- 金币:

-

- 奖励:

-

- 热心:

-

- 注册时间:

- 2006-7-3

|

|

楼主 |

发表于 2009-5-15 06:37

|

显示全部楼层

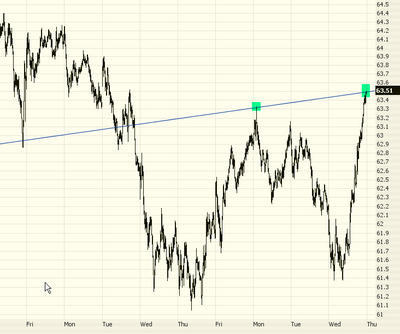

Thursday, October 20, 2005You Knew This Already

See my post and then look at the chart below, which brings you up-to-date:

The market was repelled again. "The kiss of death" - twice - is what's happened this week. And you knew what to do a day ahead of when it actually happened!

Such is the beauty of technical analysis.

at 10/20/2005 0 insightful comments

Links to this post Links to this post

Wednesday, October 19, 2005Kiss Me Twice!

I wrote yesterday about how the IWM had "kissed" the underside of a huge three-year long trendline, indicating how clearly support had turned into resistance.

After an initial softness this morning, the market firmed up and exploded higher. As you can see with the chart below, it once again "kissed" the underside of the trendline precisely!

The key question, of course, is what will it to tomorrow? If it is once again repelled, this will encourage the bears and discourage the bulls. If, however, the line is penetrated, it makes for a more shaky bearish argument, and the line becomes less meaningful for either camp.

I wanted to offer another example of how useful Fibonacci retracements can be. Over the past week or so, I was extremely short various crude oil markets, particularly oil service stocks. These positions (both shorts and puts) did quite well, but it's nerve-wracking to have a position racking of profits if you don't know when it's going to turn and go the other way.

That's where Fibonacci comes to the rescue. All I had to do was take a look at one chart - the XLE - to see that it was approaching a retracement level, meaning that both the XLE and the oil stocks were likely to bounce up.

And bounce they did. I closed out everything (and even bought XLE calls) just as the market whipped around the other direction. Thanks, Mr. Fibonacci!

at 10/19/2005 0 insightful comments

Links to this post Links to this post

Tuesday, October 18, 2005Kiss My Trendline

On Friday, Saturday, and Sunday, I was speaking at a trade show in San Francisco about Prophet.net, and I was enjoying talking to users of our products (both current and prospective) and sharing ideas about the market.

Because I did a lot of demonstrations, I had more time than usual to look at charts, and I was amazed at just how beautifully bearish everything seemed. I can't remember a time when everything seemed to line up so well.

So much so that I told many people my belief of what the market would do when the new week began - - and not in general terms, but in specific, to-the-penny terms.

My prediction was that the market would open higher on Monday, carrying through with its upward momentum on the prior Friday. But that it would "kiss" the bottom of its major ascending trendline and start reversing, and that it wouldn't look back.

My term "the market" is specifically about the IWM, although the market in general applies. Below is the intraday, minute-by-minute graph of IWM. Notice how, early on Monday, it kissed the underside of the now-broken support (which means it's resistance at this point) and fell.

To........the............penny! (I would hasten to add that I don't "adjust" my trendlines after the fact; this is a well-established, multi-YEAR trendline; you are just zoomed in very close to it).

I am writing this on Tuesday afternoon, after the close, and one of the most critical earnings reports has just been issued (Intel, INTC). Revenues and earnings were sensational, and INTC shot up higher shortly after the announcement. Then it was breakeven. Then it's down. Last I looked, it had fallen about 3%, even on that terrific news. They haven't even held their conference call yet, so who knows if INTC will be up or down tomorrow.

But having a down market on bullish news can only bring tears of joy to a bear's big brown eyes.

at 10/18/2005 0 insightful comments

Links to this post Links to this post

Newer Posts Older Posts Home |

|

|

[复制链接]

[复制链接]