Sectors (they classify things a little different than StockCharts.com).

Financials and (Large) Conglomerates were strongest, with Industrial goods advancing strongly as well. The broader S&P 500 Index rose 10% last week (for comparison).

Utilities and Consumer Goods/Staples underperformed the market and all other sectors - that’s what you’d want to see if the market has any hopes of a sustained recovery.

Keep checking ‘under the market hood’ for additional clues.

Oh, and Adam Hewison released a video update on the current rally entitled: “Bear Market Rally… or Serious Reversal” that goes into much more detail.

Corey Rosenbloom

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Register (free) for the Afraid to Trade.com Blog to stay updated

2 Comments | add comment

Update on the Two Competing SP500 Elliott Wave Interpretations

March 14th, 2009 by Corey Rosenbloom

Let me summarize the interpretations.

1. The Bullish Interpretation

States that We are Ending the 5-Wave decline that Began in 2007 (that we are in a Primary Wave 5 down… technically Wave (4) of circled 5.

I call this “bullish” because it means we just need one more swing down (in the Elliott Structure) to complete the 5-wave decline.

2. The … Bearish Interpretation

States that We are Still in an Extended Third Wave off the 2007 High (that we are an a Primary Wave 3).

I call this bearish because it implies that we are close to finishing the Primary 3rd Wave before embarking on a large ABC up… then we will begin a 5-wave decline to take us to lower lows than we’re seeing now. It’s also likely to trick so many people because the Primary 4th Wave rally is expected to be sharp (violent) and will lead so many people to believe we’ve put in a bottom… only to see price rip to new lows once the 4th Wave completes.

1. The “Bullish” Scenario:

Summary: The circled waves reflect a Primary Degree and that we are just one more swing away from completing this 5-Wave sequence of a Major C Wave (reference monthly charts).

It states that we’re currently in (4) of circled 5 of Cycle C.

Ending target: 600 - 650 within two/three months.

2. The “Bearish” Scenario

Summary: We are STILL within Primary Wave 3, and need Primary Wave 4 (perhaps up to 1,000 or 1,100) and then will need to complete Primary Wave 5 (to take us down to 500… or less. I shudder to write those words).

It implies that we’re currently in Minor 4 of Intermediate (5) of Primary circled 3. Of course, of Cycle C.

Ending Target: 500 or less by the end of 2009/beginning of 2010.

So which one is it?

It’s certainly open to debate, but we’ll know soon enough. Rather than get caught up in the long-term forecast, I think it’s important to focus on the following:

Both call for a test of the 666 low on the S&P for the next likely swing.

After that… things get murky. Both call for an up-move of potentially powerful duration… so much so that Elliott Wave International founder Robert Prechter has made the rounds on Financial TV recommending that all short-sellers ‘cover their shorts’ in anticipation of a potentially large rally-up in the Stock market.

My stance is that it doesn’t matter right now - both counts are in alignment for the time being. This will change as the strength/duration of the next up-move comes. Start looking then at the internals and structure to assess the next likely path for prices *once we get there*.

Accuracy in financial forecasting isn’t what’s important - it’s trading properly and managing risk within your expected views. Elliott Wave is one of many tools to help guide our analysis - we all know it’s never 100%.

I’ll do my best to keep you updated as more data comes in and the price structure forms itself clearer.

Until then, do the best you can with the information you have at your fingertips.

19 Comments | add comment

« Previous Page — Next Page » |  [复制链接]

[复制链接]