Posted on March 30, 2009 at 2:38 in Market comments, Starting the day by David Aranzabal1 Comment »

This weekend market opened on sunday with a 50 pips market gap to the downside in EUR/USD and 70 pips in GBP/USD.

Both gaps were filled within 2 hours but early today, after London open, we have got new lows in Eur and Cable. The sentiment is on the downside.

Heavy event/data risk week ahead

Posted on March 30, 2009 at 2:16 in Starting the day by David AranzabalNo Comments »

Good morning everybody, Good morning everybody,

Just remember in Europe we are in daylight savings. For more information please read this article.

We’ve got a busy week ahead, plenty of data releases, most of them Hi-impact.

G20 meeting on Thursday and US non-farm payrolls/employment reports on Friday are the most expected.

Prior to that, we have the ECB meeting on Thursday with latest surveys suggesting a market preference for a 50bp rate cut to 1%. Japan’s Q1 tankan survey tomorrow is expected to remain soft.

ISM manufacturing and GBP Halifax on wednesday can move the market as well, so fasten your seat belts!

Majors at a glance 03/30/2009

Posted on March 30, 2009 at 2:15 in Starting the day by David AranzabalNo Comments »

This is a quick review about how EUR/USD, GBP/USD and spot Gold look like:

GBP/USD

Sellers have resurfaced and pushed the market lower to 1.4160. Support is at these lower levels and it should not get through here without a struggle.

Buyers would only worry if 1.4140 lost. A loss of this support would keep the market under pressure—leading it lower for 1.4080 then 1.4020. Again would expect buyer to re-enter the market at these lower levels.

If 1.4140 does hold you should see this come back with 1.4335 looking to entice. Buyers are covering to these higher levels. Sellers would be evident however so you should not get too optimistic unless the market is back above 1.4350.

EUR/USD

Euros have come a little lower, but holding 1.3180. This is good for buyers and wood only worry about longs if the market does break this 1.3180 region.

If it does you would see fresh selling and this would push the market lower for 1. 3071 initially, with greater potential for 1.2980/70. Here you would see buyers emerge, thus would expect this point to hold.

Resistance is up at 1.3270/90. Sellers are waiting for a rise to here to enter the market. However, if a break is posted above here you would find that fresh buyers would take control and lead this higher for 1.3386. Profit taking will be evident at these higher levels, and buyers would only re-enter the market above 1.3415.

SPOT GOLD

Gold held support and should trade higher. It is only below 911.35 that it would weaken, and sellers would then push this lower with 891 then the targeted area.

At the lower levels buyers will take profits, thus expect this support to hold.

Resistance located at 925. If this point breaks fresh buying will be evident leading this higher for 941 to 946. Buyers will be taking profits at these higher levels. They would re enter the market above 946 for 950 then 954. Again expect profit taking.

Source: FxStreet and Charmer Charts.com

Editor’s pick

Posted on March 27, 2009 at 9:33 in Editors Pick by David AranzabalNo Comments »

Obama Seeks JPMorgan, Goldman, Citigroup Support on Bank Plan

President Barack Obama will seek support today from executives of the nation’s largest banks for his plan to stabilize the financial system and try to get beyond the furor over bailouts and bonuses.

The White House meeting at noon Washington time is scheduled to include chief executive officers Vikram Pandit of Citigroup Inc., Jamie Dimon of JPMorgan Chase & Co. and Lloyd Blankfein of Goldman Sachs Group Inc., all headquartered in New York. They are among as many as 15 banking executives expected to attend.

Lawrence Summers, Obama’s top economic adviser, said the meeting was a measure of the ties between the government and banking industry at a time of economic crisis.

“This is about our duty to do everything we can to support a robust and sustained economic expansion and the reality that the country’s major financial institutions have a major role to play,” Summers said.

Source: Bloomber

Read more…

Quote of the day

Posted on March 27, 2009 at 6:24 in Quote of the day by David Aranzabal2 Comments »

A life lived in chaos is an impossibility…

Madeleine L’Engle (1918 - )

My personal touch: Markets may seem chaotic but we must be disciplined and organized.

The trade of the day (a very easy one and 100 pips for the pocket)

Posted on March 27, 2009 at 5:15 in Market comments by David Aranzabal4 Comments »

Update: +250 pips at this time 12:44 GMT. I’m closing the rest of the trade at 1,3310 (close to double 00). We are oversold, so be careful, the price can reverse.

Today we have got a very easy setup in EUR/USD and GBP/USD. Let’s see how we could profit from the European Opening:

- MACD Divergence in 5min. chart

- Trendline Broken just at the beginning of the Frankfurt opening.

