- 金币:

-

- 奖励:

-

- 热心:

-

- 注册时间:

- 2006-7-3

|

|

楼主 |

发表于 2009-5-5 08:12

|

显示全部楼层

飞天棍僧

Wednesday, January 17, 2007When Great News Doesn't Help

After the market closed today, tech bellwether Apple, Inc. announced not just great earnings, but Oh My God blowout earnings. And how did the market react after hours? GLOBEX is down too. When stocks soften on amazingly great earnings, that's a good sign for us ursine types.

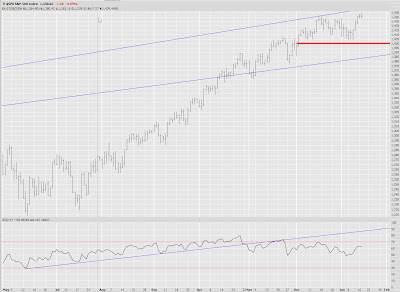

Some indexes pushed to lifetime highs intraday today, but ran out of steam. I do not see any sensational, obvious, the-world-is-coming-to-an-end type pattern. If the market falls, it's going to do so simply because there are no more Greater Fools. As for the S&P 500, shown below, it needs to break below 1,400 before things get interesting.

The Russell 2000 seems to be consolidating right now. I am hoping the current consolidation is similar to the prior one, both of which are shown in light blue highlighting here.

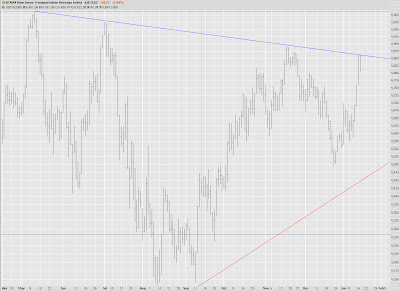

And check out the Transports - aren't trendlines amazing? The prices did a perfect about-face.

My AMLN short - so far, so good. It's down to $40 in after-hours trading. This is a sharp looking graph.

[ 本帖最后由 hefeiddd 于 2009-5-5 08:22 编辑 ] |

本帖子中包含更多资源

您需要 登录 才可以下载或查看,没有帐号?立即注册

x

|

|

[复制链接]

[复制链接]