- 金币:

-

- 奖励:

-

- 热心:

-

- 注册时间:

- 2006-7-3

|

|

楼主 |

发表于 2009-5-11 06:59

|

显示全部楼层

Monday, May 08, 2006The Waiting Game

OK, I've got a confession. All that stuff about the bulls being in control and the bears needing to hide in a cave? Deep down, I don't really believe it. I think the market has been living on borrowed time, and it's all going to blow up at some point. It's waiting for that "some point" which is exasperating.

The first is Allegheny Technologies (ATI), shown below. I've mentioned this one more than once, but it's an intriguing chart. It's clearly below its ascending trendline, and the ascent over the past few months has been so massive (with diminishing volume) I'd say this was a pretty good short, with a stop price at $80.

A similar short suggestion, with similar rationale, is Carpenter Tech (CRS) with a stop at $140.

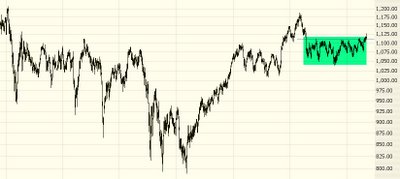

The "very bullish" chart of the American Major Market Index ($XMI) should be taken in context, by the way. If you look at the chart of the past several years, including the highlighted inverted head & shoulders, you can see that it's nothing to write home about. Even if it manages to hit its full inverted head & shoulders target, it's not going to get to any new lifetime high.

Lastly, take a look at the (recently very boring) GOOG. Its nearest Fibonacci retracement level is $394.58 by my calculations. Just look at this intraday chart over the past week or so - it is just amazing to me how the price is clinging - closer and closer, in fact - to the Fib level. Spooky!

at 5/08/2006 7 insightful comments

Links to this post Links to this post

Newer Posts Older Posts Home |

|

|

[复制链接]

[复制链接]

楼主|

发表于 2009-5-11 07:07

楼主|

发表于 2009-5-11 07:07