- Lower Highs, Lower lows.

- Entry point at the breakout or waiting to the retracement (2 opportunities).

- Stop above the previous swing high.

- Go with the flow. + 100 pips at this moment. (Partial profit taking at +20 pips)

More In trading for a living:

Daylight savings in Europe, be carefull!

Posted on March 27, 2009 at 4:33 in Technical Education by David Aranzabal2 Comments »

Just remember than on Sunday we have got daylight savings in The European Union area so we have these factors to consider:

- In Europe the clock adds 1 hour. (Spring forward)

- Difference time between EST (New York) and London Time is 5 hour again.

- London Time = GMT + 1- Western European Time (Frankfurt)= GMT +2

General Information:

General Information:

Spring forward, Fall back

During DST, clocks are turned forward an hour, effectively moving an hour of daylight from the morning to the evening.

| |

United

States | |

European

Union | | | | | Year | DST Begins

at 2 a.m. | DST Ends

at 2 a.m. |  | Summertime

period begins

at 1 a.m. UT | Summertime

period ends

at 1 a.m. UT | | 2005 | April 3 | October 30 |  | March 27 | October 30 | | 2006 | April 2 | October 29 |  | March 26 | October 29 | | 2007 | March 11 | November 4 |  | March 25 | October 28 | | 2008 | March 9 | November 2 |  | March 30 | October 26 | | 2009 | March 8 | November 1 |  | March 29 | October 25 | | 2010 | March 14 | November 7 |  | March 28 | October 31 | | 2011 | March 13 | November 6 |  | March 27 | October 30 |

General information about “Daylight saving time”:

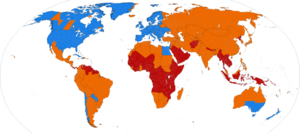

Although not used by most of the world’s people, daylight saving time is common in high latitudes. [size=90%]

DST used [size=90%]

DST no longer used [size=90%]

DST never used

Daylight saving time (DST; also summer time in British English—see Terminology) is the convention of advancing clocks so that afternoons have more daylight and mornings have less. Typically clocks are adjusted forward one hour near the start of spring and are adjusted backward in autumn. Modern DST was first proposed in 1907 by the English builder William Willett. Many countries have used it since then; details vary by location and change occasionally.

The practice is controversial. Adding daylight to afternoons benefits retailing, sports, and other activities that exploit sunlight after working hours, but causes problems for farming, entertainment and other occupations tied to the sun. Traffic fatalities are reduced when there is extra afternoon daylight; its effect on health and crime is less clear. Although an early goal of DST was to reduce evening usage of , formerly a primary use of electricity, modern heating and cooling usage patterns differ greatly, and research about how DST currently affects energy use is limited and often contradictory

DST’s occasional clock shifts present other challenges. They complicate timekeeping and can disrupt meetings, travel, billing, recordkeeping, medical devices, and heavy equipment. Many computer-based systems can adjust their clocks automatically, but this can be limited and error-prone, particularly when DST rules change.

Source: wikipedia

Today’s economic calendar

Posted on March 27, 2009 at 3:10 in Starting the day by David AranzabalNo Comments »

Today we have got a busy day, with many releases.

At 9:30 we’ve got UK GDP. Be careful before the release if you are trading short term.

At 12:30 GMT we have Core Personal Consumption. It is a significant indicator of inflation, so stay tune.

