- 金币:

-

- 奖励:

-

- 热心:

-

- 注册时间:

- 2006-7-3

|

|

楼主 |

发表于 2009-3-9 06:37

|

显示全部楼层

-------SUCCESSFUL SPECULATION BEGINS WITH OBJECTIVE OBSERVATION-------

Sunday, March 08, 2009Live Analysis Tonight

at 8 PM Eastern (scheduled for an hour). We will be discussing whether Friday's late day volume surge is the beginning of a more powerful move to come or what a failure would mean at this point. The Dow chart below shows that we are at a potentially important area where the market may find support, the charts of the S&P 500 and the Russell 2000 are at similarly important levels. We will also analyze other sectors and some individual stocks for further clues as to what may be next for our markets and where the best opportunities may be. If there are stocks or sectors you would like covered please send your requests via twitter (no more than one per person). There is still some space left, you can REGISTER HERE This is a new (to me), higher quality service that ustream and my audio is working too (-:

Posted by Brian at 3/08/2009 09:09:00 AM

Friday, March 06, 2009Stock Market Close 3/6/09

No closing video today. I will be doing live analysis on Sunday at 8:00PM Eastern. Check back here over the weekend for details I will be using a new service.

REGISTER HERE Space is limited.

Posted by Brian at 3/06/2009 04:06:00 PM

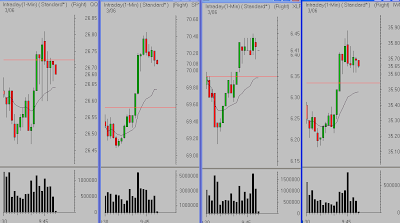

Buying Blindly

Goes completly against all I believe in. That is why I called my mom and told her to cancel the buy order...for now. I think the market can still decline precipitously before "the bounce" materializes. I told her that the QQQQ needs to trade below 25 before she should buy any position in QLD. We are down to important level, but we could still see a climactic flush. The dow is down 75 as I write this. There is no reason to be in a long trade yet.

Posted by Brian at 3/06/2009 01:22:00 PM

If I am Wrong

she will still love me..

For the record, I told her to buy a 25% position in QLD if the DOW is down 100 today (approx 6495) She is not in yet. I will also tell her to take a loss if it goes lower. I AM NOT CALLING A BOTTOM, JUST A TRADABLE BOUNCE.

I mis-labeled that first level @9399, it is a 38.2% retracement.

Posted by Brian at 3/06/2009 11:20:00 AM

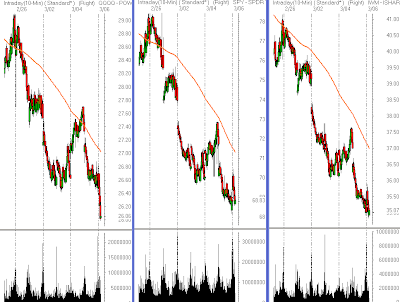

Gotta Be Quick

The initial gap failed to hold and the market is back to the path of least resistance. With a declining 5 DMA all long trades should be scalps only.

Posted by Brian at 3/06/2009 10:45:00 AM

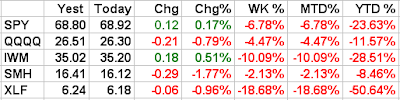

Early VWAPs HOlding

also above pivots

Posted by Brian at 3/06/2009 09:48:00 AM

For All The Hype

the reaction to the number is fairly quiet so far.

Posted by Brian at 3/06/2009 08:47:00 AM

Panic

Fear cannot be banished, but it can be calm and without panic; it can be mitigated by reason and evaluation.

~Vannevar Bush

Posted by Brian at 3/06/2009 05:50:00 AM

Labels: quotes

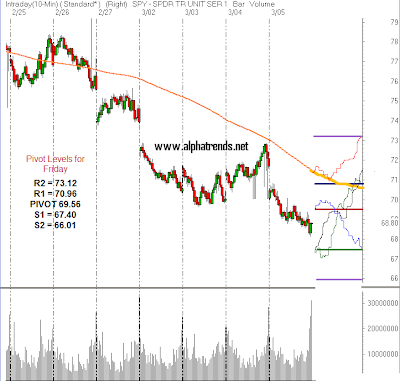

Thursday, March 05, 2009Roadmap for Tomorrow?

The chart below is complete fiction beyond the close at 68.80 on Thursday. I have sketched in 4 possible scenarios for trading tomorrow. See explainations below the chart.

Scenario 1- Red Line

The market gaps significantly higher (near the 5DMA) digests the move a bit and then rockets higher after a brief dip below the VWAP. The market continues higher into the close as shorts scramble to cover and new cash comes in from the sidelines.

Scenario 2- Blue Line

The market gaps higher, excited longs chase the strength but the market slowly churns and breaks below the daily VWAP which causes longs to liquidate and shorts (including me at this point) pile in to exploit the further weakness. In this scenario prices close near the low and the market continues to be vulnerable to this tortuous selloff. See song below.

Scenario 3- Black Line

The Market gaps down towards S1 and buyers immediately show up and pressure shorts to cover on "bad news" The market pauses briefly below daily pivot (which is also prior support from 3/3 which was resistance on 3/5) After the brief consolidation which takes prices below VWAP, buyers re-emerge and pressure shorts into the close.

Scenario 4- Green Line

This is the one I like best in spite of small long position. The market gaps down near S1 rallies for about 10 minutes then falls below VWAP and takes out the morning low. This lower low occurs on lighter volume and the market recovers back above VWAP (this is where I load up with stops below morning low). Shorts realize they had their chance to buy at low prices, they chase and that brings sidelined cash to the party. The market goes positive, stalls a bit, sucks in more shorts then rockets higher into the close.

I am hoping for one of the bullish outcomes, but gotta keep an open mind to all outcomes because bear markets continue on broken hope. Any of these scenarios is possible or the market could do something completely outside of what I have outlined. The point is to be prepared for anything, forget what YOU think of the jobs number, listen to the market. We are down at important levels here and if the market is going to experience a BEAR MARKET RALLY, this is a likely area where it will emerge from. When I trade tomorrow I will have an open mind. VWAP will be a big factor in how I decide to trade as it will tell me in real time who (buyers or sellers) has control of the session. More important than VWAP, economic numbers, pivot levels, moving averages, etc. will be the same things that keep traders alive to pay increasing taxes (editorial comment) each day; EMOTIONAL CONTROL, POSITION SIZING, RISK MANAGEMENT AND DISCIPLINE.

Nothing here is meant as a prediction it is just meant to show the thought process at an important level.

Boulevard of Broken Dreams seems appropriate until tomorrow...

Posted by Brian at 3/05/2009 07:06:00 PM

Older Posts

Subscribe to: Posts (Atom) |

|

|

[复制链接]

[复制链接]

楼主|

发表于 2009-3-9 06:23

楼主|

发表于 2009-3-9 06:23

楼主|

发表于 2009-3-9 06:26

楼主|

发表于 2009-3-9 06:26

楼主|

发表于 2009-3-9 06:27

楼主|

发表于 2009-3-9 06:27

楼主|

发表于 2009-3-9 06:35

楼主|

发表于 2009-3-9 06:35