- 金币:

-

- 奖励:

-

- 热心:

-

- 注册时间:

- 2006-7-3

|

|

楼主 |

发表于 2009-5-5 14:26

|

显示全部楼层

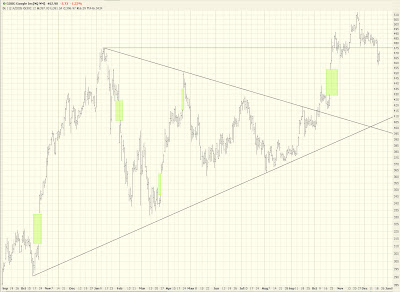

One could make a flimsy argument that GOOG is sporting a petite head and shoulders pattern. I wouldn't even mention it. Oops, too late. Anyway, I have high (low) hopes for GOOG in January.

Finally, TSO continues to be well behaved. This looks like a nice, fat toppy pattern to me.

Someone commented (and let me say, I really appreciate the comments section - - I read it religiously) that yesterday's graph of the coming disaster in Medicare has nothing to do with stocks or the financial markets. I dunno, I think the insolvency of the United States will surely be germane at some point.

Oh, I forgot. Liquidity. There's liquidity. And all that money needs a place to go. (Where it came from, no one knows - - actually they do - - leverage, leverage, leverage. Which, oh, is a two-edged sword). Anyway, liquidity is the current This Time It's Different argument. Just like how the Internet's productivity enhancement changed everything and justified the valuations of 1999.

People just never learn. Never. I simply cannot wait for those Liquidity twits to get blown to hell. Then at least we can wait a few years before we have to endure them again with another fabricated story.

at 12/20/2006 17 insightful comments

Links to this post Links to this post

Labels: $indu, $ndx, analysts, csx, fdx, goog, rbak, tso

Newer Posts Older Posts Home |

|

|

[复制链接]

[复制链接]