| 07:00GermanyImport | | Price Index (MoM) (Jan) |  | -0.5% | -0.4% | -4.0% |  | | | 07:00GermanyImport | | Price Index (YoY) (Jan) |  | -5.4% | -6.0% | -5.1% |  | | | n/aUnited | KingdomNationwide | Housing Prices n.s.a (YoY) (Mar) |  | | -18.1% | -17.6% |  | | | n/aUnited | KingdomNationwide | Housing Prices s.a (MoM) (Mar) |  | | -1.5% | -1.8% |  | | | n/aGermanyConsumer | | Price Index (MoM) (Mar)  |  | -0.5% | 0.1% | 0.6% |  | | | 09:30 | United KingdomCurrent | Account (4Q) |  | | -£5.8B | -£7.7B |  | | | 09:30 | United KingdomGross | Domestic Product (QoQ) (4Q) |  | | -1.5% | -0.7% |  | | | 09:30 | United KingdomGross | Domestic Product (YoY) (4Q) |  | | -1.9% | 0.2% |  | | | 10:00 | European Monetary UnionIndustrial | New Orders (YoY) (Jan) |  | | -28.2% | -22.3% |  | | | 10:00 | European Monetary UnionIndustrial | New Orders s.a. (MoM) (Jan) |  | | -6.5% | -5.2% |  | | | 10:30SwitzerlandKOF | | Leading Indicator (Mar) |  | | -1.55 | -1.41 |  | | | 12:30 | United StatesCore | Personal Consumption Expenditure - Prices Index (MoM) (Feb) |  | | 0.1% | 0.1% |  | | | 12:30 | United StatesCore | Personal Consumption Expenditure - Prices Index (YoY) (Feb) |  | | 1.6% | 1.6% |  | | | 12:30 | United StatesPersonal | Consumption Expenditure Deflator (Feb) |  | | 0.8% | 0.7% |  | | | 12:30 | United StatesPersonal | Income (MoM) (Feb) |  | | -0.1% | 0.4% |  | | | 12:30 | United StatesPersonal | Spending (Feb) |  | | 0.2 | 0.6 |  | | | 14:00 | United StatesReuters | /Michigan Consumer Sentiment Index (Mar) |  | | 56.8 | 56.3 |  |

Editor’s Pick

Posted on March 27, 2009 at 2:42 in Editors Pick by David Aranzabal1 Comment »

Hedge Funds, Buyout Firms Say Regulation Unstoppable

Hedge funds and private-equity firms, after opposing increased federal oversight for years, said they can’t escape the Obama administration’s plan to include them in an overhaul of U.S. financial regulation.

“We’re not going to be able to stand in the way of that speeding train,” David Rubenstein, co-founder of private-equity firm Carlyle Group, said at a conference in New York yesterday.

“New rules of the game” are necessary to restore confidence in the financial system after credit markets seized up and stocks fell the most since the Great Depression, Treasury Secretary Timothy Geithner said yesterday. He proposed requiring hedge funds and private-equity firms to register with the U.S. Securities and Exchange Commission and to disclose information about their holdings.

“The industry has been bracing for the call for regulation and within reasonable bounds accepts it,” Jim Chanos, founder of New York-based Kynikos Associates Ltd. and head of the Coalition of Private Investment Companies, a hedge-fund trade group, said yesterday in a Bloomberg Television interview.

Source: Bloomberg.

Read more…

Majors at a glance

Posted on March 27, 2009 at 2:31 in Starting the day by David Aranzabal4 Comments »

This is a quick review about how EUR/USD, GBP/USD and spot Gold look like:

GBP/USD

Sellers came into Sterling yesterday, pushing the market lower to 1.4425. You have seen a small bounce from these lower levels, but overhead resistance at 1.4520 should provoke sellers once more to appear.

A loss through 1.4420 would also fuel the downside scenario and see the market coming lower for the short term 50% retracement target of 1.4335/09. Once more you will see profit taking at these lower levels. Buyers will resurface here, and it is only below 1.4300 that buyers should be worried.

If back above 1.4550 one would expect the sellers to reverse position as this will move higher with 1.4620/40 your nearby objective. Positions will be covered. Buyers would once more appear over 1.4640 for another go at 1.4775/80.

EUR/USD

Euros held up well yesterday with buyers coming in at 1.3495/90. Short term resistance is at 1.3620/40 , and would expect buyers to come in over this level to try and push the market higher for 1.3739/63.

Profit taking will occur around these levels. Buyers would be expected to resume position taking if the markets broke through 1.3800. This would clear the short term topping pattern that has been evident and lead the market higher for 1.3856/96. Profit taking will be seen. Above 1.3896 sees further strength leading to 1.3963.

Currently support is located at 1.3474/50. Buyers will reappear at these lower levels, and would only worry about their long positions if the market lost 1.3410 support.

SPOT GOLD

Gold sellers appeared just prior the 946 target and Gold then came lower to 932.16 and is currently under pressure once more.

Below 930 will see a fresh wave of sellers appear as Gold should then break lower back to excellent support located at 918/915.25. Here profit taking will occur and the tentative buyers will emerge. You should see the market bounce from these lower levels and back above 932 would see further buying pressure for the 946 resistance.

However if 914 breaks you will see a reversal of sentiment with buyers reversing their positions for this to come lower with 903/903 then targeted in the short term. Sellers will cover shorts to here, and look to re-sell if the market is below 900.40.

Source: FxStreet.com and Charmer Charts.com

—–

Watch the latest session video review in HD (High Definition) !! . Press here.

—-

« Newer posts – Older posts » |

[复制链接]

[复制链接]